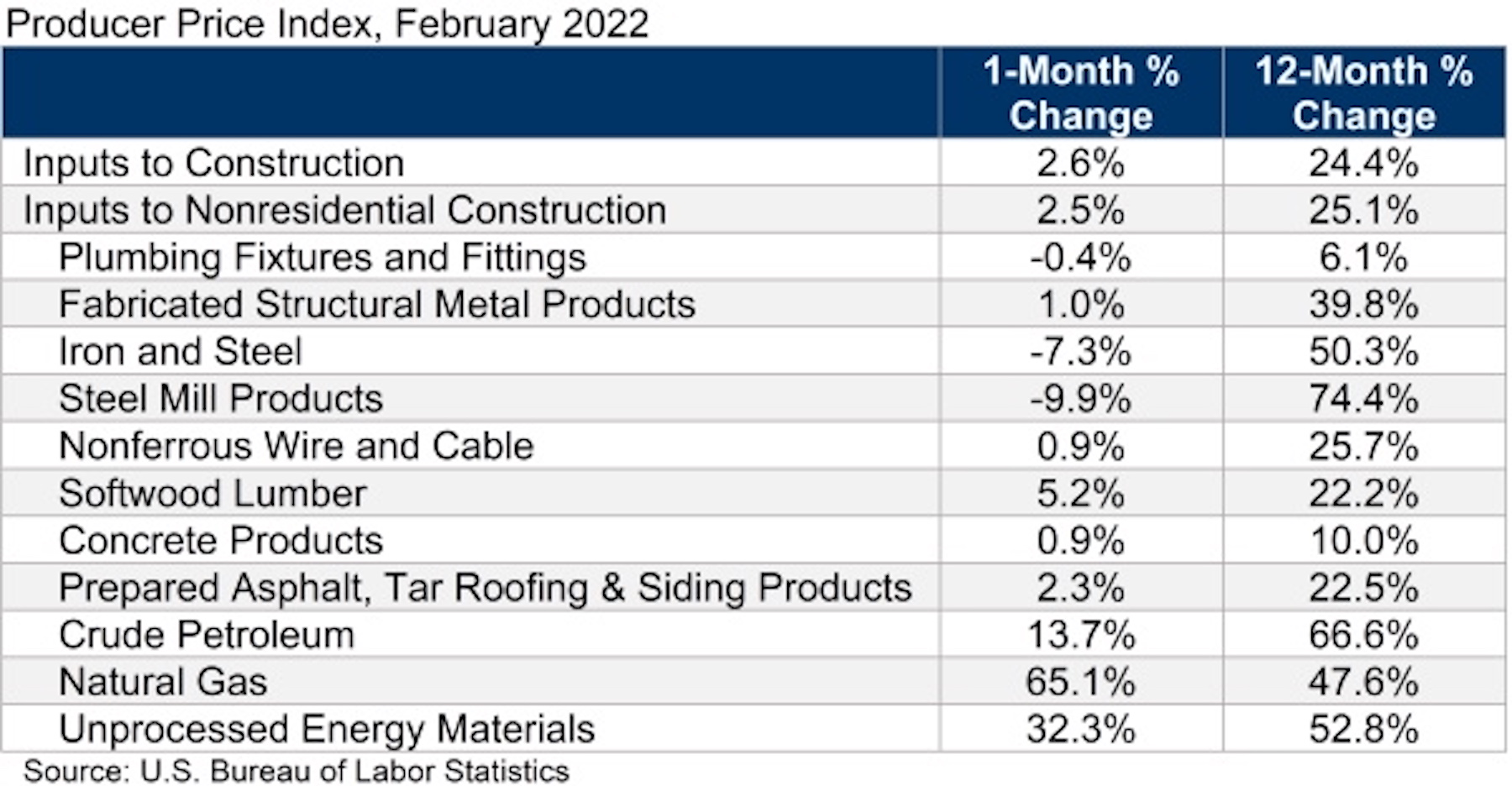

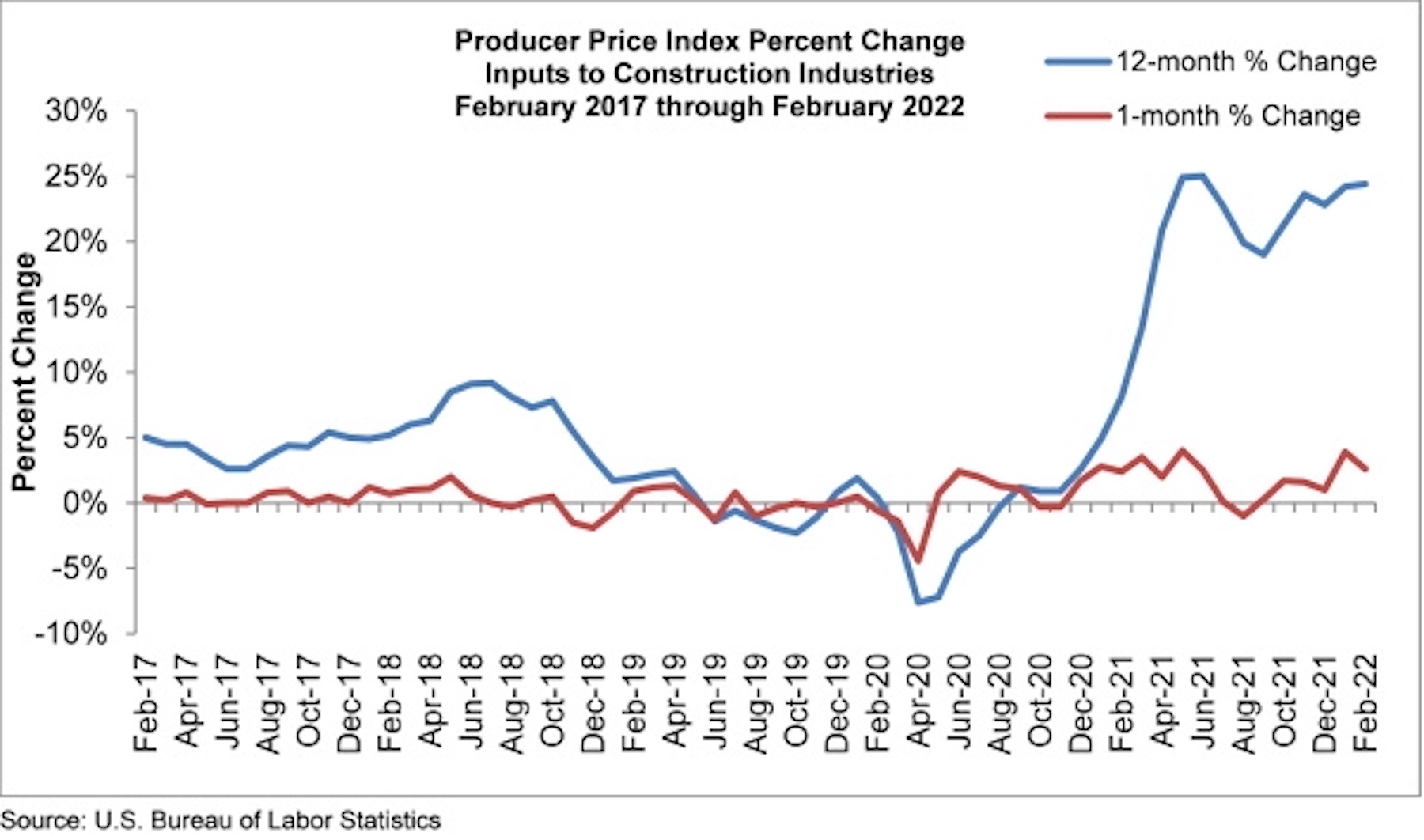

Construction input prices increased 2.6% in February compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices rose 2.5% for the month.

Construction input prices are up 24.4% from a year ago, while nonresidential construction input prices are up 25.1%. Input prices for natural gas and unprocessed energy materials increased for the month, rising 65.1% and 32.3%, respectively. Crude petroleum prices increased 13.7% in February. All three energy subcategories are up significantly on a year-over-year basis.

“It will get worse before it gets better,” said ABC Chief Economist Anirban Basu. “Not only has Russia’s assault on democratic Ukraine created supply challenges in a number of categories, including oil and natural gas, but the reemergence of COVID-19 in parts of Asia and Europe is also poised to produce additional impacts. While many still expect commodity prices to decline later this year, the wait has been meaningfully extended by geopolitical conflicts and ongoing COVID-19 lockdowns.

“For contractors, this has the potential to put even more downward pressure on margins,” said Basu. “It is likely that, as bid prices continue to soar, more project owners will choose to delay project starts. The current state of affairs also creates complications for public agencies considering when to start large-scale infrastructure projects. It is a challenging time to begin such projects, given the workforce shortages that remain and materials price inflation. Undoubtedly, some public administrators will decide to extend planning time, delaying project start dates.

“Remarkably, many projects to date have continued to move forward,” said Basu. “Construction backlog, as measured by ABC’s Construction Backlog Indicator, has remained stable for several months in the wake of rapidly rising materials prices. It remains to be seen whether this stability can prove resilient in the face of additional, severe supply challenges.”

Related Stories

Market Data | May 1, 2017

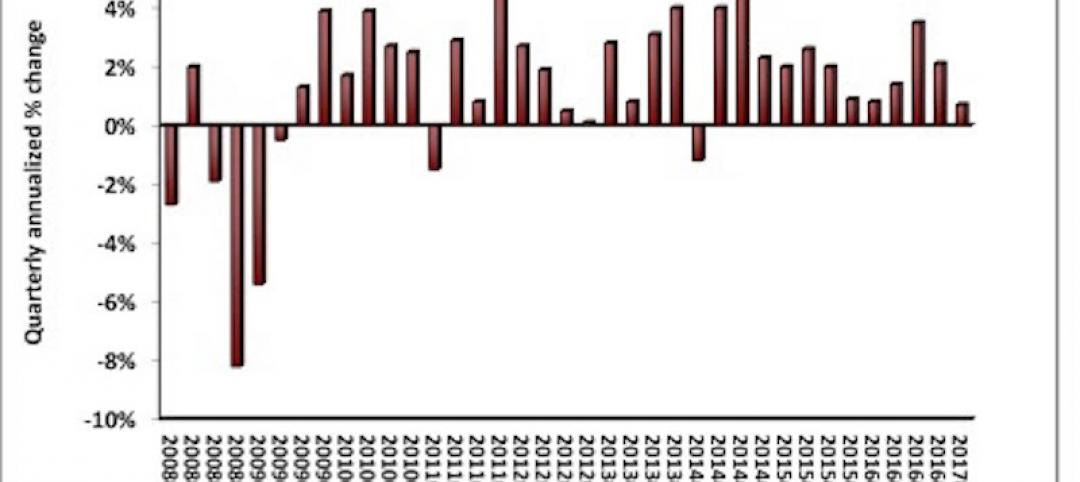

Nonresidential Fixed Investment surges despite sluggish economic in first quarter

Real gross domestic product (GDP) expanded 0.7 percent on a seasonally adjusted annualized rate during the first three months of the year.

Industry Research | Apr 28, 2017

A/E Industry lacks planning, but still spending large on hiring

The average 200-person A/E Firm is spending $200,000 on hiring, and not budgeting at all.

Architects | Apr 27, 2017

Number of U.S. architects holds steady, while professional mobility increases

New data from NCARB reveals that while the number of architects remains consistent, practitioners are looking to get licensed in multiple states.

Market Data | Apr 6, 2017

Architecture marketing: 5 tools to measure success

We’ve identified five architecture marketing tools that will help your firm evaluate if it’s on the track to more leads, higher growth, and broader brand visibility.

Market Data | Apr 3, 2017

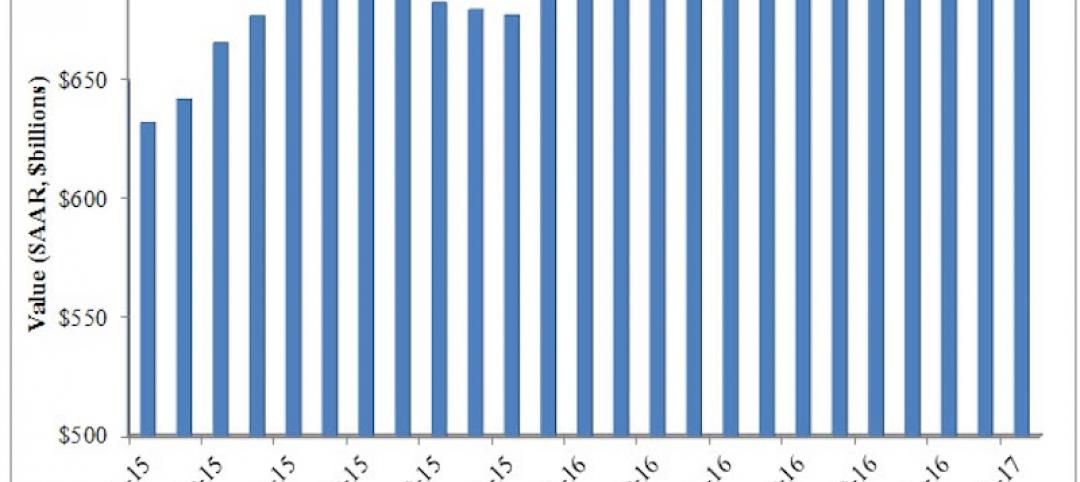

Public nonresidential construction spending rebounds; overall spending unchanged in February

The segment totaled $701.9 billion on a seasonally adjusted annualized rate for the month, marking the seventh consecutive month in which nonresidential spending sat above the $700 billion threshold.

Market Data | Mar 29, 2017

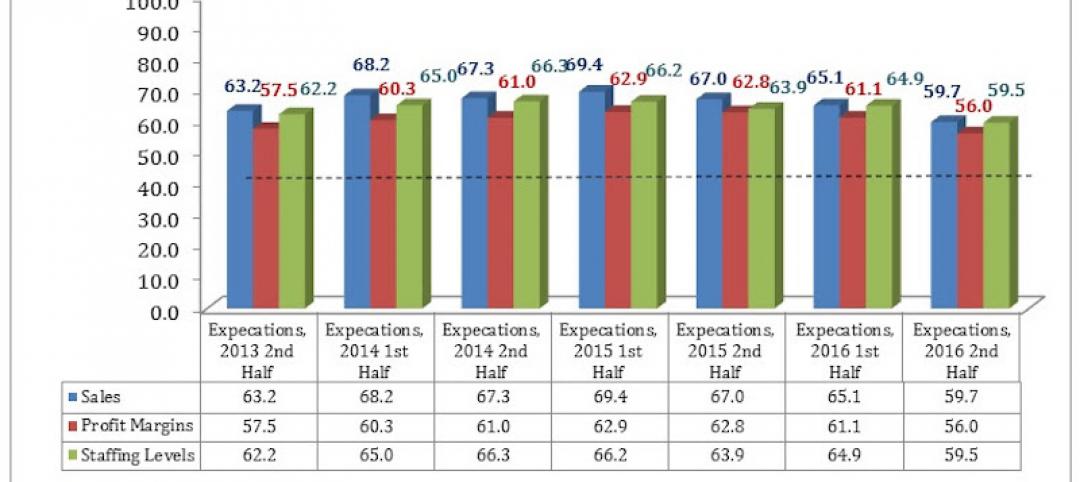

Contractor confidence ends 2016 down but still in positive territory

Although all three diffusion indices in the survey fell by more than five points they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

Industry Research | Mar 24, 2017

The business costs and benefits of restroom maintenance

Businesses that have pleasant, well-maintained restrooms can turn into customer magnets.

Industry Research | Mar 22, 2017

Progress on addressing US infrastructure gap likely to be slow despite calls to action

Due to a lack of bipartisan agreement over funding mechanisms, as well as regulatory hurdles and practical constraints, Moody’s expects additional spending to be modest in 2017 and 2018.

Industry Research | Mar 21, 2017

Staff recruitment and retention is main concern among respondents of State of Senior Living 2017 survey

The survey asks respondents to share their expertise and insights on Baby Boomer expectations, healthcare reform, staff recruitment and retention, for-profit competitive growth, and the needs of middle-income residents.

Industry Research | Mar 14, 2017

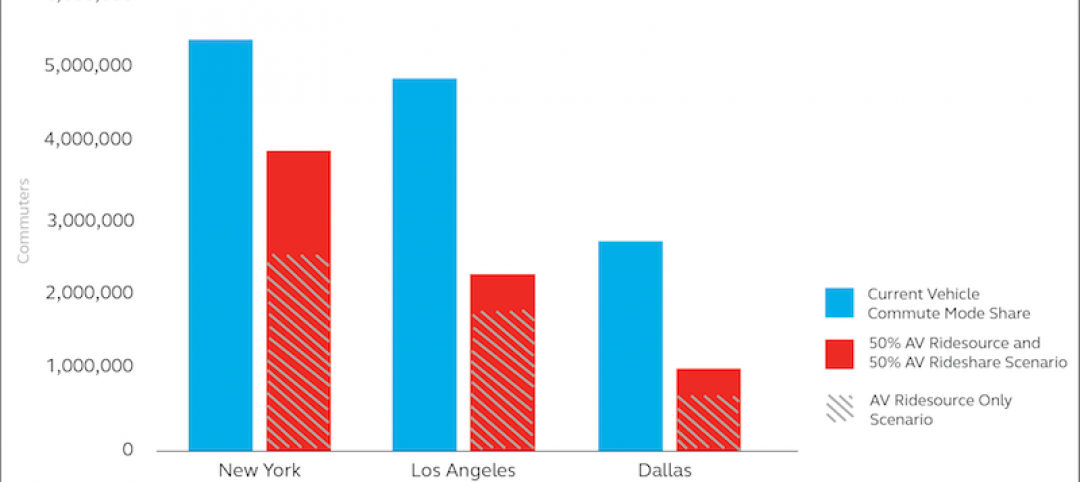

6 ways cities can prepare for a driverless future

A new report estimates 7 million drivers will shift to autonomous vehicles in 3 U.S. cities.