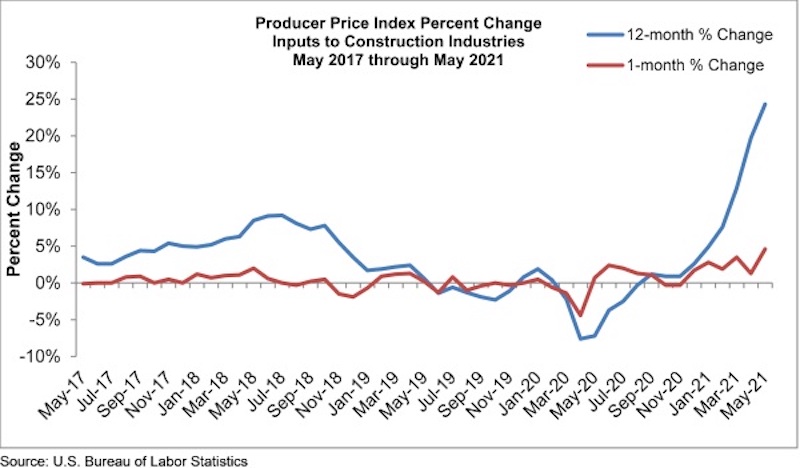

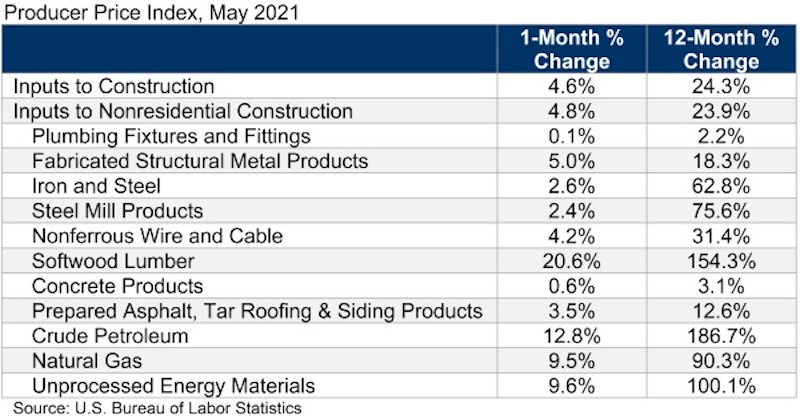

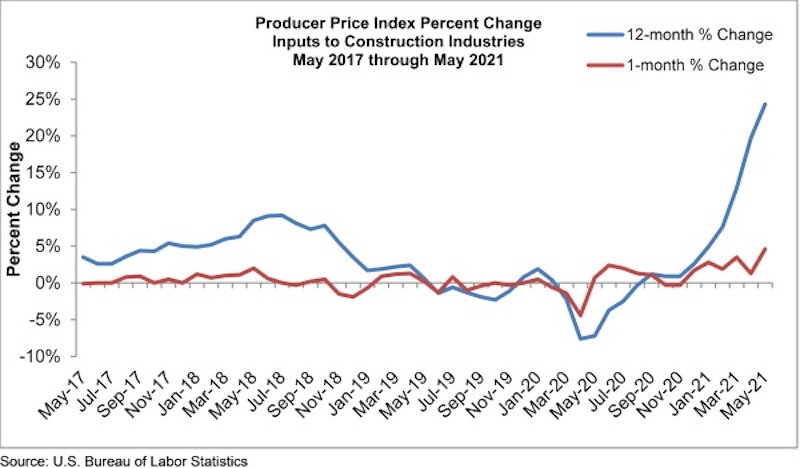

Construction input prices increased 4.6% in May compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices increased 4.8% for the month.

Construction input prices are 24.3% higher than a year ago, while nonresidential construction input prices increased 23.9% over that span. Similar to last month, all three energy subcategories registered significant year-over-year price increases. Crude petroleum has risen 187%, while the prices of unprocessed energy materials and natural gas have increased 100% and 90%, respectively. The price of softwood lumber has expanded 154% over the past year.

“The specter of elevated construction input prices will not end anytime soon,” said ABC Chief Economic Anirban Basu. “While global supply chains should become more orderly over time as the pandemic fades into memory, global demand for inputs will be overwhelming as the global economy comes back to life. Domestically, contractors expect sales to rise over the next six months, as indicated by ABC’s Construction Confidence Index. This means that project owners who delayed the onset of construction for a few months in order to secure lower bids may come to regret that decision.

“Many economists continue to believe that the surge in prices is temporary, the result of an economic reopening shock,” said Basu. “To a large extent, they are correct. The cure for high prices is high prices. When prices are elevated, suppliers have greater incentive to boost capacity and bolster output. That dynamic eventually results in a downward shift in prices. Operations at input producers should also become smoother over time as staff is brought back and standard operating procedures are reestablished.

“Still, there are some things that have changed during the pandemic and will not shift back,” said Basu. “For instance, money supply around the world has expanded significantly. Governments have been running large deficits. This means that some of the inflationary pressure that contractors and others are experiencing may not be temporary, and that inflation and interest rates may not be as low during the decade ahead as they were during the decade leading up to the pandemic.”

Related Stories

Market Data | Dec 19, 2018

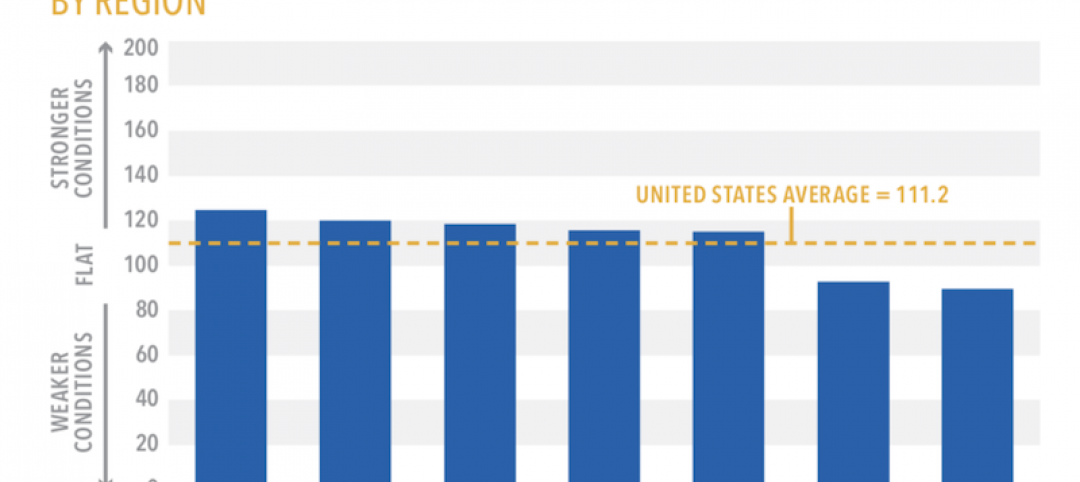

Brokers look forward to a commercial real estate market that mirrors 2018’s solid results

Respondents to a recent Transwestern poll expect flat to modest growth for rents and investment in offices, MOBs, and industrial buildings.

Market Data | Dec 19, 2018

When it comes to economic clout, New York will far outpace other U.S. metros for decades to come

But San Jose, Calif., is expected to have the best annual growth rate through 2035, according to Oxford Economics’ latest Global Cities report.

Market Data | Dec 19, 2018

Run of positive billings continues at architecture firms

November marked the fourteenth consecutive month of increasing demand for architectural firm services.

Market Data | Dec 5, 2018

ABC predicts construction sector will remain strong in 2019

Job growth, high backlog and healthy infrastructure investment all spell good news for the industry.

Market Data | Dec 4, 2018

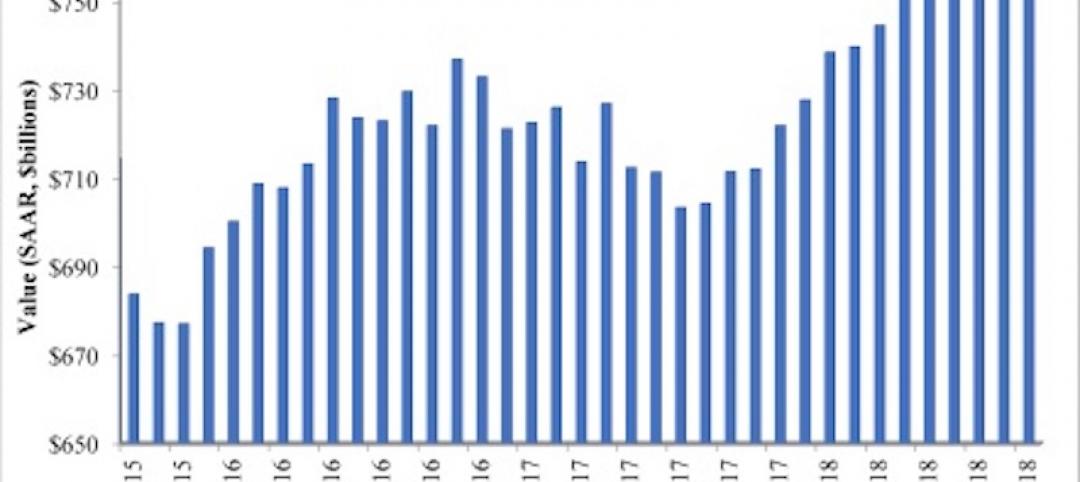

Nonresidential spending rises modestly in October

Thirteen out of 16 subsectors are associated with year-over-year increases.

Market Data | Nov 20, 2018

Construction employment rises from October 2017 to October 2018 in 44 states and D.C.

Texas has biggest annual job increase while New Jersey continues losses; Iowa, Florida and California have largest one-month gains as Mississippi and Louisiana trail.

Market Data | Nov 15, 2018

Architecture firm billings continue to slow, but remain positive in October

Southern region reports decline in billings for the first time since June 2012.

Market Data | Nov 14, 2018

A new Joint Center report finds aging Americans less prepared to afford housing

The study foresees a significant segment of seniors struggling to buy or rent on their own or with other people.

Market Data | Nov 12, 2018

Leading hotel markets in the U.S. construction pipeline

Projects already under construction and those scheduled to start construction in the next 12 months, combined, have a total of 3,782 projects/213,798 rooms and are at cyclical highs.

Market Data | Nov 6, 2018

Unflagging national office market enjoys economic tailwinds

Stable vacancy helped push asking rents 4% higher in third quarter.