Construction employment increased by 26,000 jobs in September to a total of 7,245,000, but the gains were concentrated in housing, while employment in the infrastructure and nonresidential building construction sector remained little changed, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said the pandemic was prompting strong demand for new housing as more Americans work from home, while undermining private-sector development of office, retail and other types of projects and forcing many local and state governments to cut construction budgets.

“Construction is becoming steadily more split between a robust residential component and generally stagnant private nonresidential and public construction activity,” said Ken Simonson, the association’s chief economist, noting that in the three months since June, residential construction employment has increased nearly 3 percent while nonresidential employment has slipped 0.2 percent. “As project cancellations mount, so too will job losses on the nonresidential side unless the federal government provides funding for infrastructure and relief for contractors.”

The AGC of America-Autodesk Workforce Survey, released last month, found that 38 percent of respondents—whose firms perform all types of nonresidential construction--expect it will take more than six months for their firm’s volume of business to return to normal, relative to a year earlier. That percentage topped the 29 percent who reported business was already at or above year-ago levels.

A likely reason for the more pessimistic outlook is the rapid increase in postponed or canceled projects, the economist said. He noted that the latest survey found 60 percent of firms report a scheduled project has been postponed or canceled, compared to 12 percent that had won new or additional work as a result of the pandemic.

The employment pickup in September was mainly in homebuilding, home improvement and a portion of nonresidential construction, Simonson noted. There was a rise of 22,100 jobs in residential construction employment, comprising residential building (6,600) and residential specialty trade contractors (15,500). There was a gain of 4,000 jobs in nonresidential construction employment, covering nonresidential building (5,300), specialty trades (2,100) and heavy and civil engineering construction (-3,400).

The industry’s unemployment rate in September was 7.1 percent, with 700,000 former construction workers idled. These figures were more than double the September 2019 figures of 3.2 percent and 319,000 workers, respectively.

Association officials said that nonresidential construction was likely to continue to stagnate while the pandemic persists without new additional federal coronavirus recovery measures. Those recovery measures must include liability protections for businesses that are protecting workers from the coronavirus, new infrastructure investments and funding for depleted state and local construction budgets, they added.

“Until businesses are confident enough to invest in new development projects and state and local governments are able to invest in public works, the commercial construction sector will not be able to fully recover,” said Stephen E. Sandherr, the association’s chief executive officer. “Protecting honest employers, improving our infrastructure and helping state and local officials fix schools and improve other public facilities will create the jobs people need and the momentum our economy requires.”

Related Stories

Market Data | Nov 2, 2018

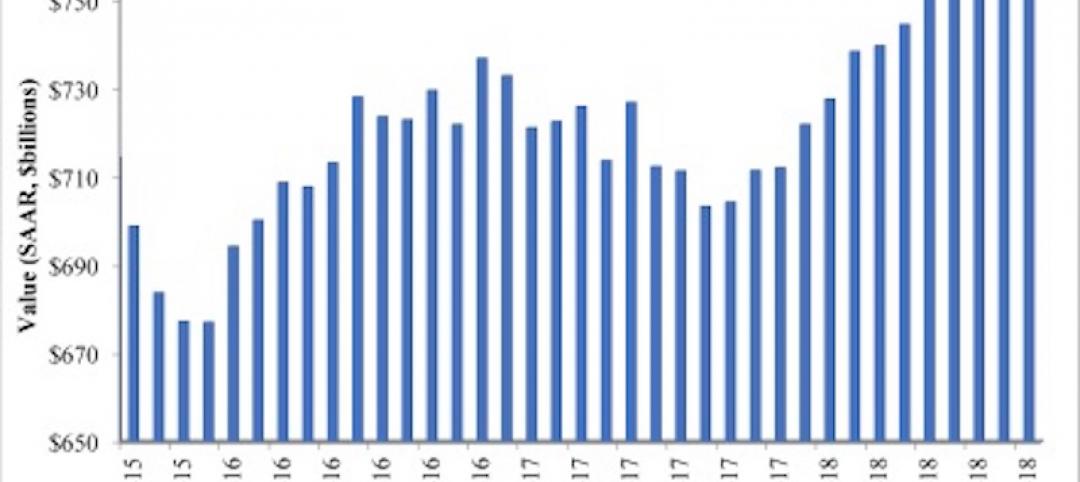

Nonresidential spending retains momentum in September, up 8.9% year over year

Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September.

Market Data | Oct 30, 2018

Construction projects planned and ongoing by world’s megacities valued at $4.2trn

The report states that Dubai tops the list with total project values amounting to US$374.2bn.

Market Data | Oct 26, 2018

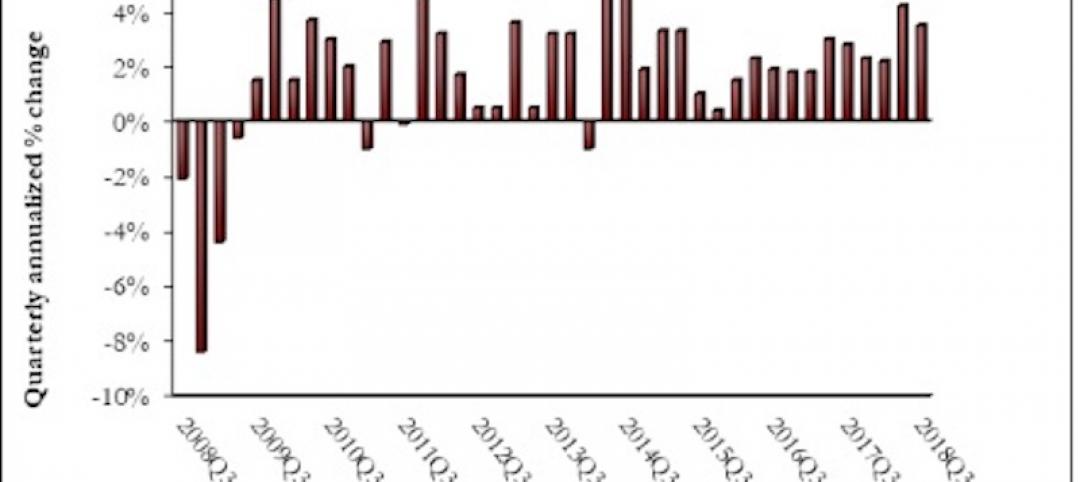

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

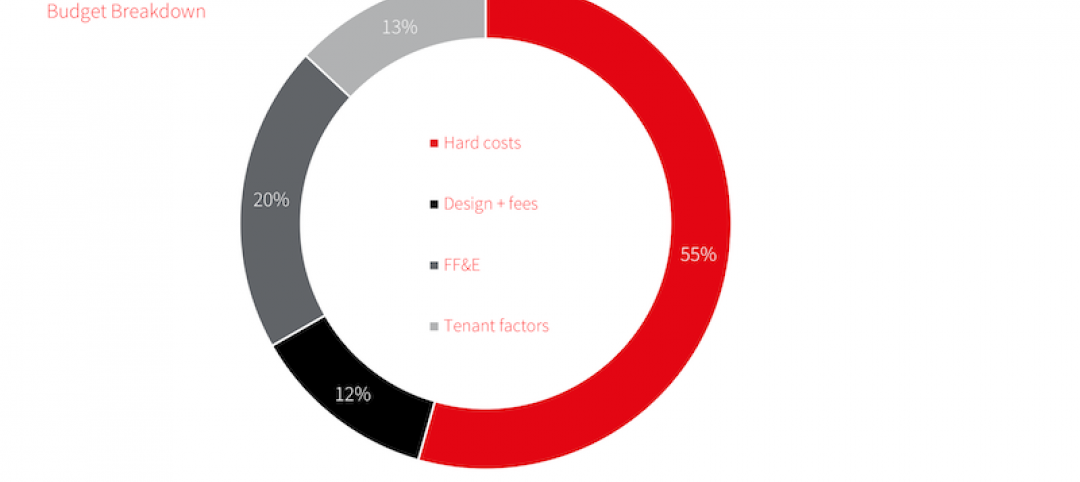

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.