A bruising presidential election and a tightening labor market are prompting reservations about future spending for nonresidential building, even as the construction industry’s performance has staved off most gloom-and-doom scenarios.

Total spending for nonresidential building was up nearly 11%, to $103.3 billion, in the first quarter. The Census Bureau estimated that the value of nonresidential building put in place rose 3.1% in April compared to April 2015, to an annualized $461.8 billion, spurred by robust building of hotels, offices, and entertainment/amusement centers.

TOP CONTRACTOR GIANTS

2015 GC Revenue ($)

1. Turner Construction Co. $10,566,643,175

2. Whiting-Turner Contracting Co. $5,530,003,229

3. Fluor Corp. $5,048,920,000

4. Skanska USA $4,887,571,264

5. Gilbane Building Co. $4,406,057,000

6. PCL Construction Enterprises $4,344,294,460

7. Balfour Beatty US $3,955,770,283

8. Structure Tone $3,865,600,000

9. AECOM $3,772,057,000

10. DPR Construction $3,085,975,000

TOP CM/PM GIANTS

2015 CM/PM Revenue ($)

1. Hill International $503,000,000

2. Jacobs $460,670,000

3. JLL $328,233,760

4. Hunter Roberts Construction Group $259,724,915

5. AECOM $256,933,000

6. Burns & McDonnell $255,390,861

7. WSP | Parsons Brinckerhoff $173,063,000

8. Turner Construction Co. $161,788,824

9. Sachse Construction $109,836,555

10. Cumming $96,538,000

CONSTRUCTION GIANTS SPONSORED BY:

“The construction sector is likely to be the economic tailwind” in the U.S., predicts Kermit Baker, PhD, Chief Economist with the American Institute of Architects.

Baker and chief economists Ken Simonson of the Associated General Contractors of America and Alex Carrick of CMD Construction Data expect nonresidential construction spending to increase 9–10% this year and 4–8% in 2017. More than one-third of AGC’s membership expects there will be more work to bid on this year than last year, particularly in the retail, warehouse, lodging, and office sectors.

The trio of economists raised a number of red flags about factors that could slow construction spending. “Market fundamentals remain positive, but are fading in most sectors,” said Baker.

Carrick and Simonson are less sanguine about spending for education-related projects, mainly because growth figures for 4- to 17-year-olds and 18- to 26-year-olds are either flat lining or receding.

Simonson noted that recent legislation passed by Congress extends tax credits and allows for more federal dollars to flow into construction. But the federal government is reducing its overall physical footprint, so it’s more likely to renovate existing buildings than build new.

Multifamily housing, which has been one of the construction industry’s high-powered turbines—it’s up 30% since 2009, according to Baker—is expected to taper off to a still-strong but normalized range of 410,000–440,000 units per year.

Simonson also pointed out that the U.S. population has been growing at less than 1% annually, and that several states have lost population. Immigration, which has pushed population growth over the past few decades, has lost traction. The factors could lead to less mobility and less demand for new construction.

HELLO!!! ARE THERE ANY CARPENTERS OUT THERE?

Another area of concern for contractors is finding the skilled labor they need to complete projects they bid for.

The country’s unemployment rate stood at 4.7% in May, and was down in 269 of 387 metros, according to Bureau of Labor Statistics estimates. Carrick noted that the labor participation rate (the labor force as a percentage of the working-age population) fell to 62.5% in Q1/2016, from 67% in 2001.

Citing a recent survey of 1,300 AGC-member companies, Simonson said that 79% are having difficulty finding hourly craft professionals, and 73% struggle to hire carpenters. More than half (56%) said they have raised their base pay for hourly workers; 29% provide incentives and bonuses.

None of the economists anticipates a recession rearing its head any time soon. “I think there’s too much negative talk about the economy,” said Carrick. What does worry him are the sluggish energy sector and economic slowdowns outside the U.S., specifically China.

As for the presidential race, AGC’s Simonson lamented that it might not make much difference who wins. “I expect continued gridlock,” he says. “Uncertainty will cause companies to hold back on major investments.”

More on the 2016 Construction Giants: BD+C's John Caulfield examines how Turner uses to design-build, P3, Lean practices, and engineering services.

RETURN TO THE GIANTS 300 LANDING PAGE

Related Stories

| Sep 8, 2022

U.S. construction costs expected to rise 14% year over year by close of 2022

Coldwell Banker Richard Ellis (CBRE) is forecasting a 14.1% year-on-year increase in U.S. construction costs by the close of 2022.

Giants 400 | Sep 7, 2022

Top 110 Industrial Sector Contractors + CM Firms for 2022

Clayco, Arco Construction, Ryan Companies, and STO Building Group top the ranking of the nation's largest industrial facility sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

| Sep 7, 2022

Use of GBCI building performance tools rapidly expanding

More than seven billion square feet of project space is now being tracked using Green Business Certification Inc.’s (GBCI’s) Arc performance platform.

| Sep 7, 2022

K-8 school will help students learn by conducting expeditions in their own communities

In August, SHP, an architecture, design, and engineering firm, broke ground on the new Peck Expeditionary Learning School in Greensboro, N.C. Guilford County Schools, one of the country’s 50 largest school districts, tapped SHP based on its track record of educational design.

| Sep 6, 2022

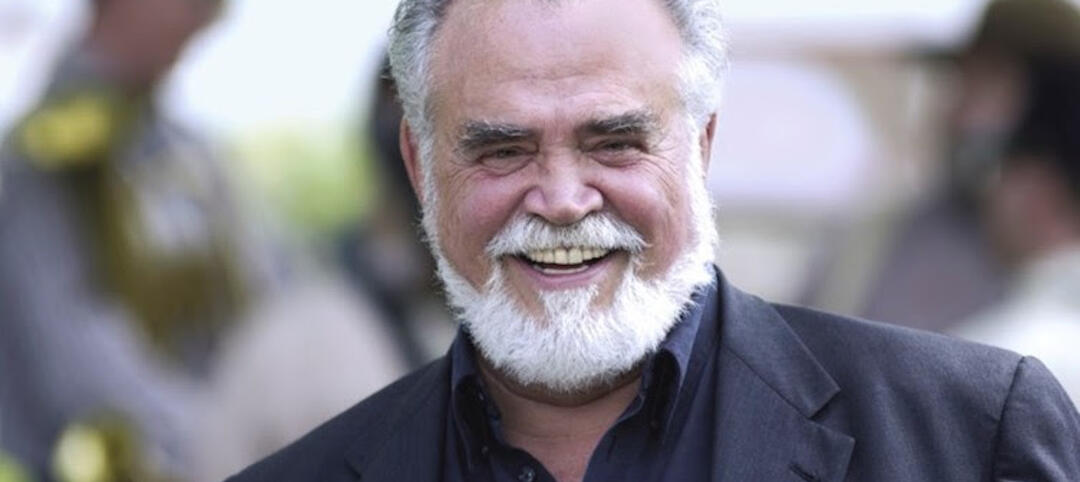

Herbert V. Kohler, Jr. (1939-2022) An incomparable spirit

Dynamic leader and Kohler Co. Executive Chairman Herbert Vollrath Kohler, Jr. passed away on September 3, 2022, in Kohler, Wisconsin.

| Sep 6, 2022

Demand for flexible workspace reaches all-time high

Demand for flexible workspace including coworking options has never been higher, according to a survey from Yardi Kube, a space management software provider that is part of Yardi Systems.

| Sep 2, 2022

Converting office buildings to apartments is cheaper, greener than building new

Converting office buildings to apartments is cheaper and greener than tearing down old office properties and building new residential buildings.

| Sep 2, 2022

New UMass Medical School building enables expanded medical class sizes, research labs

A new nine-story, 350,000 sf biomedical research and education facility under construction at the University of Massachusetts Chan Medical School in Worcester, Mass., will accommodate larger class sizes and extensive lab space.

Giants 400 | Sep 1, 2022

Top 100 K-12 School Contractors and CM Firms for 2022

Gilbane, Core Construction, Skanska, and Balfour Beatty head the ranking of the nation's largest K-12 school sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

| Sep 1, 2022

ABC: Nonresidential Construction Spending Increases by a Modest 0.8% in July

National nonresidential construction spending increased 0.8% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.