National nonresidential construction spending fell 1.2% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $809.1 billion for the month.

Of the 16 nonresidential subcategories, 10 were down on a monthly basis. Private nonresidential spending declined 1.0% while public nonresidential construction spending was down 1.3% in July.

“There are two primary countervailing forces influencing the trajectory of nonresidential construction spending,” said Basu. “The first is a force for good and involves the reopening of the economy and associated rebound in overall economic activity. Despite the lingering pandemic, third quarter GDP growth is likely to be quite strong. All things being equal, this would tend to strengthen business for contractors.

'Next year is shaping up to be an especially harsh one for many contractors, especially as some are already indicating that they are nearing the end of their backlog. The wild card, as is often the case, is Congress.'

“However, the second force at work is not benign and appears to be the stronger of the two,” said Basu. “The crisis has resulted in tighter project financing conditions, battered state and local government finances, substantial commercial vacancy and uncertainty regarding the future of key segments, such as office and lodging. And while backlog was strong at the start of the year, contractors indicate that it is now declining rapidly, in part due to abundant project cancellations.”

“Next year is shaping up to be an especially harsh one for many contractors, especially as some are already indicating that they are nearing the end of their backlog,” said Basu. “The wild card, as is often the case, is Congress. Another stimulus package could go a long way toward improving the trajectory of overall nonresidential construction spending, particularly one with a sizable infrastructure component. The upshot is that declines in nonresidential construction spending are likely even in the context of broader economic recovery.”

Related Stories

| Jan 31, 2013

The Opus Group completes construction of corporate HQ for Church & Dwight Co.

The Opus Group announced today the completion of construction on a new 250,000-square-foot corporate headquarter campus for Church & Dwight Co., Inc., in Ewing Township, near Princeton, N.J.

| Jan 31, 2013

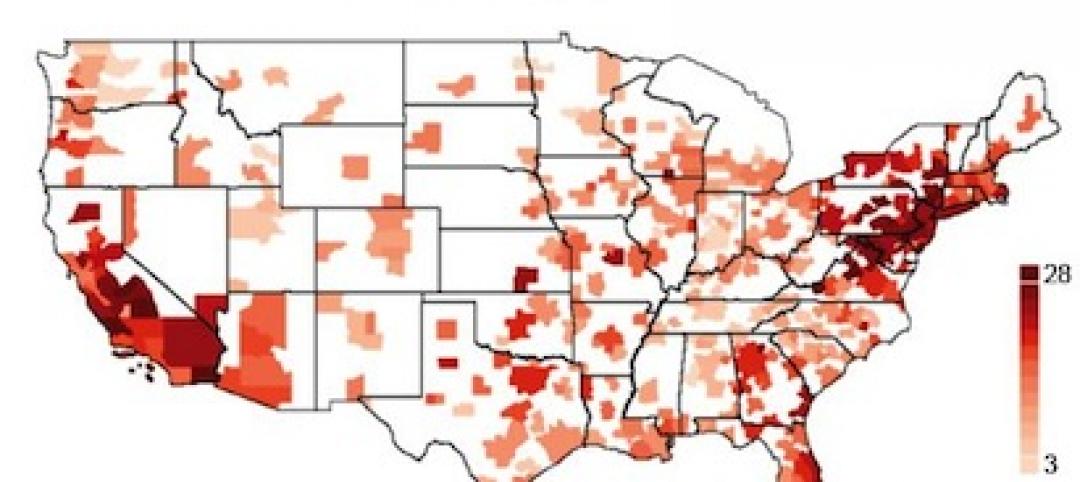

Map of U.S. illustrates planning times for commercial construction

Stephen Oliner, a UCLA professor doing research for the Federal Reserve Board, has made the first-ever estimate of planning times for commercial construction across the United States.

| Jan 29, 2013

Tutor Perini Corp. to Implement Textura Prequalification Management Companywide

Rollout across the Tutor Perini organization will enhance the subcontractor prequalification experience and enable a standardized process in support of the contractor default insurance program.

| Jan 22, 2013

Midwestern Construction Company Acquires Local Architecture Firm

St. Charles, Ill.-based design/build and construction firm acquires architecture firm.

| Jan 16, 2013

2013 40 Under 40 application process now open

Building Design+Construction's 40 Under 40 is open to AEC professionals from around the globe.

| Jan 15, 2013

Hill International selected as PM for Secon Nile Towers in Cairo

The Secon Nile Towers will feature two 23-story buildings: one five-star hotel tower and one residential and retail tower.

| Jan 10, 2013

Guide predicts strongest, weakest AEC markets for 2013

2013 Guide to U.S. AEC markets touts apartments, natural gas, senior housing and transmission and distribution.