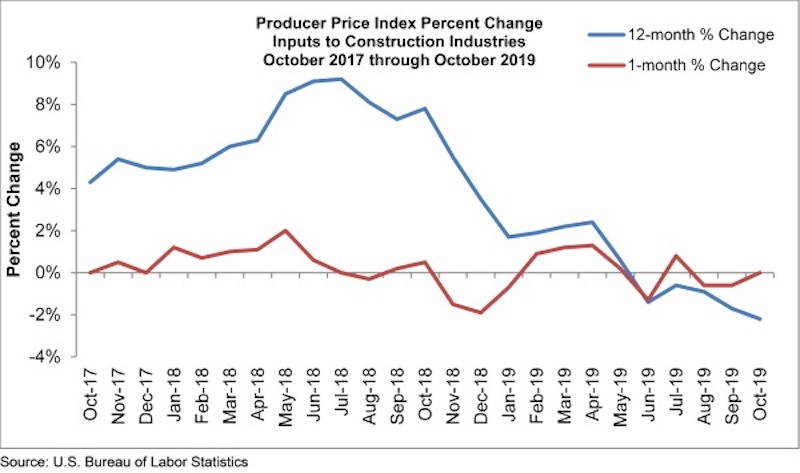

Construction input prices remained unchanged on a monthly basis in October but are down 2.2% year-over-year, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Falling energy prices accounted for much of the year-over-year price decline. Among the eight subcategories that decreased, the most significant were in natural gas (-31.8%), crude petroleum (-29.8%) and unprocessed energy materials (-26.3%). Monthly natural gas prices, however, were up 7.7% from September, likely due in part to seasonal factors. Two other subcategories had year-over-year decreases greater than 10%: iron and steel (-16.1%) and steel mill products (-13.1%).

“New month, same story on materials prices,” said ABC Chief Economist Anirban Basu. “While the decline in crude petroleum prices in October may have been caused by a spike in oil prices in September due to an assault on Saudi facilities, price weakness was apparent in several other materials categories as well. Many categories experienced effectively no change in price whatsoever on a monthly basis, including key materials such as softwood lumber, concrete, plumbing fixtures and the segment that includes prepared asphalt.

“While the U.S. nonresidential construction sector remains busy and a majority of contractors expect to see an increase in sales over the next few months, according to ABC’s Construction Confidence Indicator, materials prices continue to languish due to a combination of a weakening global economy, a sturdy U.S. dollar and recently observed declines in investment in structures. The lifting of tariffs on certain producers of steel and aluminum earlier this year may also be playing a factor, with iron and steel prices down approximately 16% compared to one year ago and the price of steel mill products down more than 13%.

“Contractors can expect more seesawing in materials prices going forward as opposed to smooth declines,” said Basu. “There is evidence that certain parts of the global economy are firming, which will help stabilize the demand for certain materials. The U.S. dollar is no longer strengthening as it had been, in part because the Federal Reserve has pursued an easier money policy this year. That said, there could be a dip in oil prices next year as more supply comes online from nations such as Canada, Norway, Brazil and Guyana.”

Related Stories

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.

Market Data | Jan 18, 2017

Architecture Billings Index ends year on positive note

Architecture firms close 2016 with the strongest performance of the year.

Market Data | Jan 12, 2017

73% of construction firms plan to expand their payrolls in 2017

However, many firms remain worried about the availability of qualified workers.

Market Data | Jan 9, 2017

Trump market impact prompts surge in optimism for U.S. engineering firm leaders

The boost in firm leader optimism extends across almost the entire engineering marketplace.

Market Data | Jan 5, 2017

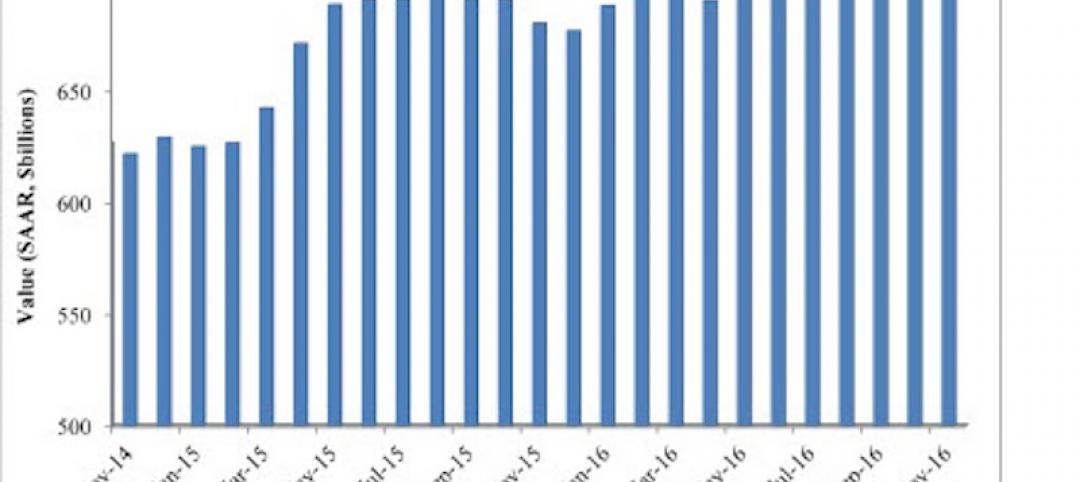

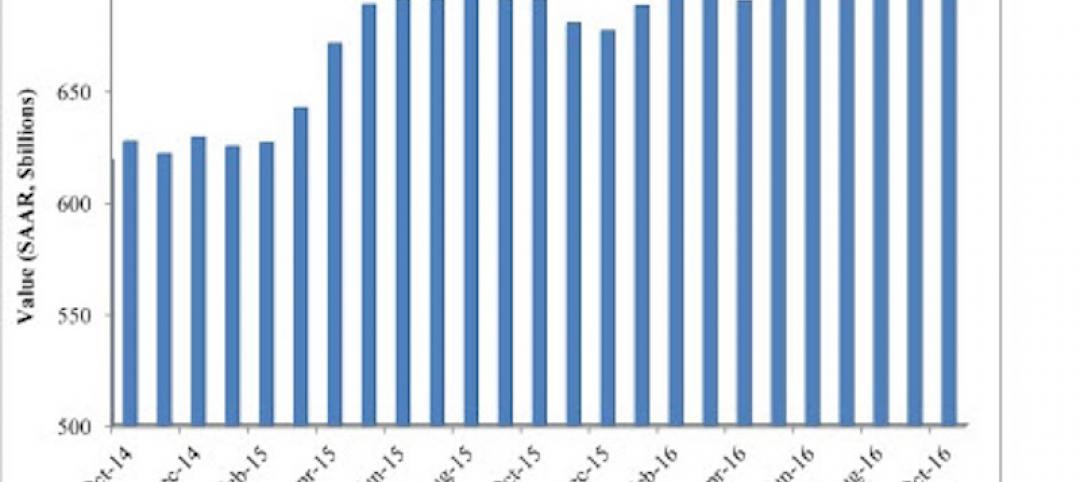

Nonresidential spending thrives in strong November spending report

Many construction firms have reported that they remain busy but have become concerned that work could dry up in certain markets in 2017 or 2018, says Anirban Basu, ABC Chief Economist.

Market Data | Dec 21, 2016

Architecture Billings Index up slightly in November

New design contracts also return to positive levels, signifying future growth in construction activity.

Market Data | Dec 21, 2016

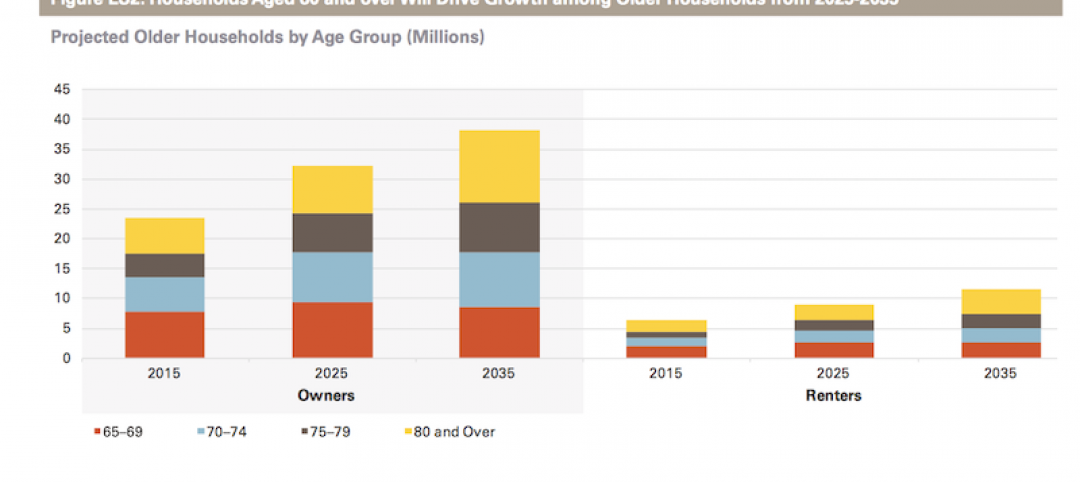

Will housing adjust to an aging population?

New Joint Center report projects 66% increase in senior heads of households by 2035.

Market Data | Dec 13, 2016

ABC predicts modest growth for 2017 nonresidential construction sector; warns of vulnerability for contractor

“The U.S. economy continues to expand amid a weak global economy and, despite risks to the construction industry, nonresidential spending should expand 3.5 percent in 2017,” says ABC Chief Economist Anirban Basu.

Market Data | Dec 2, 2016

Nonresidential construction spending gains momentum

Nonresidential spending is now 2.6 percent higher than at the same time one year ago.