Construction spending decreased 0.2 percent from November to December as declines in public and private nonresidential projects outweighed a large rise in single-family homebuilding, according to a new analysis of federal data released today by the Associated General Contractors of America. Association officials noted that its recent survey found widespread optimism about prospects for projects available to bid on in 2020 but they urged officials in Washington to follow through on announced plans for infrastructure spending increases.

“Both the actual spending totals for December and our members’ expectations for 2020 point to a positive year for all major categories of construction,” said Ken Simonson, the association’s chief economist. “Continuing job gains throughout the nation, along with low interest rates, make a good year for residential construction especially likely, while spending many nonresidential categories should match or exceed 2019 levels.”

Construction spending totaled $1.328 trillion at a seasonally adjusted annual rate in December, a decrease of 0.2 percent from November but a gain of 5.0 percent from December 2018, according to estimates the U.S. Census Bureau released today. Private residential spending increased 1.4 percent for the month, led by a 2.7 percent increase in single-family homebuilding. Private nonresidential spending declined 1.8 percent for the month and 0.1 percent compared to December 2018. Public construction spending slipped 0.4 percent from November but jumped 11.5 percent from a year earlier.

For 2019 as a whole, spending totaled $1.303 trillion, a dip of 0.3 percent from the 2018 total. Private residential spending declined 4.7 percent for the year, private nonresidential spending was flat, and public construction spending increased 7.1 percent.

The new spending data comes as the association’s 2020 Construction Outlook survey found that for each of 13 project types, more contractors expect an increase in 2020 than a decrease in the dollar value of projects they compete for. On balance, the 956 respondents were most optimistic about water and sewer construction, followed by highway and bridge projects, transportation structures (including airports, transit, rail and port facilities), schools, and hospitals.

Association officials said continued growth in highway and other transportation construction depends in part on timely action by Congress and the President to approve new infrastructure spending plans. The officials noted that the current highway and transit funding legislation expires in less than eight months, and they urged policy makers to reach agreement swiftly on how to boost funding for all types of infrastructure.

“Expanding and modernizing the transportation infrastructure is essential for continued economic health,” said Stephen E. Sandherr, the association’s chief executive officer. “That is why Congress and the Trump administration must act quickly to boost investments in all modes of transportation.”

View the 2020 Construction Outlook Survey.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

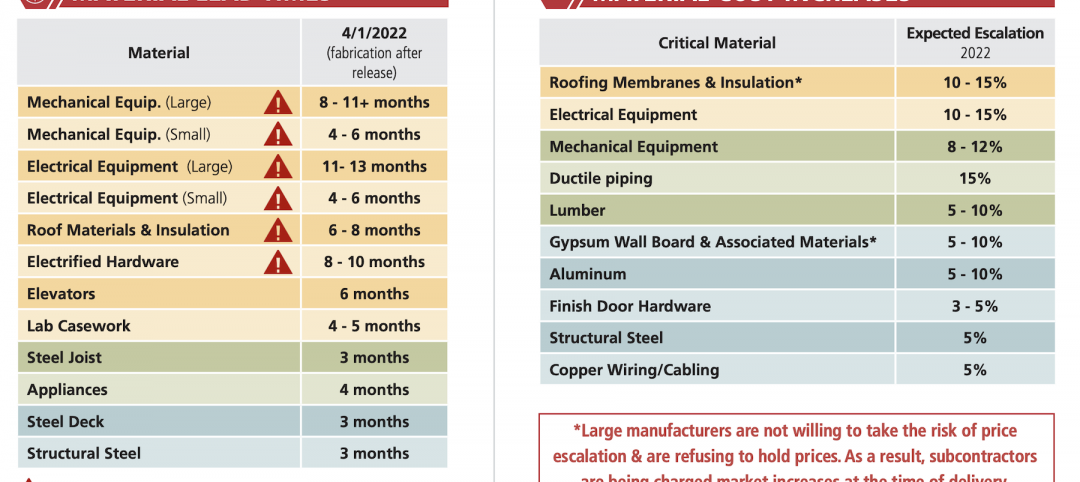

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment