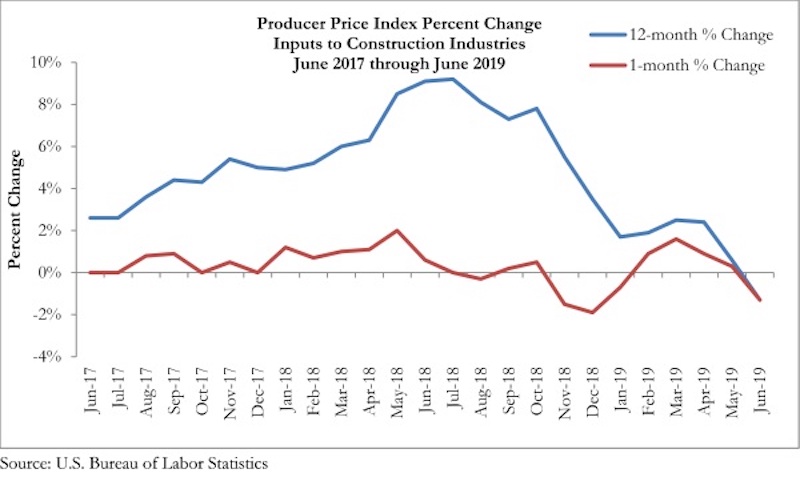

Construction input prices decreased 1.3% on both a monthly and yearly basis in June, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. This is the first time in nearly three years that input prices have fallen on a year-over-year basis.

Overall, nonresidential construction input prices declined 1.4% from May 2019 but are down just 0.8% from June 2018. Among the 11 sub-categories, only natural gas (+1.6%) and concrete products (+0.9%) prices increased compared to May 2019. On a yearly basis, three of the sub-category prices have declined by more than 20%, including softwood lumber (-23.1%), crude petroleum (-22.2%) and natural gas (-22.3%).

“Eighteen months ago, surging construction materials prices represented one of the leading sources of concern among construction executives,” said ABC Chief Economist Anirban Basu. “That was a time of solid global economic growth and the first synchronized worldwide global expansion in approximately a decade. Yet things can change dramatically in a year and a half. According to today’s data release, construction materials prices are falling, in part a reflection of a weakening global economy.

“Given that the United States is in the midst of its lengthiest economic expansion with an unemployment rate at approximately a 50-year low, such low inflation remains a conundrum,” said Basu. “However, the June PPI numbers indicate that those commodities exposed to global economic weakness have been the ones to experience declines in prices, with the exception of concrete products and natural gas. While America has begun to export more natural gas, today’s prices largely reflect the domestic demand and supply.

“With the global economy continuing to stumble, there is little reason to believe that materials prices will bounce back significantly,” said Basu. “Of course, trade issues and other disputes can quickly alter the trajectories of prices. If economic forces are allowed to play out, contractors should be able to focus the bulk of their attention on labor compensation costs and worry relatively less about materials prices.”

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

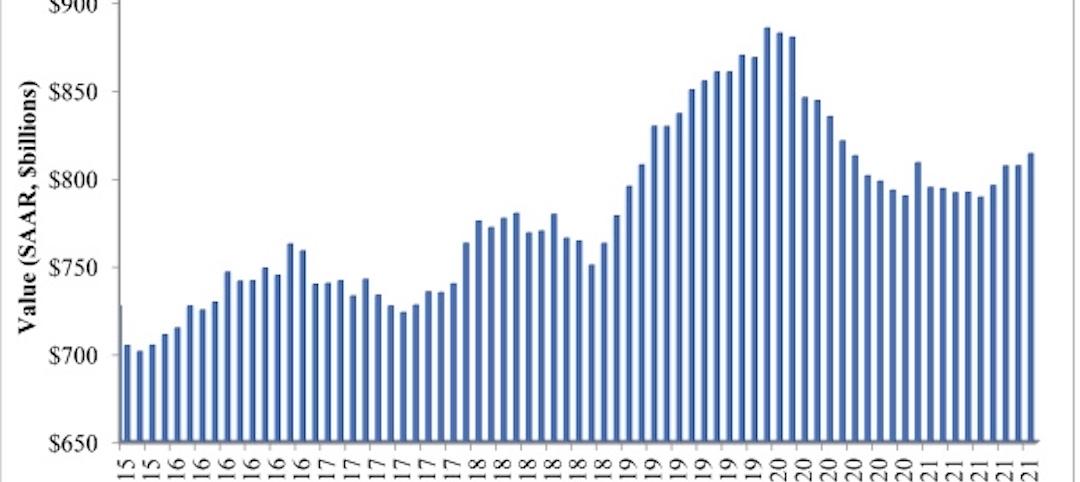

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.