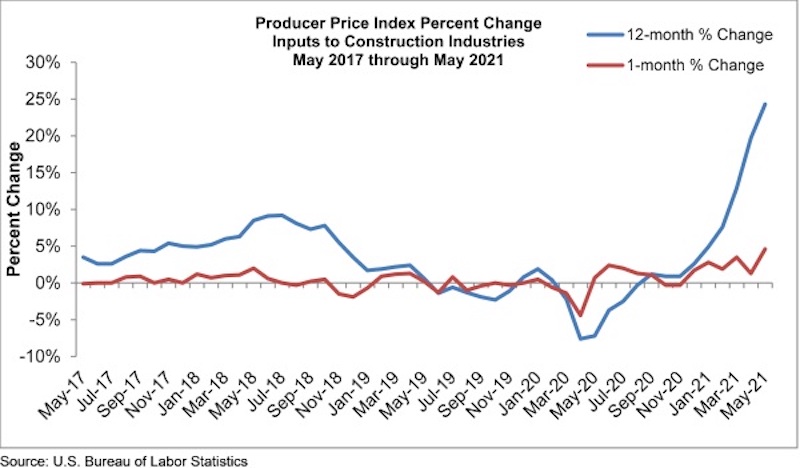

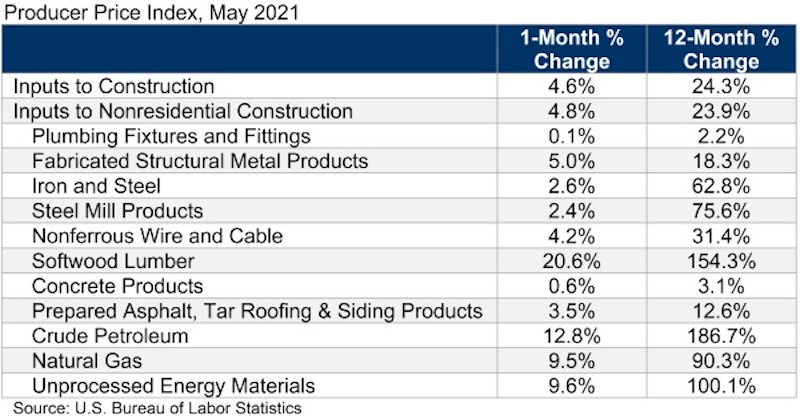

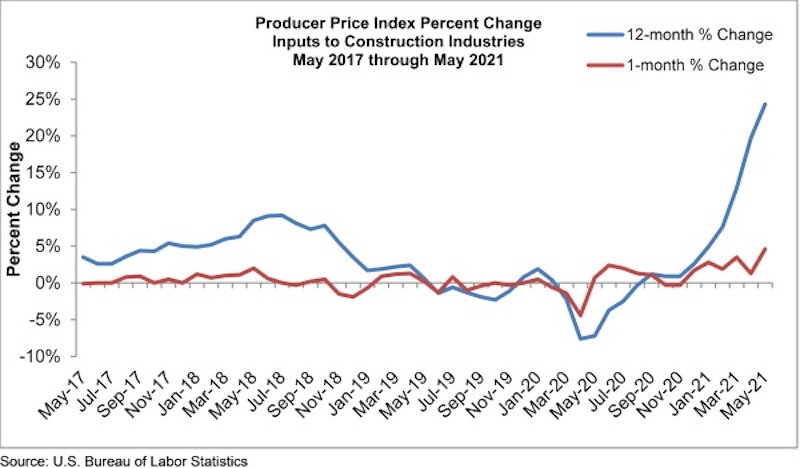

Construction input prices increased 4.6% in May compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices increased 4.8% for the month.

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span. Similar to last month, all three energy subcategories registered significant year-over-year price increases. Crude petroleum has risen 187%, while the prices of unprocessed energy materials and natural gas have increased 100% and 90%, respectively. The price of softwood lumber has expanded 154% over the past year.

“The specter of elevated construction input prices will not end anytime soon,” said ABC Chief Economic Anirban Basu. “While global supply chains should become more orderly over time as the pandemic fades into memory, global demand for inputs will be overwhelming as the global economy comes back to life. Domestically, contractors expect sales to rise over the next six months, as indicated by ABC’s Construction Confidence Index. This means that project owners who delayed the onset of construction for a few months in order to secure lower bids may come to regret that decision.

“Many economists continue to believe that the surge in prices is temporary, the result of an economic reopening shock,” said Basu. “To a large extent, they are correct. The cure for high prices is high prices. When prices are elevated, suppliers have greater incentive to boost capacity and bolster output. That dynamic eventually results in a downward shift in prices. Operations at input producers should also become smoother over time as staff is brought back and standard operating procedures are reestablished.

“Still, there are some things that have changed during the pandemic and will not shift back,” said Basu. “For instance, money supply around the world has expanded significantly. Governments have been running large deficits. This means that some of the inflationary pressure that contractors and others are experiencing may not be temporary, and that inflation and interest rates may not be as low during the decade ahead as they were during the decade leading up to the pandemic.”

Related Stories

Market Data | Aug 12, 2021

Steep rise in producer prices for construction materials and services continues in July.

The producer price index for new nonresidential construction rose 4.4% over the past 12 months.

Market Data | Aug 6, 2021

Construction industry adds 11,000 jobs in July

Nonresidential sector trails overall recovery.

Market Data | Aug 2, 2021

Nonresidential construction spending falls again in June

The fall was driven by a big drop in funding for highway and street construction and other public work.

Market Data | Jul 29, 2021

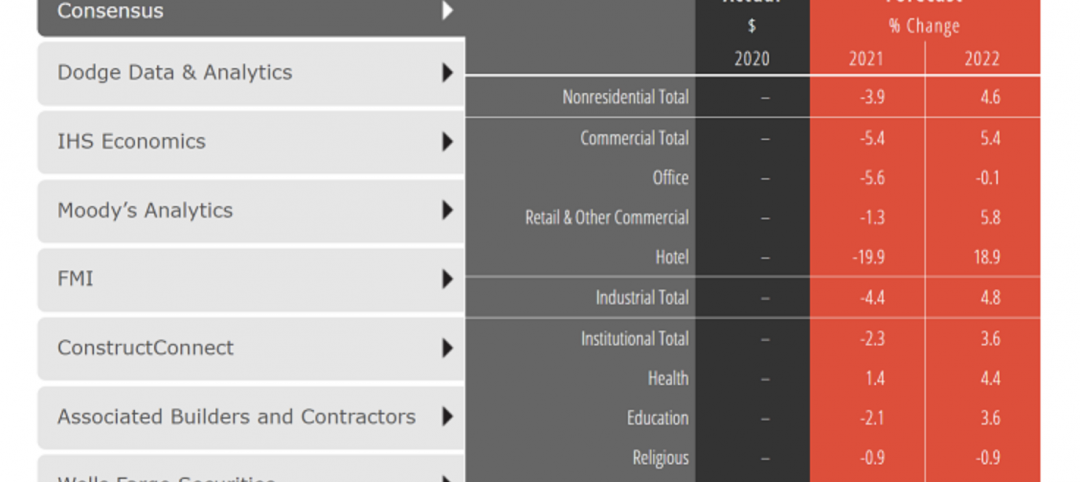

Outlook for construction spending improves with the upturn in the economy

The strongest design sector performers for the remainder of this year are expected to be health care facilities.

Market Data | Jul 29, 2021

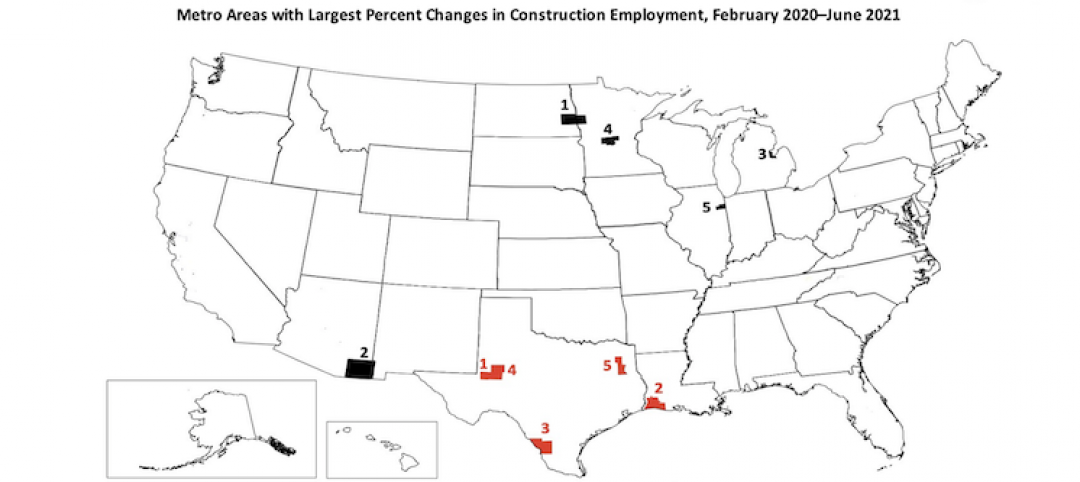

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.