Construction employment declined for the third time in the past four months in May as nonresidential contractors coped with lengthening and unpredictable delivery times that limited their ability to start or complete projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials added that many contractors report they are having a hard time finding qualified workers to hire as some people remain reluctant to return to work while their children are learning from home, or they are collecting elevated unemployment supplements.

“Steadily worsening production and delivery delays have exceeded even the record cost increases for numerous materials as the biggest headache for many nonresidential contractors,” said Ken Simonson, the association’s chief economist. “If they can’t get the materials, they can’t put employees to work.”

Seasonally adjusted construction employment in May totaled 7,423,000, a drop of 20,000 from the downwardly revised April total. Industry employment declined as well in April and February. The total in May remained 225,000 less than in February 2020, the high point before the pandemic drove construction employment down by more than a million jobs.

The gap widened in May between residential construction, which has experienced feverish demand for new and remodeled housing, and nonresidential construction, which has been declining, aside from a few niches. Residential construction firms—contractors working on new housing, additions, and remodeling—gained 1,900 employees during the month and employed 35,000 more workers (1.2%) in May than in the pre-pandemic peak month of February 2020. In contrast, the nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 21,800 jobs in May and employed 260,000 fewer workers or 5.6% less than in February 2020.

“Contractors are being told they must wait nearly a year to receive shipments of steel and 4-6 months for roofing materials,” Simonson noted. “These delays make it impossible to start some projects and to complete others, leaving contractors unable to keep workers employed. In addition, soaring prices for steel, lumber, and other materials are deterring owners from committing to going ahead with projects.”

Association officials urged Congress and the Biden administration to take steps to address the record materials price increases and supply chain bottlenecks. They said the President should end tariffs on key materials like lumber, steel, and aluminum. They added that Washington officials should look at ways to ease manufacturing and shipping backups. And they urged Congress to allow unemployment supplements to expire, as planned, after Labor Day.

“The decline in construction employment is likely less about a lack of demand as it is about the challenges contractors are facing in meeting that demand,” said Stephen E. Sandherr, the association’s chief executive officer. “Supply-chain problems and labor shortages are holding back what should otherwise be a much stronger recovery for the construction sector.”

Related Stories

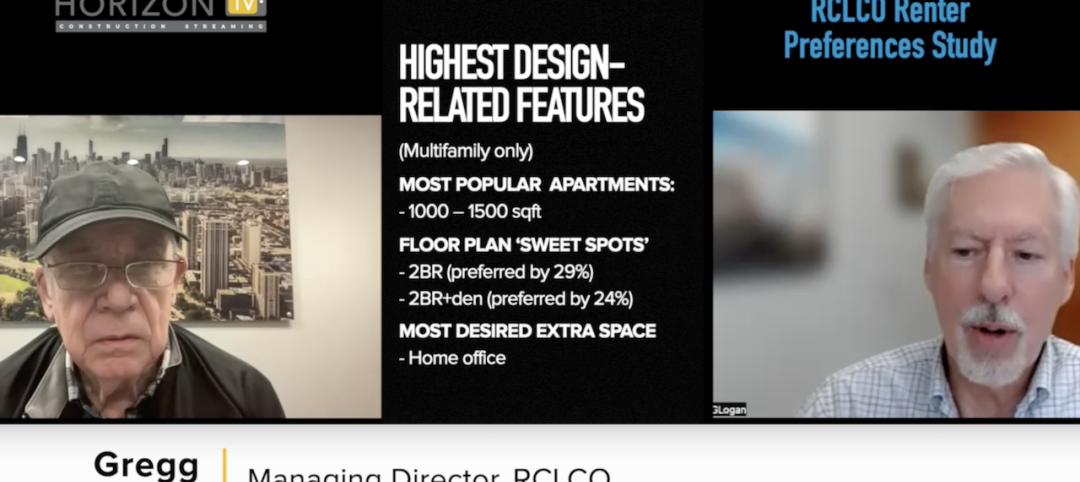

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

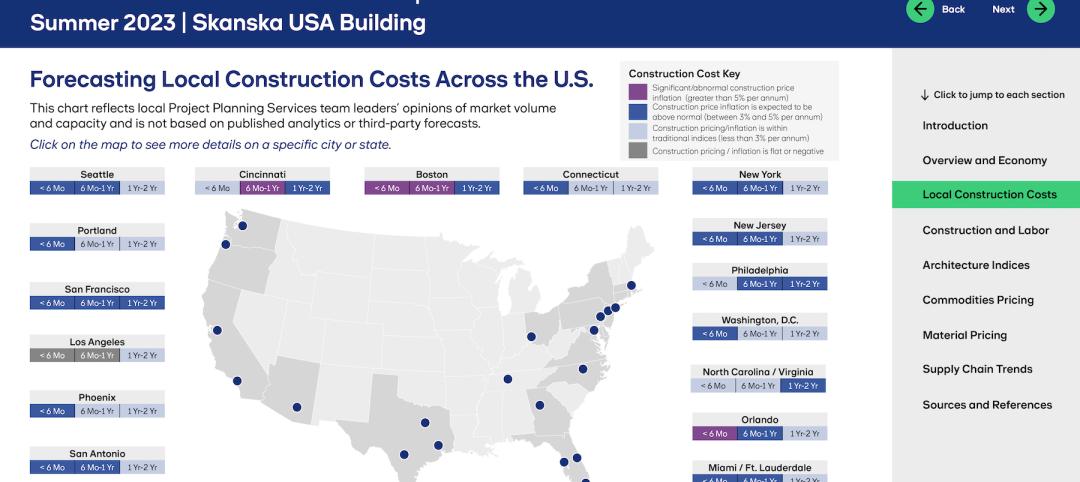

Market Data | Aug 18, 2023

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.

Apartments | Aug 14, 2023

Yardi Matrix updates near-term multifamily supply forecast

The multifamily housing supply could increase by up to nearly 7% by the end of 2023, states the latest Multifamily Supply Forecast from Yardi Matrix.

Hotel Facilities | Aug 2, 2023

Top 5 markets for hotel construction

According to the United States Construction Pipeline Trend Report by Lodging Econometrics (LE) for Q2 2023, the five markets with the largest hotel construction pipelines are Dallas with a record-high 184 projects/21,501 rooms, Atlanta with 141 projects/17,993 rooms, Phoenix with 119 projects/16,107 rooms, Nashville with 116 projects/15,346 rooms, and Los Angeles with 112 projects/17,797 rooms.

Market Data | Aug 1, 2023

Nonresidential construction spending increases slightly in June

National nonresidential construction spending increased 0.1% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. Spending is up 18% over the past 12 months. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.07 trillion in June.

Hotel Facilities | Jul 27, 2023

U.S. hotel construction pipeline remains steady with 5,572 projects in the works

The hotel construction pipeline grew incrementally in Q2 2023 as developers and franchise companies push through short-term challenges while envisioning long-term prospects, according to Lodging Econometrics.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Market Data | Jul 24, 2023

Leading economists call for 2% increase in building construction spending in 2024

Following a 19.7% surge in spending for commercial, institutional, and industrial buildings in 2023, leading construction industry economists expect spending growth to come back to earth in 2024, according to the July 2023 AIA Consensus Construction Forecast Panel.

Contractors | Jul 13, 2023

Construction input prices remain unchanged in June, inflation slowing

Construction input prices remained unchanged in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices were also unchanged for the month.

Contractors | Jul 11, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of June 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in June 2023, according to an ABC member survey conducted June 20 to July 5. The reading is unchanged from June 2022.