Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

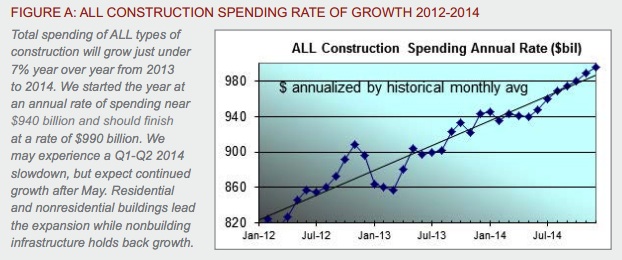

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

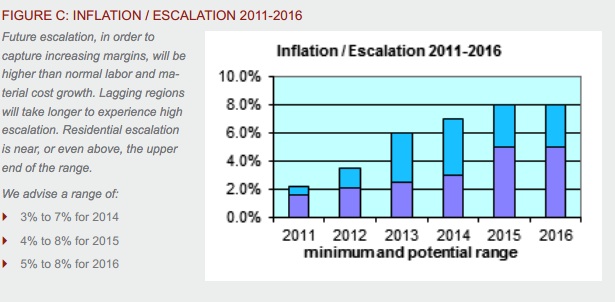

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

| Aug 11, 2010

Design firms slash IT spending in 2009

Over half of architecture, engineering, and environmental consulting firms (55%) are budgeting less for information technology in 2009 than they did in 2008, according to a new report from ZweigWhite. The 2009 Information Technology Survey reports that firms' 2009 IT budgets are a median of 3.3% of net service revenue, down from 3.6% in 2008. Firms planning to decrease spending are expected to do so by a median of 20%.

| Aug 11, 2010

A glimmer of hope amid grim news as construction employment falls in most states, metro areas

The construction employment picture brightened slightly with 18 states adding construction jobs from April to May according to a new analysis of data released today by the Bureau of Labor Statistics (BLS). However, construction employment overall continued to decline, noted Ken Simonson, the chief economist for the Associated General Contractors of America.

| Aug 11, 2010

Thom Mayne unveils 'floating cube' design for the Perot Museum of Nature and Science in Dallas

Calling it a “living educational tool featuring architecture inspired by nature and science,” Pritzker Prize Laureate Thom Mayne and leaders from the Museum of Nature & Science unveiled the schematic designs and building model for the Perot Museum of Nature & Science at Victory Park. Groundbreaking on the approximately $185 million project will be held later this fall, and the Museum is expected to open by early 2013.

| Aug 11, 2010

SOM's William F. Baker awarded Fritz Leonhardt Prize for achievement in structural engineering

In recognition of his engineering accomplishments, which include many of the tallest skyscrapers of our time, William F. Baker received the coveted Fritz Leonhardt Prize in Stuttgart, Germany. He is the first American to receive the prize.

| Aug 11, 2010

American Concrete Institute forms technical committee on BIM for concrete structures

The American Concrete Institute (ACI) announces the formation of a new technical committee on Building Information Modeling (BIM) of Concrete Structures.

| Aug 11, 2010

10 tips for mitigating influenza in buildings

Adopting simple, common-sense measures and proper maintenance protocols can help mitigate the spread of influenza in buildings. In addition, there are system upgrades that can be performed to further mitigate risks. Trane Commercial Systems offers 10 tips to consider during the cold and flu season.

| Aug 11, 2010

Reed Construction Data files corporate espionage lawsuit against McGraw-Hill Construction Dodge

Reed Construction Data (RCD), a leading construction information provider and a wholly-owned subsidiary of Reed Elsevier (NYSE:RUK, NYSE:ENL), today filed suit in federal court against McGraw-Hill Construction Dodge, a unit of The McGraw-Hill Companies, Inc. (NYSE:MHP). The suit charges that Dodge has unlawfully accessed confidential and trade secret information from RCD since 2002 by using a series of fake companies to pose as RCD customers.

| Aug 11, 2010

Jacobs, HOK top BD+C's ranking of the 75 largest state/local government design firms

A ranking of the Top 75 State/Local Government Design Firms based on Building Design+Construction's 2009 Giants 300 survey. For more Giants 300 rankings, visit http://www.BDCnetwork.com/Giants

| Aug 11, 2010

Brad Pitt’s foundation unveils 14 duplex designs for New Orleans’ Lower 9th Ward

Gehry Partners, William McDonough + Partners, and BNIM are among 14 architecture firms commissioned by Brad Pitt's Make It Right foundation to develop duplex housing concepts specifically for rebuilding the Lower 9th Ward in New Orleans. All 14 concepts were released yesterday.

| Aug 11, 2010

NAVFAC releases guidelines for sustainable reconstruction of Navy facilities

The guidelines provide specific guidance for installation commanders, assessment teams, estimators, programmers and building designers for identifying the sustainable opportunities, synergies, strategies, features and benefits for improving installations following a disaster instead of simply repairing or replacing them as they were prior to the disaster.