Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

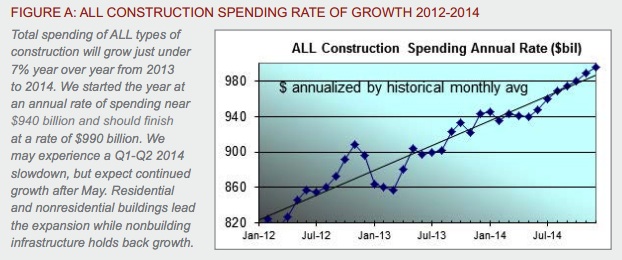

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

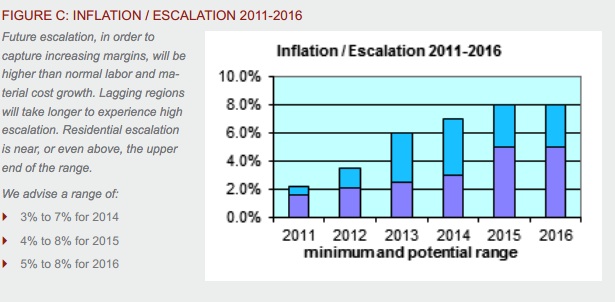

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

Green | Apr 8, 2024

LEED v5 released for public comment

The U.S. Green Building Council (USGBC) has opened the first public comment period for the first draft of LEED v5. The new version of the LEED green building rating system will drive deep decarbonization, quality of life improvements, and ecological conservation and restoration, USGBC says.

Codes and Standards | Apr 8, 2024

Boston’s plans to hold back rising seawater stall amid real estate slowdown

Boston has placed significant aspects of its plan to protect the city from rising sea levels on the actions of private developers. Amid a post-Covid commercial development slump, though, efforts to build protective infrastructure have stalled.

Sustainability | Apr 8, 2024

3 sustainable design decisions to make early

In her experience as an architect, Megan Valentine AIA, LEED AP, NCARB, WELL AP, Fitwel, Director of Sustainability, KTGY has found three impactful sustainable design decisions: site selection, massing and orientation, and proper window-to-wall ratios.

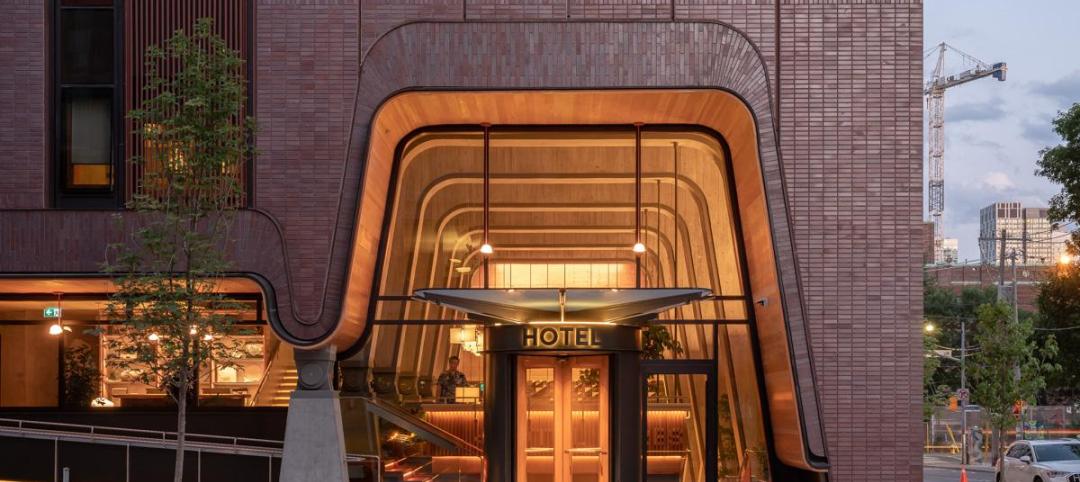

Brick and Masonry | Apr 4, 2024

Best in brick buildings: 9 projects take top honors in the Brick in Architecture Awards

The Ace Hotel Toronto, designed by Shim-Sutcliffe Architects, and the TCU Music Center by Bora Architecture & Interiors are among nine "Best in Class" winners and 44 overall winners in the Brick Industry Association's 2023 Brick in Architecture Awards.

Retail Centers | Apr 4, 2024

Retail design trends: Consumers are looking for wellness in where they shop

Consumers are making lifestyle choices with wellness in mind, which ignites in them a feeling of purpose and a sense of motivation. That’s the conclusion that the architecture and design firm MG2 draws from a survey of 1,182 U.S. adult consumers the firm conducted last December about retail design and what consumers want in healthier shopping experiences.

Healthcare Facilities | Apr 3, 2024

Foster + Partners, CannonDesign unveil design for Mayo Clinic campus expansion

A redesign of the Mayo Clinic’s downtown campus in Rochester, Minn., centers around two new clinical high-rise buildings. The two nine-story structures will reach a height of 221 feet, with the potential to expand to 420 feet.

Sports and Recreational Facilities | Apr 2, 2024

How university rec centers are evolving to support wellbeing

In a LinkedIn Live, Recreation & Wellbeing’s Sadat Khan and Abby Diehl joined HOK architect Emily Ostertag to discuss the growing trend to design and program rec centers to support mental wellbeing and holistic health.

Architects | Apr 2, 2024

AE Works announces strategic acquisition of WTW Architects

AE Works, an award-winning building design and consulting firm is excited to announce that WTW Architects, a national leader in higher education design, has joined the firm.

Office Buildings | Apr 2, 2024

SOM designs pleated façade for Star River Headquarters for optimal daylighting and views

In Guangzhou, China, Skidmore, Owings & Merrill (SOM) has designed the recently completed Star River Headquarters to minimize embodied carbon, reduce energy consumption, and create a healthy work environment. The 48-story tower is located in the business district on Guangzhou’s Pazhou Island.

K-12 Schools | Apr 1, 2024

High school includes YMCA to share facilities and connect with the broader community

In Omaha, Neb., a public high school and a YMCA come together in one facility, connecting the school with the broader community. The 285,000-sf Westview High School, programmed and designed by the team of Perkins&Will and architect of record BCDM Architects, has its own athletic facilities but shares a pool, weight room, and more with the 30,000-sf YMCA.