Construction spending declined for the fourth consecutive month in June as decreases in single-family, highway and educational projects outweighed increases in several private nonresidential categories, according to an analysis by the Associated General Contractors of America of government data released today. As state and local government face budget deficits, association officials cautioned that investments in infrastructure and other construction projects are likely to continue falling unless Congress and the Trump administration provide additional, targeted and dedicated infrastructure funding.

“Regrettably, the overall downward trend in spending is likely to continue and to spread to more project types as work that began before the pandemic hit finishes up,” said Ken Simonson, the association’s chief economist. “Unless the federal government invests heavily—and promptly—in infrastructure projects, both public and private nonresidential investment are likely to shrink further.”

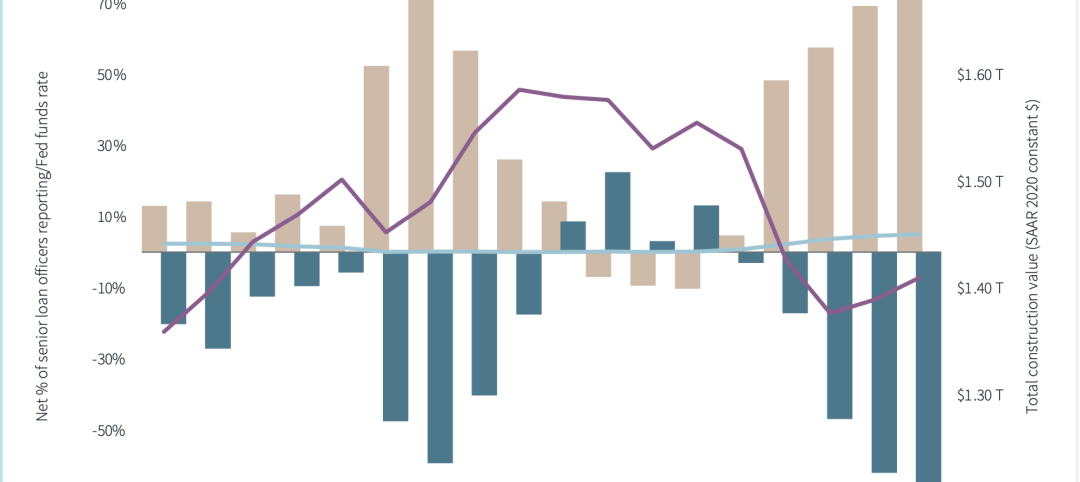

Construction spending in June totaled $1.36 trillion at a seasonally adjusted annual rate, a decline of 0.7% from May and the lowest total in a year. After reaching a record high in February of $1.44 trillion, total spending has slumped by 6.0%, the steepest four-month contraction in a decade, the economist noted.

Public construction spending decreased by 0.7% in June, dragged down by a 1.7% drop in highway and street construction spending and a 2.7% decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 0.6%.

Private nonresidential construction spending inched up 0.2% from May to June, led by a gain of 0.7% in the largest segment, power construction. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 1.3%, while manufacturing construction rose 1.7% and office construction edged up 0.3%.

Private residential construction spending shrank by 1.5% in June as spending on single-family homebuilding plunged 3.6% to its lowest level since late 2016. In contrast, new multifamily construction spending climbed for the third month in a row, posting a 3.0% increase from May.

Association officials said that state and local budgets are getting hammered by declining economic activity related to the ongoing pandemic. They urged Congress and the administration to quickly pass new infrastructure and recovery measures to help reverse the declines in public spending. They added that those new investments would help put many people back to work in good-paying construction careers.

“It will be hard to rebuild the economy if state and local governments lack the resources needed to improve roads, retrofit schools and keep drinking water safe,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of letting people languish in unemployment, Washington can put people back to work simply by boosting investments in needed infrastructure and other construction projects.”

Related Stories

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.