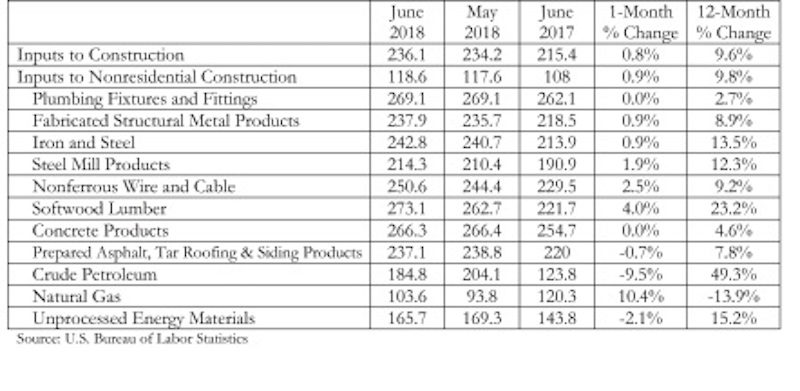

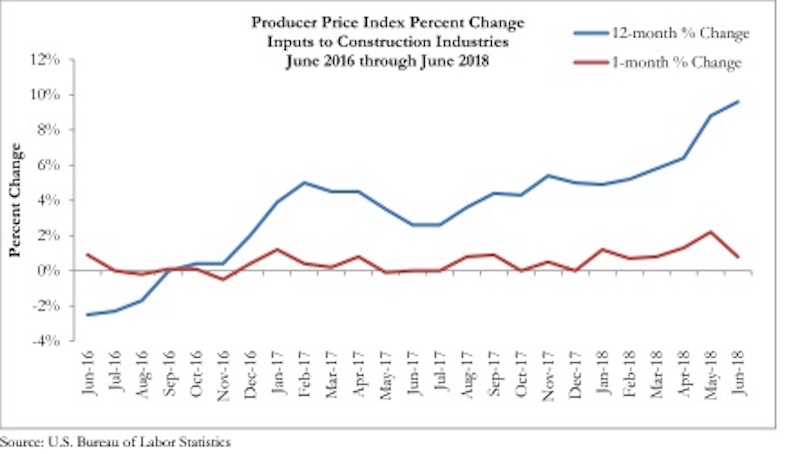

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction material prices rose another 0.8% in June and are 9.6% higher than they were at the same time one year ago.

June represents the latest month associated with rapidly rising construction input prices. Nonresidential construction materials prices effectively mirrored overall construction prices by rising 0.9% on a month-over-month basis and 9.8% on a year-over-year basis.

“In general, this emerging state of affairs is unfavorable,” said ABC Chief Economist Anirban Basu. “Rapidly rising materials prices interfere with economic progress in numerous ways, including by making it less likely that a particular development will move forward. They also increase the cost of delivering government-financed infrastructure, raise costs for final consumers such as homeowners, renters and office tenants, and exacerbate overall inflationary pressures, which serves to push nominal borrowing costs higher.

“Materials prices are up roughly 10% in just one year, and certain categories have experienced significant rates of price increase,” said Basu. “Among these are key inputs that appear to have been impacted by evolving policymaking, including the price of crude petroleum, which is up 49% over the past year, iron and steel, which is up nearly 14%, and softwood lumber, up 23%.

“Some contractors may note the similarities between the current period and the period immediately preceding the onset of the global financial crisis,” said Basu. “Materials prices, for instance, were rising rapidly for much of 2006 and 2007 as the economic expansion that began in 2001 reached its final stages. Today’s data will provide further ammunition for policymakers committed to tightening monetary policy and raising short-term interest rates.

“With no end in sight regarding the ongoing tariff spat between the United States and a number of leading trading partners, and with the domestic economy continuing to expand briskly, construction input prices are positioned to increase further going forward, though the current rate of increase appears unsustainable.”

Related Stories

Market Data | Jan 31, 2022

Canada's hotel construction pipeline ends 2021 with 262 projects and 35,325 rooms

At the close of 2021, projects under construction stand at 62 projects/8,100 rooms.

Market Data | Jan 27, 2022

Record high counts for franchise companies in the early planning stage at the end of Q4'21

Through year-end 2021, Marriott, Hilton, and IHG branded hotels represented 585 new hotel openings with 73,415 rooms.

Market Data | Jan 27, 2022

Dallas leads as the top market by project count in the U.S. hotel construction pipeline at year-end 2021

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms.

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.