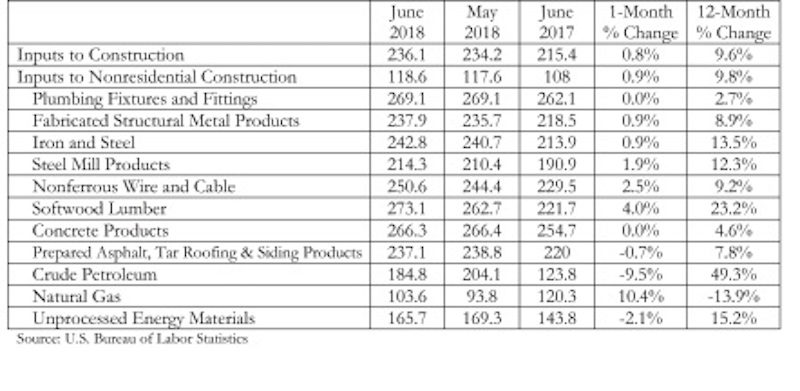

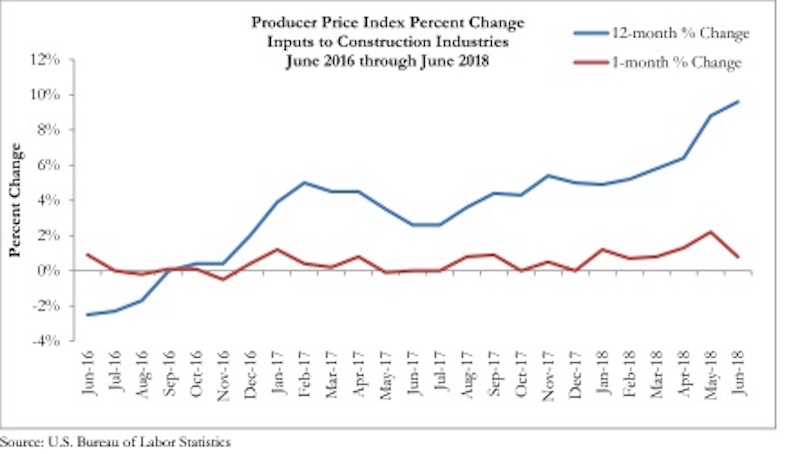

According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction material prices rose another 0.8% in June and are 9.6% higher than they were at the same time one year ago.

June represents the latest month associated with rapidly rising construction input prices. Nonresidential construction materials prices effectively mirrored overall construction prices by rising 0.9% on a month-over-month basis and 9.8% on a year-over-year basis.

“In general, this emerging state of affairs is unfavorable,” said ABC Chief Economist Anirban Basu. “Rapidly rising materials prices interfere with economic progress in numerous ways, including by making it less likely that a particular development will move forward. They also increase the cost of delivering government-financed infrastructure, raise costs for final consumers such as homeowners, renters and office tenants, and exacerbate overall inflationary pressures, which serves to push nominal borrowing costs higher.

“Materials prices are up roughly 10% in just one year, and certain categories have experienced significant rates of price increase,” said Basu. “Among these are key inputs that appear to have been impacted by evolving policymaking, including the price of crude petroleum, which is up 49% over the past year, iron and steel, which is up nearly 14%, and softwood lumber, up 23%.

“Some contractors may note the similarities between the current period and the period immediately preceding the onset of the global financial crisis,” said Basu. “Materials prices, for instance, were rising rapidly for much of 2006 and 2007 as the economic expansion that began in 2001 reached its final stages. Today’s data will provide further ammunition for policymakers committed to tightening monetary policy and raising short-term interest rates.

“With no end in sight regarding the ongoing tariff spat between the United States and a number of leading trading partners, and with the domestic economy continuing to expand briskly, construction input prices are positioned to increase further going forward, though the current rate of increase appears unsustainable.”

Related Stories

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Market Data | Feb 9, 2016

Cushman & Wakefield is bullish on U.S. economy and its property markets

Sees positive signs for construction and investment growth in warehouses, offices, and retail

Market Data | Feb 5, 2016

CMD/Oxford forecast: Nonresidential building growth will recover modestly in 2016

Increased government spending on infrastructure projects should help.

Market Data | Feb 4, 2016

Mortenson: Nonresidential construction costs expected to increase in six major metros

The Construction Cost Index, from Mortenson Construction, indicated rises between 3 and 4% on average.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.

Data Centers | Jan 28, 2016

Top 10 markets for data center construction

JLL’s latest outlook foresees a maturation in certain metros.

Market Data | Jan 20, 2016

Nonresidential building starts sag in 2015

CDM Research finds only a few positive signs among the leading sectors.

Market Data | Jan 20, 2016

Architecture Billings Index ends year on positive note

While volatility persists, architecture firms reported healthy performance for 2015.

Market Data | Jan 15, 2016

ABC: Construction material prices continue free fall in December

In December, construction material prices fell for the sixth consecutive month. Prices have declined 7.2% since peaking in August 2014.

Market Data | Jan 13, 2016

Morgan Stanley bucks gloom and doom, thinks U.S. economy has legs through 2020

Strong job growth and dwindling consumer debt give rise to hope.