Construction employment decreased from January 2020 to January 2021 in nearly two-thirds of the nation’s metro areas, according to an analysis by the Associated General Contractors of America of government employment data released today, as project cancellations and a lack of new orders have forced firms to reduce their headcount, the association’s latest contractor survey shows. Association officials said more layoffs are likely for the industry amid spiking materials prices and uncertain demand for new projects.

“More contractors are telling us they are cutting headcount than adding workers, which is consistent with the new data showing the industry is shrinking in many parts of the country,” said Ken Simonson, the association’s chief economist. “More than three-fourth of the firms said projects had been postponed or canceled, while only one out of five reported winning new work or an add-on to an existing project in the previous two months as a result of the pandemic. That imbalance makes further job losses likely in many metros.”

Construction employment fell in 225, or 63%, of 358 metro areas between January 2020 and January 2021. Industry employment was stagnant in 41 additional metro areas, while only 92 metro areas—26%—added construction jobs.

Houston-The Woodlands-Sugar Land, Texas lost the largest number of construction jobs over the 12-month period (-32,900 jobs, -14%), followed by New York City (-23,000 jobs, -15%); Midland, Texas (-11,100 jobs, -29%); and Chicago-Naperville-Arlington Heights, Ill. (-10,400 jobs, -9%). Lake Charles, La. had the largest percentage decline (-40%, -8,100 jobs), followed by Odessa, Texas (-37%, -7,600 jobs); Midland; and Laredo, Texas (-27%, -1,100 jobs).

Sacramento--Roseville--Arden-

Association officials are urging Congress and the Biden administration to work together to address rising materials prices, supply chain backups and invest in infrastructure. They are asking the administration to end tariffs on key construction materials, including steel and lumber, work with shippers to get deliveries back on track and pass the significant new infrastructure investments the president has promised.

“The construction industry won’t be able to fully recover and start adding jobs in significant numbers as long as materials prices continue to spike, deliveries remain unreliable and demand remains uncertain,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials can’t fix every problem, but they can help by removing tariffs, helping hard-hit shippers and boosting investments in the nation’s infrastructure.”

View the metro employment 12-month data, rankings, top 10, multi-division metros. View AGC’s survey.

Related Stories

Market Data | Aug 2, 2017

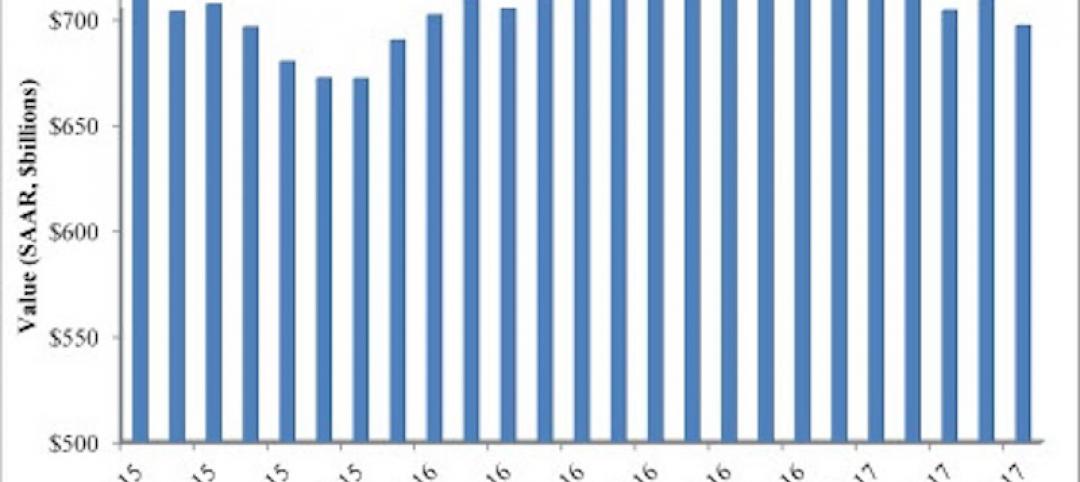

Nonresidential Construction Spending falls in June, driven by public sector

June’s weak construction spending report can be largely attributed to the public sector.

Market Data | Jul 31, 2017

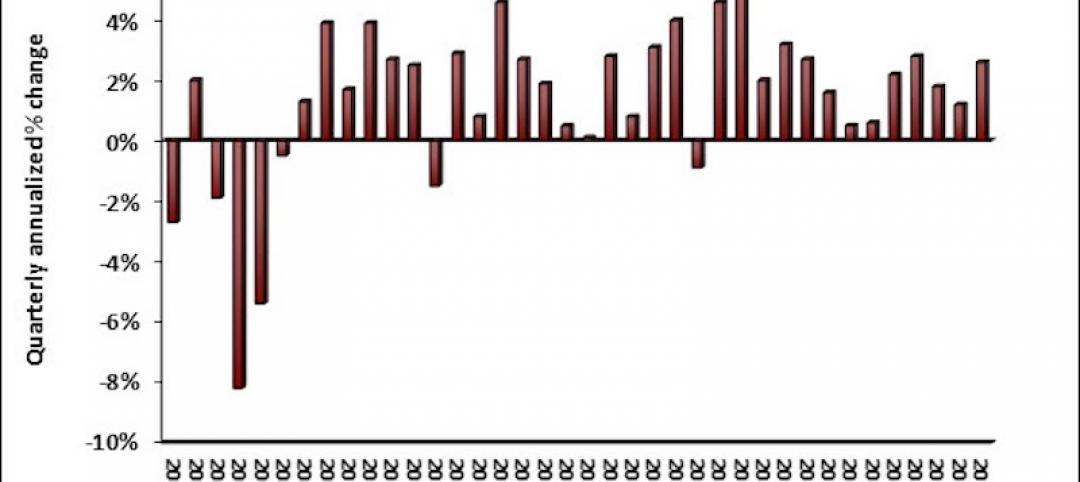

U.S. economic growth accelerates in second quarter; Nonresidential fixed investment maintains momentum

Nonresidential fixed investment, a category of GDP embodying nonresidential construction activity, expanded at a 5.2% seasonally adjusted annual rate.

Multifamily Housing | Jul 27, 2017

Apartment market index: Business conditions soften, but still solid

Despite some softness at the high end of the apartment market, demand for apartments will continue to be substantial for years to come, according to the National Multifamily Housing Council.

Market Data | Jul 25, 2017

What's your employer value proposition?

Hiring and retaining talent is one of the top challenges faced by most professional services firms.

Market Data | Jul 25, 2017

Moderating economic growth triggers construction forecast downgrade for 2017 and 2018

Prospects for the construction industry have weakened with developments over the first half of the year.

Industry Research | Jul 6, 2017

The four types of strategic real estate amenities

From swimming pools to pirate ships, amenities (even crazy ones) aren’t just perks, but assets to enhance performance.

Market Data | Jun 29, 2017

Silicon Valley, Long Island among the priciest places for office fitouts

Coming out on top as the most expensive market to build out an office is Silicon Valley, Calif., with an out-of-pocket cost of $199.22.

Market Data | Jun 26, 2017

Construction disputes were slightly less contentious last year

But poorly written and administered contracts are still problems, says latest Arcadis report.

Industry Research | Jun 26, 2017

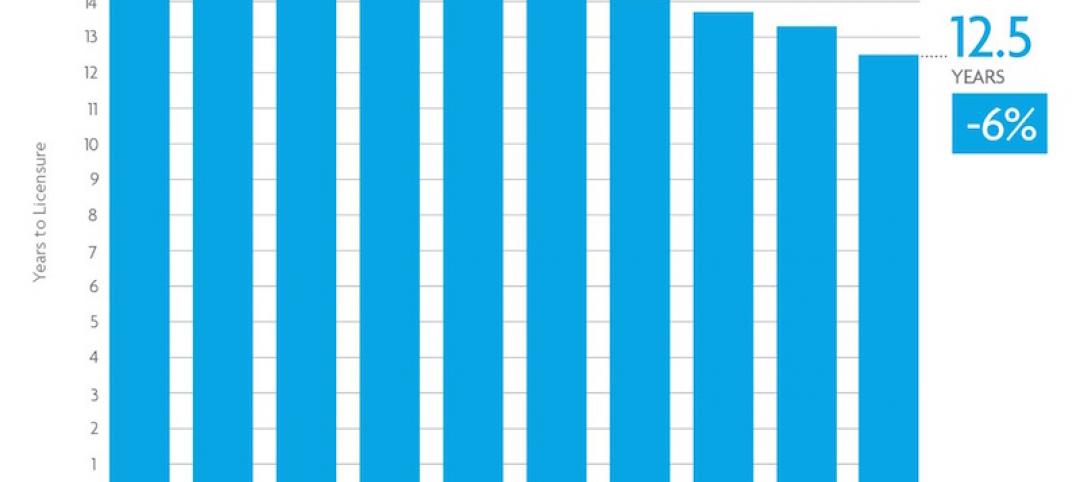

Time to earn an architecture license continues to drop

This trend is driven by candidates completing the experience and examination programs concurrently and more quickly.

Industry Research | Jun 22, 2017

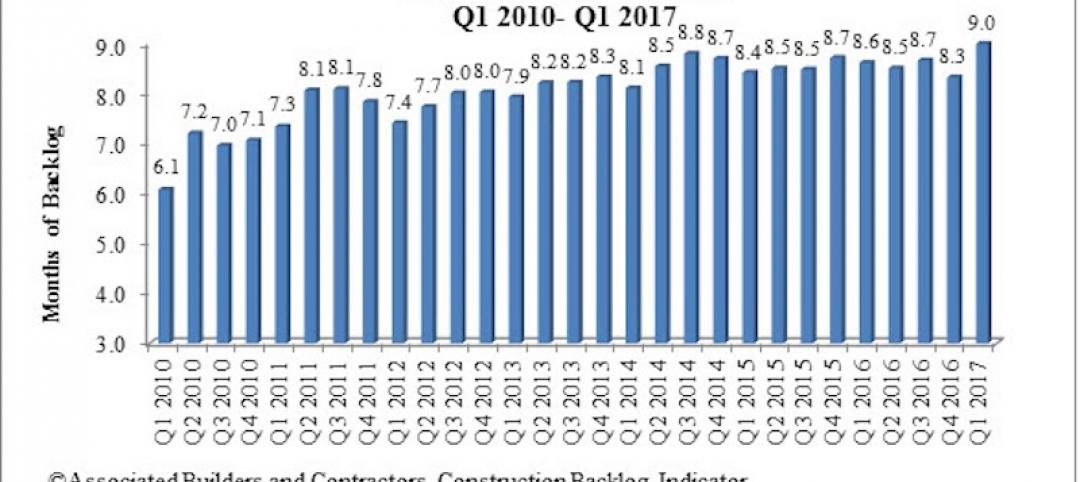

ABC's Construction Backlog Indicator rebounds in 2017

The first quarter showed gains in all categories.