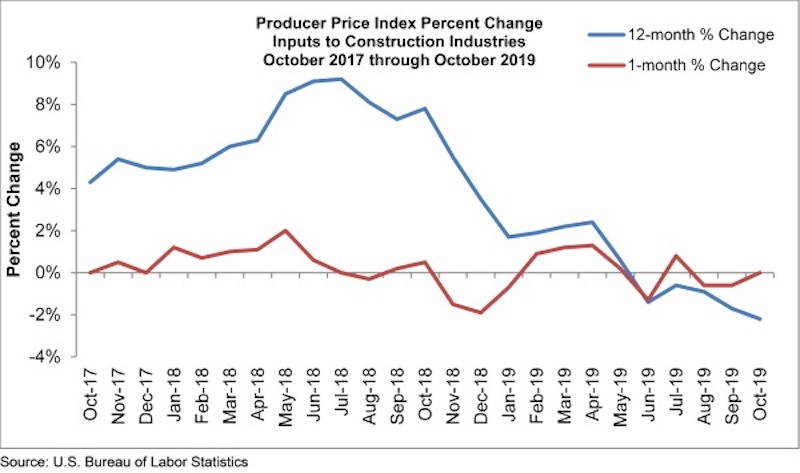

Construction input prices remained unchanged on a monthly basis in October but are down 2.2% year-over-year, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Falling energy prices accounted for much of the year-over-year price decline. Among the eight subcategories that decreased, the most significant were in natural gas (-31.8%), crude petroleum (-29.8%) and unprocessed energy materials (-26.3%). Monthly natural gas prices, however, were up 7.7% from September, likely due in part to seasonal factors. Two other subcategories had year-over-year decreases greater than 10%: iron and steel (-16.1%) and steel mill products (-13.1%).

“New month, same story on materials prices,” said ABC Chief Economist Anirban Basu. “While the decline in crude petroleum prices in October may have been caused by a spike in oil prices in September due to an assault on Saudi facilities, price weakness was apparent in several other materials categories as well. Many categories experienced effectively no change in price whatsoever on a monthly basis, including key materials such as softwood lumber, concrete, plumbing fixtures and the segment that includes prepared asphalt.

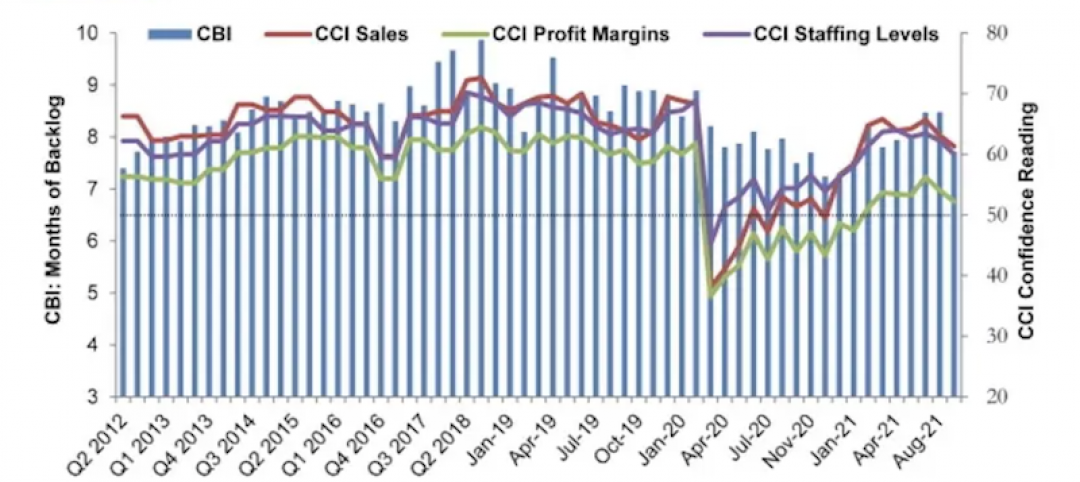

“While the U.S. nonresidential construction sector remains busy and a majority of contractors expect to see an increase in sales over the next few months, according to ABC’s Construction Confidence Indicator, materials prices continue to languish due to a combination of a weakening global economy, a sturdy U.S. dollar and recently observed declines in investment in structures. The lifting of tariffs on certain producers of steel and aluminum earlier this year may also be playing a factor, with iron and steel prices down approximately 16% compared to one year ago and the price of steel mill products down more than 13%.

“Contractors can expect more seesawing in materials prices going forward as opposed to smooth declines,” said Basu. “There is evidence that certain parts of the global economy are firming, which will help stabilize the demand for certain materials. The U.S. dollar is no longer strengthening as it had been, in part because the Federal Reserve has pursued an easier money policy this year. That said, there could be a dip in oil prices next year as more supply comes online from nations such as Canada, Norway, Brazil and Guyana.”

Related Stories

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

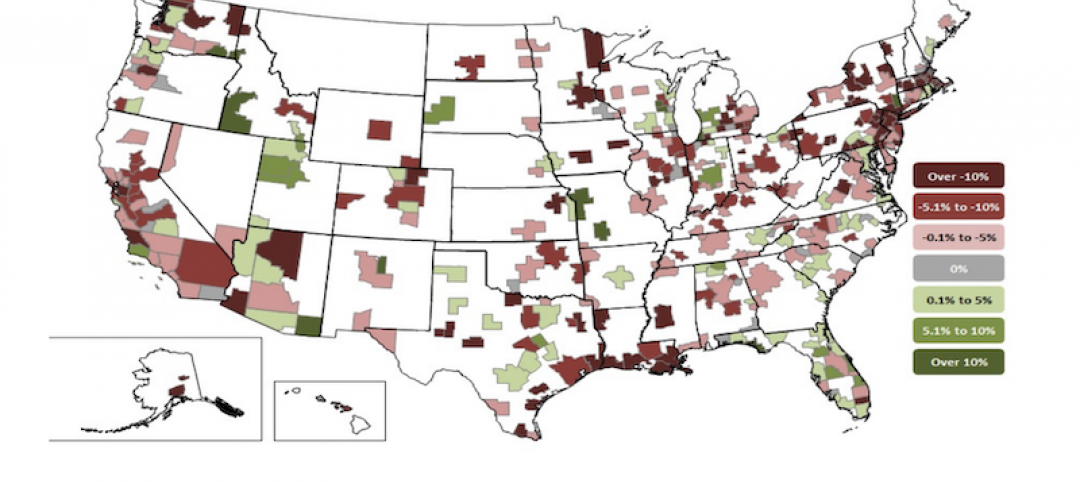

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.

Market Data | Aug 24, 2021

July construction employment lags pre-pandemic peak in 36 states

Delta variant of coronavirus threatens to hold down further gains.

Market Data | Aug 17, 2021

Demand for design activity continues to expand

The ABI score for July was 54.6.