Construction employment was unchanged from March to April as nonresidential contractors and homebuilders alike struggled to obtain materials and find enough workers, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said the industry’s recovery was being hampered by problems getting stable prices and reliable deliveries of key materials, while the pandemic and federal policies were making it harder for firms to find workers to hire.

“Contractors are experiencing unprecedented intensity and range of cost increases, supply-chain disruptions, and worker shortages that have kept firms from increasing their workforces,” said Ken Simonson, the association’s chief economist. “These challenges will make it difficult for contractors to rebound as the pandemic appears to wane.”

Construction employment in April totaled 7,452,000, matching the March total but amounting to 196,000 employees or 2.6% below the most recent peak in February 2020. The number of former construction workers who were unemployed in April, 768,000, dropped by half from a year ago and the sector’s unemployment rate fell from 16.6% in April 2020 to 7.7% last month.

“The fact that employment has stalled—despite strong demand for new homes, remodeling of all types, and selected categories of nonresidential projects—suggests that contractors can’t get either the materials or the workers they need,” Simonson added. The economist noted that many firms report key materials are backlogged or rationed, while others report they are having a hard time getting former workers to return to work. He added these factors are contributing to rising costs for many contractors, which are details in the association’s updated Construction Inflation Alert.

Although employment was nearly stagnant for the month for both residential and nonresidential construction, the sectors differ sharply in their recovery since the pre-pandemic peak in February 2020. Residential construction firms—contractors working on new housing, additions, and remodeling—gained only 3,000 employees during the month but have added 46,000 workers or 1.6% over 14 months. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 3,000 jobs in April and employed 242,000 fewer workers or 5.2% less than in February 2020.

Association officials said that the temporary new federal unemployment supplements appear to be keeping some people from returning to work, while others are being forced to care for dependents not yet back in school or day care, or loved ones afflicted with the coronavirus. They added that federal tariffs and labor shortages within the shipping and manufacturing sector are a major reason for the rising materials prices and supply chain problems.

“Ironically, the latest coronavirus relief bill may actually be holding back economic growth by keeping people away from work at a time when demand is rebounding,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials need to look at ways to encourage people to return to work, end damaging tariffs on materials like steel and lumber, and act to ease shipping delays and backlogs.”

Related Stories

Market Data | Jul 19, 2021

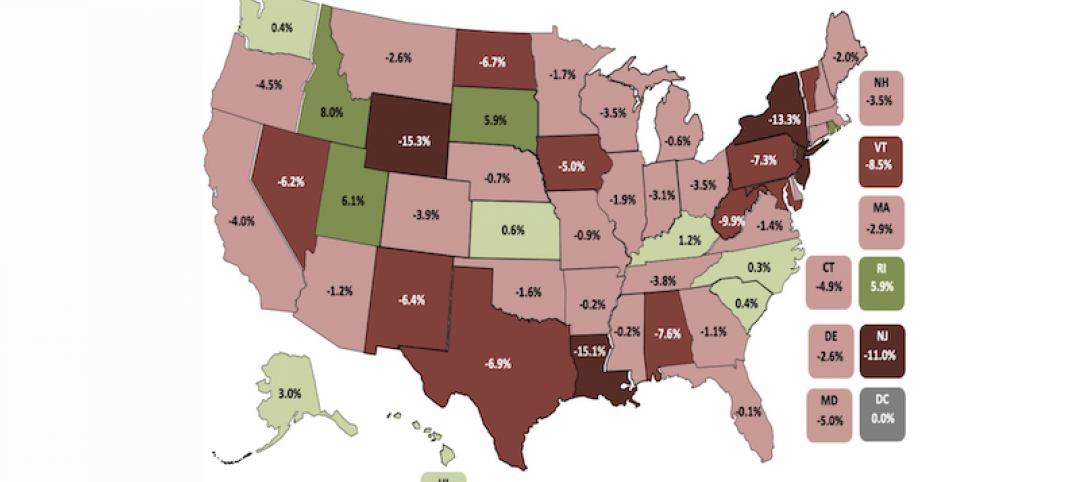

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

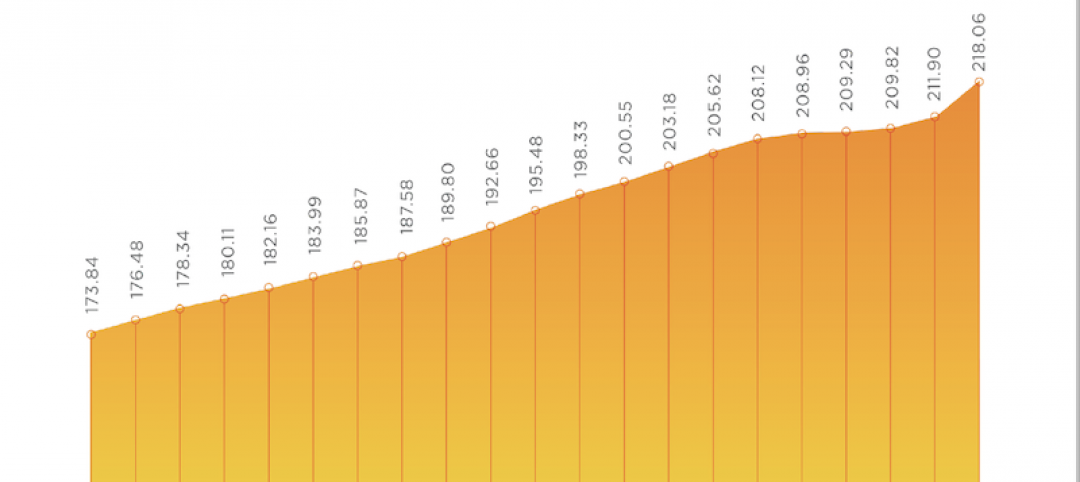

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.

Market Data | Jul 13, 2021

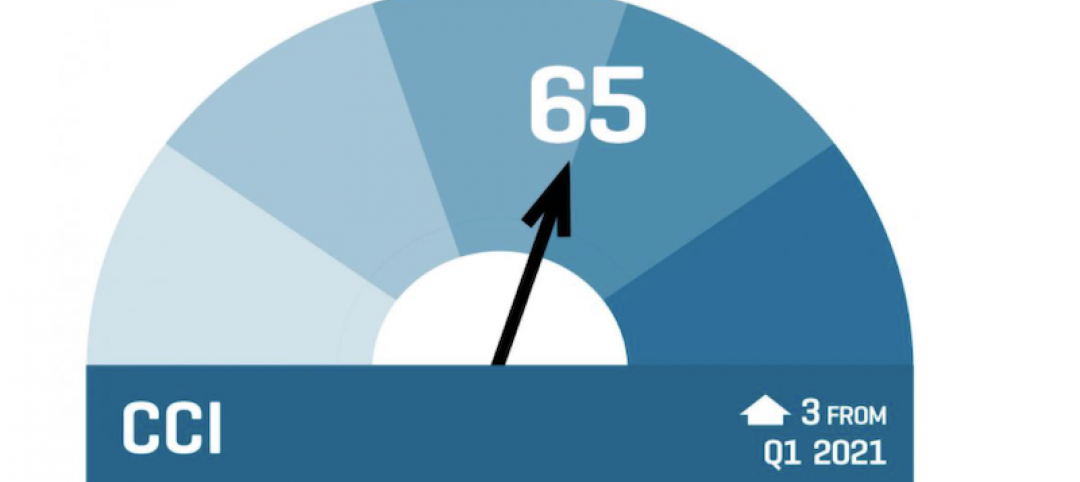

ABC’s Construction Backlog Indicator and Contractor Confidence Index rise in June

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels increased modestly in June.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Market Data | Jul 7, 2021

Construction employment declines by 7,000 in June

Nonresidential firms struggle to find workers and materials to complete projects.

Market Data | Jun 30, 2021

Construction employment in May trails pre-covid levels in 91 metro areas

Firms struggle to cope with materials, labor challenges.

Market Data | Jun 23, 2021

Construction employment declines in 40 states between April and May

Soaring material costs, supply-chain disruptions impede recovery.

Market Data | Jun 22, 2021

Architecture billings continue historic rebound

AIA’s Architecture Billings Index (ABI) score for May rose to 58.5 compared to 57.9 in April.

Market Data | Jun 17, 2021

Commercial construction contractors upbeat on outlook despite worsening material shortages, worker shortages

88% indicate difficulty in finding skilled workers; of those, 35% have turned down work because of it.