Construction employment in January remained below pre-pandemic levels in all but eight states, according to an analysis by the Associated General Contractors of America of government employment data released today, while more firms have reduced headcount than have added to it in the past year, the association’s recent survey shows. Association officials said the jobs figures and survey results underscore the need for federal measures to stem future sector job losses.

“Despite improvement in many sectors of the economy, nonresidential contractors are coping with widespread project cancellations and postponements, soaring materials costs, and lengthening delivery times,” said Ken Simonson, the association’s chief economist. “That combination makes further job cuts likely in many states.”

The survey, which included responses from nearly 1500 firms, found 34% had reduced their employee count in the past year, compared to just 20% that had added employees. More than three-fourths of the firms had experienced project cancellations or deferrals, while only 21% reported winning new projects or add-ons to existing projects in the past two months.

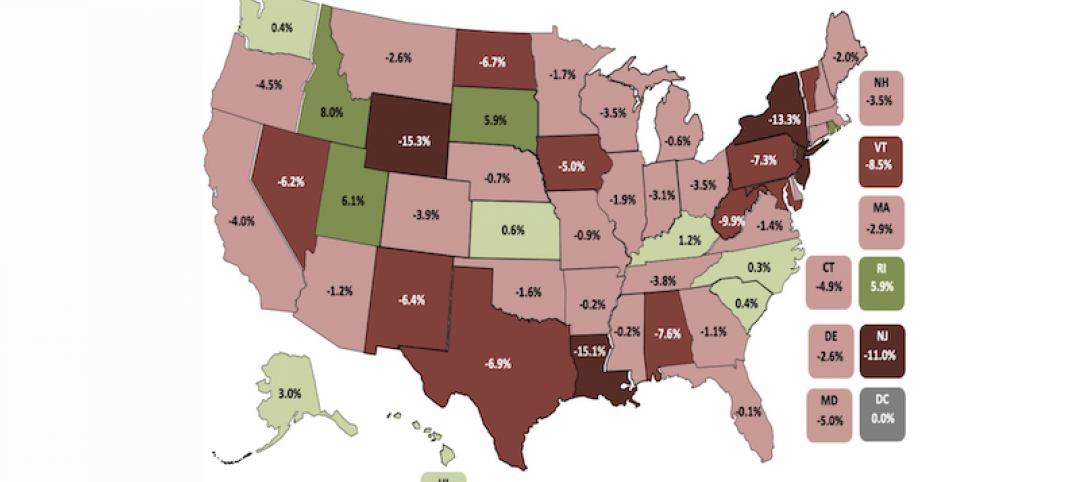

Seasonally adjusted construction employment in January 2021 was lower than in February 2020—the last month before the pandemic forced many contractors to suspend work—in 42 states and was unchanged in the District of Columbia. Texas lost the most construction jobs over the period (-51,900 jobs or -6.6%), followed by California (-36,200 jobs, -4.0%), and New York (-26,000 jobs, -6.4%). Louisiana experienced the largest percentage loss (-14.0%, -19,200 jobs), followed by Wyoming (-9.6%, -2,200 jobs).

Only eight states added construction jobs from February 2020 to January 2021. Idaho added the most jobs (4,500 jobs, 8.2%), trailed by Utah (3,300 jobs, 2.9%), Alabama (6,100 jobs, 6.4%) and Arkansas (1,900 jobs, 3.6%,). Idaho added the highest percentage, followed by Arkansas and Alaska (3.0%, 500 jobs).

From December to January,19 states and D.C. lost construction jobs, 27 states added jobs, and there was no change in Alaska, North and South Dakota, and Wyoming. California had the largest loss of construction jobs for the month (-4,000 jobs or -0.5%), followed by South Carolina (-3,200 jobs, -3.0%) and Illinois (-3,200 jobs, -1.4%). South Carolina had the largest percentage decline, followed by Wisconsin (-2.4%, -3,000 jobs).

Florida added the most construction jobs over the month (3,500 jobs, 0.6%), followed by Texas (0.4%). Vermont had the largest monthly percentage gain (3.4%, 500 jobs), trailed by Idaho (3.3%, 1,900 jobs).

Association officials said demand for construction will continue to suffer amid pandemic-induced economic uncertainty and urged federal officials to enact measures to help stem additional job losses in the sector. These new measures should include new federal investments in infrastructure, ending tariffs on key construction materials, addressing supply chain backups and avoiding costly and unneeded new regulatory burdens.

“The pandemic is driving away projects, contributing to spiking materials prices and helping make delivery schedules unreliable,” said Stephen E. Sandherr, the association’s chief executive officer. “Contractors will not be able to build back better if they have to keep paying higher prices for materials that rarely arrive on time.”

View state February 2020-January 2021 data and rankings and December-January rankings. View AGC’s survey.

Related Stories

Market Data | Jul 19, 2021

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

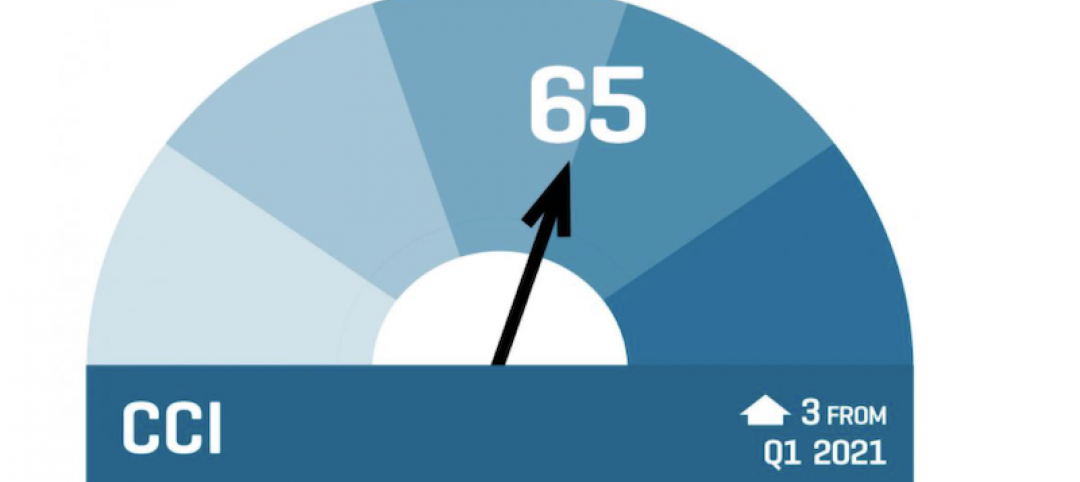

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.