Construction employment increased by 51,000 jobs in December, with gains for nonresidential as well as residential contractors, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned, however, that its latest survey shows widespread pessimism among contractors about the volume of work available in 2021, and they urged lawmakers to focus on measures designed to rebuild the economy and demand for construction.

“December’s employment gains likely reflect milder weather than usual for the month rather than sustained demand for projects,” said Ken Simonson, the association’s chief economist. “In fact, our survey found contractors expect the volume of work is likely to decline for nearly all nonresidential project types, and most firms have experienced project cancellations or postponements.”

Construction employment climbed to 7,413,000 in December, an increase of 0.7% compared to November. However, employment in the sector remains down by 226,000 or 3.0% since the most recent peak in February.

Residential construction has weathered the pandemic much better than nonresidential segments, Simonson added. While both parts of the industry had huge job losses from the pre-pandemic peak in February to April, residential building and specialty trade contractors have now recouped all of the employment losses they incurred. In contrast, nonresidential construction employment—comprising nonresidential building, specialty trades, and heavy and civil engineering construction—was 241,000 lower in December than in February.

Unemployment in construction nearly doubled in 2020. The industry’s unemployment rate in December was 9.6%, compared to 5.0% in December 2019. A total of 930,000 former construction workers were unemployed, up from 489,000 a year earlier. Both figures were the highest for December since 2013.

The association’s 2021 Construction Hiring and Business Outlook Survey found that 78% of contractors reported a project had been canceled or postponed, while only 25% reported winning new or additional work as a result of the pandemic, the economist noted. He said that suggests many firms will have to lay off employees once current projects wrap up. The survey included responses from more than 1,300 contractors that perform all types of construction other than homebuilding.

Association officials urged the new Congress and incoming Biden administration to enact measures to boost investments in all manner of public infrastructure. They added that Washington needs to backfill depleted state and local construction budgets so those new federal infrastructure investments can be more effective in boosting demand and construction employment.

“As Washington officials pivot from providing pandemic relief to focusing on rebuilding the economy, infrastructure needs to be at the top of their agenda,” said Stephen E. Sandherr, the association’s chief executive officer. “There is a real chance to come out of the pandemic with a stronger and more efficient economy fs we can act now to rebuild aging and over-burdened infrastructure.”

Related Stories

Market Data | Jun 22, 2018

Multifamily market remains healthy – Can it be sustained?

New report says strong economic fundamentals outweigh headwinds.

Market Data | Jun 21, 2018

Architecture firm billings strengthen in May

Architecture Billings Index enters eighth straight month of solid growth.

Market Data | Jun 20, 2018

7% year-over-year growth in the global construction pipeline

There are 5,952 projects/1,115,288 rooms under construction, up 8% by projects YOY.

Market Data | Jun 19, 2018

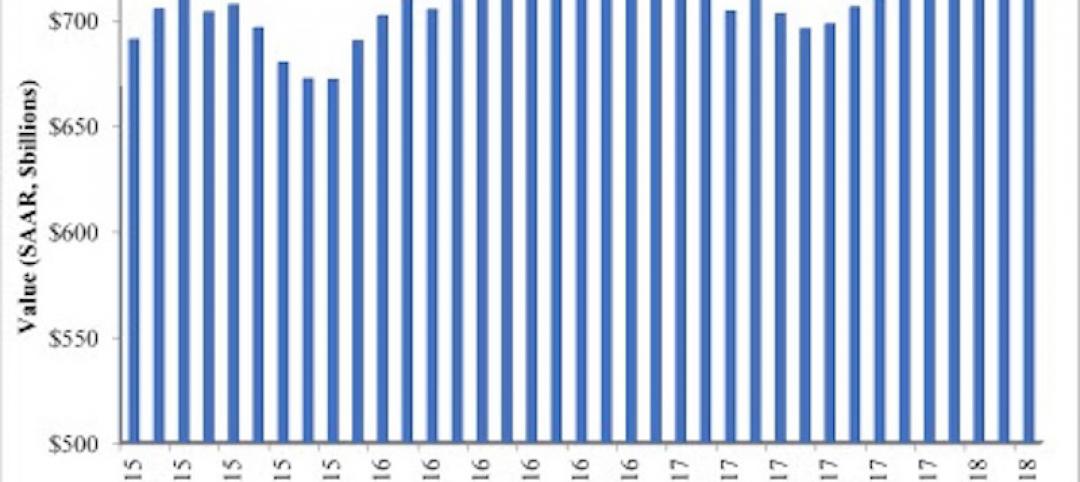

ABC’s Construction Backlog Indicator remains elevated in first quarter of 2018

The CBI shows highlights by region, industry, and company size.

Market Data | Jun 19, 2018

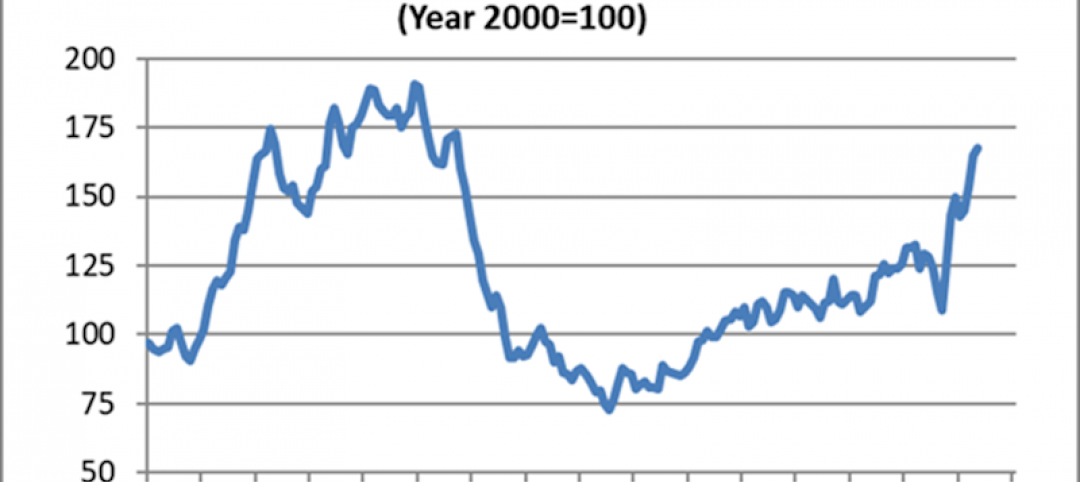

America’s housing market still falls short of providing affordable shelter to many

The latest report from the Joint Center for Housing Studies laments the paucity of subsidies to relieve cost burdens of ownership and renting.

Market Data | Jun 18, 2018

AI is the path to maximum profitability for retail and FMCG firms

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases.

Market Data | Jun 12, 2018

Yardi Matrix report details industrial sector's strength

E-commerce and biopharmaceutical companies seeking space stoke record performances across key indicators.

Market Data | Jun 8, 2018

Dodge Momentum Index inches up in May

May’s gain was the result of a 4.7% increase by the commercial component of the Momentum Index.

Market Data | Jun 4, 2018

Nonresidential construction remains unchanged in April

Private sector spending increased 0.8% on a monthly basis and is up 5.3% from a year ago.

Market Data | May 30, 2018

Construction employment increases in 256 metro areas between April 2017 & 2018

Dallas-Plano-Irving and Midland, Texas experience largest year-over-year gains; St. Louis, Mo.-Ill. and Bloomington, Ill. have biggest annual declines in construction employment amid continuing demand.