Construction employment decreased from January 2020 to January 2021 in nearly two-thirds of the nation’s metro areas, according to an analysis by the Associated General Contractors of America of government employment data released today, as project cancellations and a lack of new orders have forced firms to reduce their headcount, the association’s latest contractor survey shows. Association officials said more layoffs are likely for the industry amid spiking materials prices and uncertain demand for new projects.

“More contractors are telling us they are cutting headcount than adding workers, which is consistent with the new data showing the industry is shrinking in many parts of the country,” said Ken Simonson, the association’s chief economist. “More than three-fourth of the firms said projects had been postponed or canceled, while only one out of five reported winning new work or an add-on to an existing project in the previous two months as a result of the pandemic. That imbalance makes further job losses likely in many metros.”

Construction employment fell in 225, or 63%, of 358 metro areas between January 2020 and January 2021. Industry employment was stagnant in 41 additional metro areas, while only 92 metro areas—26%—added construction jobs.

Houston-The Woodlands-Sugar Land, Texas lost the largest number of construction jobs over the 12-month period (-32,900 jobs, -14%), followed by New York City (-23,000 jobs, -15%); Midland, Texas (-11,100 jobs, -29%); and Chicago-Naperville-Arlington Heights, Ill. (-10,400 jobs, -9%). Lake Charles, La. had the largest percentage decline (-40%, -8,100 jobs), followed by Odessa, Texas (-37%, -7,600 jobs); Midland; and Laredo, Texas (-27%, -1,100 jobs).

Sacramento--Roseville--Arden-

Association officials are urging Congress and the Biden administration to work together to address rising materials prices, supply chain backups and invest in infrastructure. They are asking the administration to end tariffs on key construction materials, including steel and lumber, work with shippers to get deliveries back on track and pass the significant new infrastructure investments the president has promised.

“The construction industry won’t be able to fully recover and start adding jobs in significant numbers as long as materials prices continue to spike, deliveries remain unreliable and demand remains uncertain,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials can’t fix every problem, but they can help by removing tariffs, helping hard-hit shippers and boosting investments in the nation’s infrastructure.”

View the metro employment 12-month data, rankings, top 10, multi-division metros. View AGC’s survey.

Related Stories

Market Data | May 2, 2023

Nonresidential construction spending up 0.7% in March 2023 versus previous month

National nonresidential construction spending increased by 0.7% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $997.1 billion for the month.

Hotel Facilities | May 2, 2023

U.S. hotel construction up 9% in the first quarter of 2023, led by Marriott and Hilton

In the latest United States Construction Pipeline Trend Report from Lodging Econometrics (LE), analysts report that construction pipeline projects in the U.S. continue to increase, standing at 5,545 projects/658,207 rooms at the close of Q1 2023. Up 9% by both projects and rooms year-over-year (YOY); project totals at Q1 ‘23 are just 338 projects, or 5.7%, behind the all-time high of 5,883 projects recorded in Q2 2008.

Market Data | May 1, 2023

AEC firm proposal activity rebounds in the first quarter of 2023: PSMJ report

Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year.

Industry Research | Apr 25, 2023

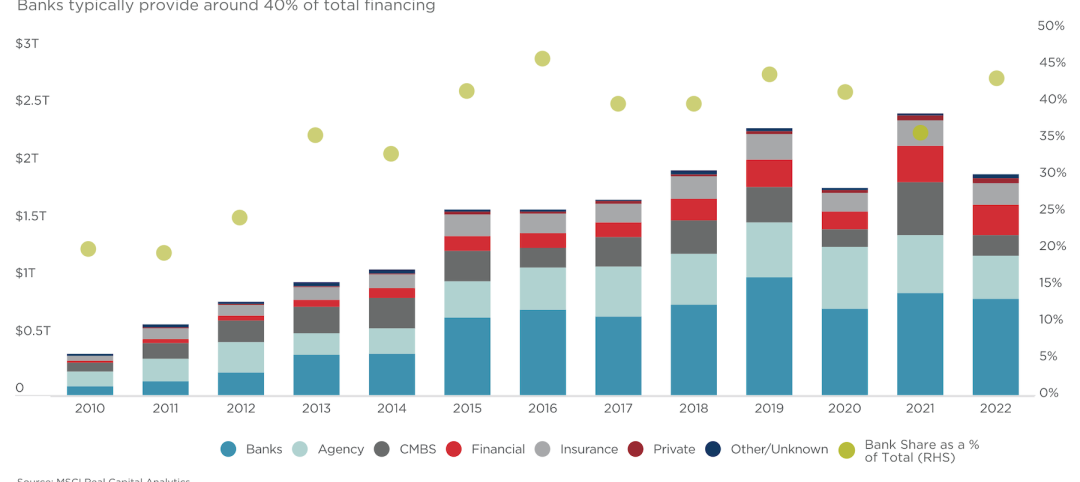

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

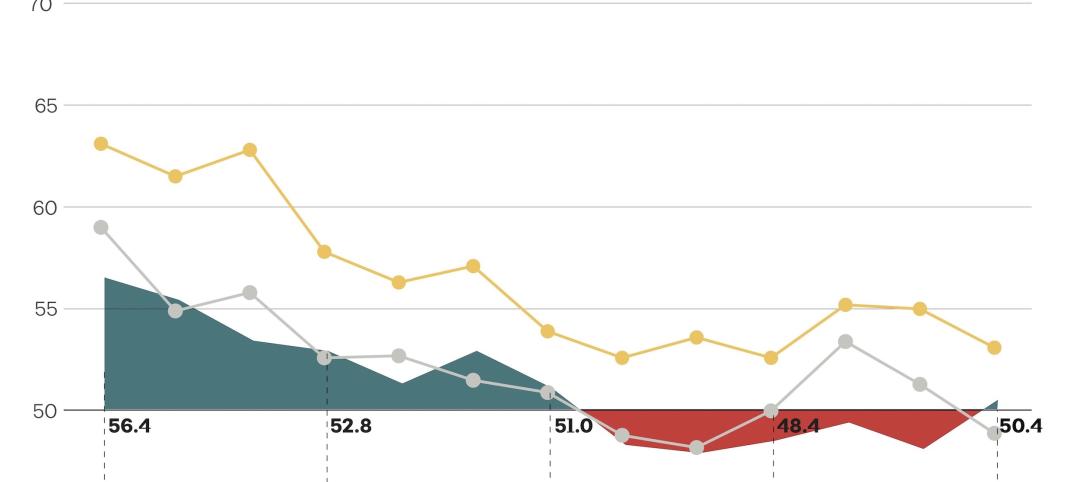

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.