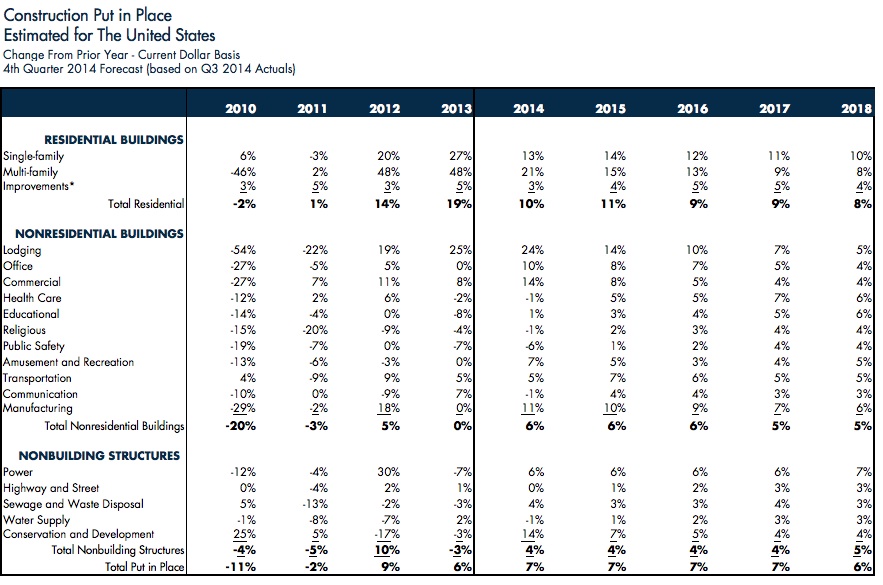

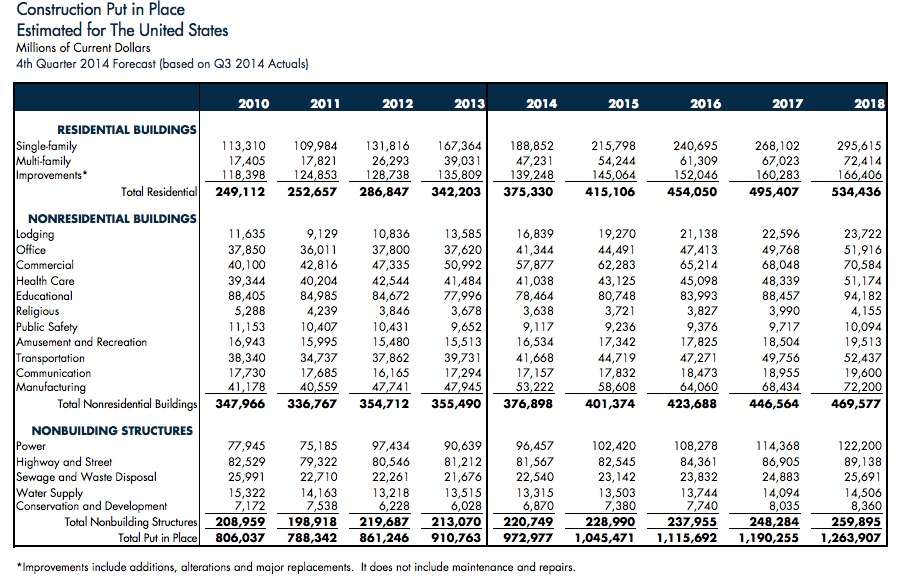

Driven by a recovering economy, increasing demand for multifamily housing, and a manufacturing sector buoyed by robust oil and gas drilling and production, construction put in place (CPIP) in the U.S. grew by 7% to just under $973 billion in 2014, according to estimates by FMI, the Raleigh, N.C.-based consultant and service provider for the construction industry.

FMI’s Construction Outlook for the fourth quarter projects steady, single-digit annual growth rates through 2018, when CPIP is expected to reach $1.264 trillion. FMI tempers its predictions, though, by pointing out that declining oil prices could hobble future construction budgets. And the “wild card” that could affect the construction industry next year and beyond is “what the new Congress will (or will not) do,” and how its actions impact sectors dependent on government spending, notably education.

CPIP for nonresidential buildings, a subset of the total construction value, rose 6% to $376.9 billion in 2014. FMI’s Nonresidential Construction Index “remains solidly in positive territory.” And a full percentage point of that growth is attributable to an 11% gain in the manufacturing sector, to $53.2 billion. But FMI cautions that oil and gas production within this sector is “highly cyclical,” which may explain why FMI lowers its 2015 growth projection for manufacturing to 10%, and anticipates lower growth rates in the proceeding three years.

Lodging is another area that has benefited mightily from the country’s economic rebound. Its CPIP soared by 24% to $16.8 billion in 2014. FMI cites Lodging Economics, which noted that hotel construction hit a five-year high in the third quarter of 2014. And with occupancy rates still ascending, FMI foresees double-digit CPIP growth in 2015 and 2016.

The Commercial sector did “better than expected” when its CPIP rose by 14% to $57.9 billion in 2014. Drivers in this sector include lower unemployment rates, a stabilizing housing market, and still-low inflation. But FMI expects that growth to tail off in the coming years, as retail remains in a transformative stage of needing to be more responsive to consumers to keep them coming to their stores while, at the same time, integrating those customers’ online sales activities. (The Census Bureau estimated that while retail and food service sales barely increased through the first nine months of 2014, nonstore retailers increased by 9.2%.)

Office vacancy rates last year dropped below 16% for the first time since 2008, according to the commercial real estate consultant and investment manager Jones Lang LaSalle. And the prospect of a steadier stream of tenants helped push the office sector’s CPIP to a 10% increase in 2014. FMI sees that pattern continuing in 2015, but then expects growth to soften in the out years.

A 1.4% increase in freight rail-car loadings was just one manifestation of how an improving economy is boosting the fortunes of the nation’s Transportation sector, whose CPIP jumped 5% in 2014, and is expected to grow by 7% in 2015 to $44.7 billion. FMI points out there are several urban metrorail projects in the works. The omnibus spending bill that Congress passed in December includes $500 million for the Department of Transportation’s TIGER (Transportation Investment Generating Economic Recovery) grant program. And construction within the airline industry should benefit from a 2.2% annual growth rate in carrier passengers the Federal Aviation Administration forecasts over the next 20 years.

The Amusements and Recreation sector is being charged by a spurt in stadium and arena construction around the country. But in light of three casino closings in Atlantic City, N.J., in 2014, the gaming industry within this sector, says FMI, is “rethinking” its facilities for greater appeal to broader customer bases, including “the combination of multiple entertainment and shopping into one park.” Nevertheless, “casino plans are underway in a number of states, including New York, Pennsylvania, Maryland, Florida and Ohio, with some investors coming from offshore,” notes FMI, which expects annual CPIP growth in the sector to fall between 5% and 7% over the next four years.

A number of nonresidential building sectors were on the downswing in 2014. While health care’s CPIP was off by only 1%, there’s a lot of uncertainty about this sector’s future and that of the Affordable Care Act, with a Republican Party that has adamantly opposed that law controlling both houses of Congress. But FMI still thinks this sector could grow by 5% in 2015 to $43.1 billion. “Ambulatory health care centers and renovations to existing facilities in order to be competitive and keep up with changing technologies and patient needs will continue to be the focus for construction.”

The Communications sector’s CPIP stood at negative 1% 2014, as much of this industry’s build out of high-speed Internet infrastructure has been completed. FMI predicts a modest rebound for this sector in 2015, as “the current trend is for building more data centers and beefing up security and privacy against potential interlopers and severe weather events.”

Constrained state and local budgets were mitigating factors in the Education sector’s paltry 1% CPIP gain in 2014. That CPIP, at $78.5 billion, was still the highest among any nonresidential building sectors. But since the recession, “it has been a difficult battle [for Education] to get back to previous levels of spending,” FMI observes. However, with student enrollment expected to expand by 2.5 million over the next four years, municipalities and states are starting to loosen their purse strings again to fund school construction and renovation projects. FMI projects low-single-digit CPIP growth for the sector over that period, with a greater emphasis on design flexibility and energy efficiency.

Despite the fact that the country’s jails and prisons are bursting at the seams, the CPIP for the Public Safety sector was off by 6% in 2014. Still, FMI foresees modest growth in this sector, especially as private firms assume more control within the U.S. penal system. The private prison industry, which operates 5% of the country’s 5,000 prisons and jails, is growing at a 30% annual rate.

Related Stories

| Jun 2, 2014

Parking structures group launches LEED-type program for parking garages

The Green Parking Council, an affiliate of the International Parking Institute, has launched the Green Garage Certification program, the parking industry equivalent of LEED certification.

| May 29, 2014

7 cost-effective ways to make U.S. infrastructure more resilient

Moving critical elements to higher ground and designing for longer lifespans are just some of the ways cities and governments can make infrastructure more resilient to natural disasters and climate change, writes Richard Cavallaro, President of Skanska USA Civil.

| May 23, 2014

Top interior design trends: Gensler, HOK, FXFOWLE, Mancini Duffy weigh in

Tech-friendly furniture, “live walls,” sit-stand desks, and circadian lighting are among the emerging trends identified by leading interior designers.

| May 20, 2014

Kinetic Architecture: New book explores innovations in active façades

The book, co-authored by Arup's Russell Fortmeyer, illustrates the various ways architects, consultants, and engineers approach energy and comfort by manipulating air, water, and light through the layers of passive and active building envelope systems.

| May 19, 2014

What can architects learn from nature’s 3.8 billion years of experience?

In a new report, HOK and Biomimicry 3.8 partnered to study how lessons from the temperate broadleaf forest biome, which houses many of the world’s largest population centers, can inform the design of the built environment.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 11, 2014

Final call for entries: 2014 Giants 300 survey

BD+C's 2014 Giants 300 survey forms are due Wednesday, May 21. Survey results will be published in our July 2014 issue. The annual Giants 300 Report ranks the top AEC firms in commercial construction, by revenue.

| Apr 29, 2014

USGBC launches real-time green building data dashboard

The online data visualization resource highlights green building data for each state and Washington, D.C.

| Apr 22, 2014

Bright and bustling: Grimshaw reveals plans for the Istanbul Grand Airport [slideshow]

In partnership with the Nordic Office of Architecture and Haptic Architects, Grimshaw Architects has revealed its plans for the terminal of what will be one of the world's busiest airports. The terminal is expected to serve 150 million passengers per year.

| Apr 9, 2014

Steel decks: 11 tips for their proper use | BD+C

Building Teams have been using steel decks with proven success for 75 years. Building Design+Construction consulted with technical experts from the Steel Deck Institute and the deck manufacturing industry for their advice on how best to use steel decking.