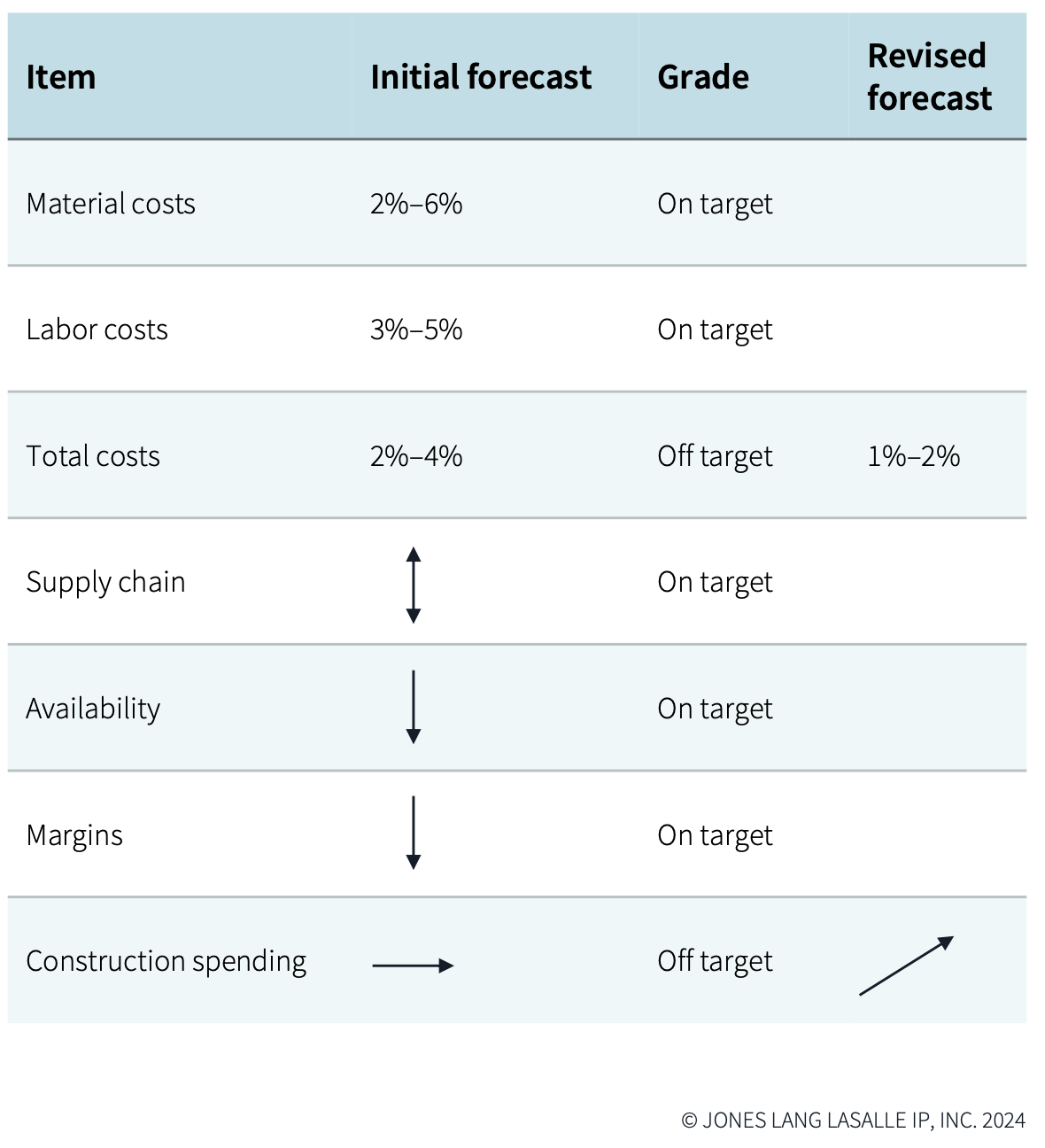

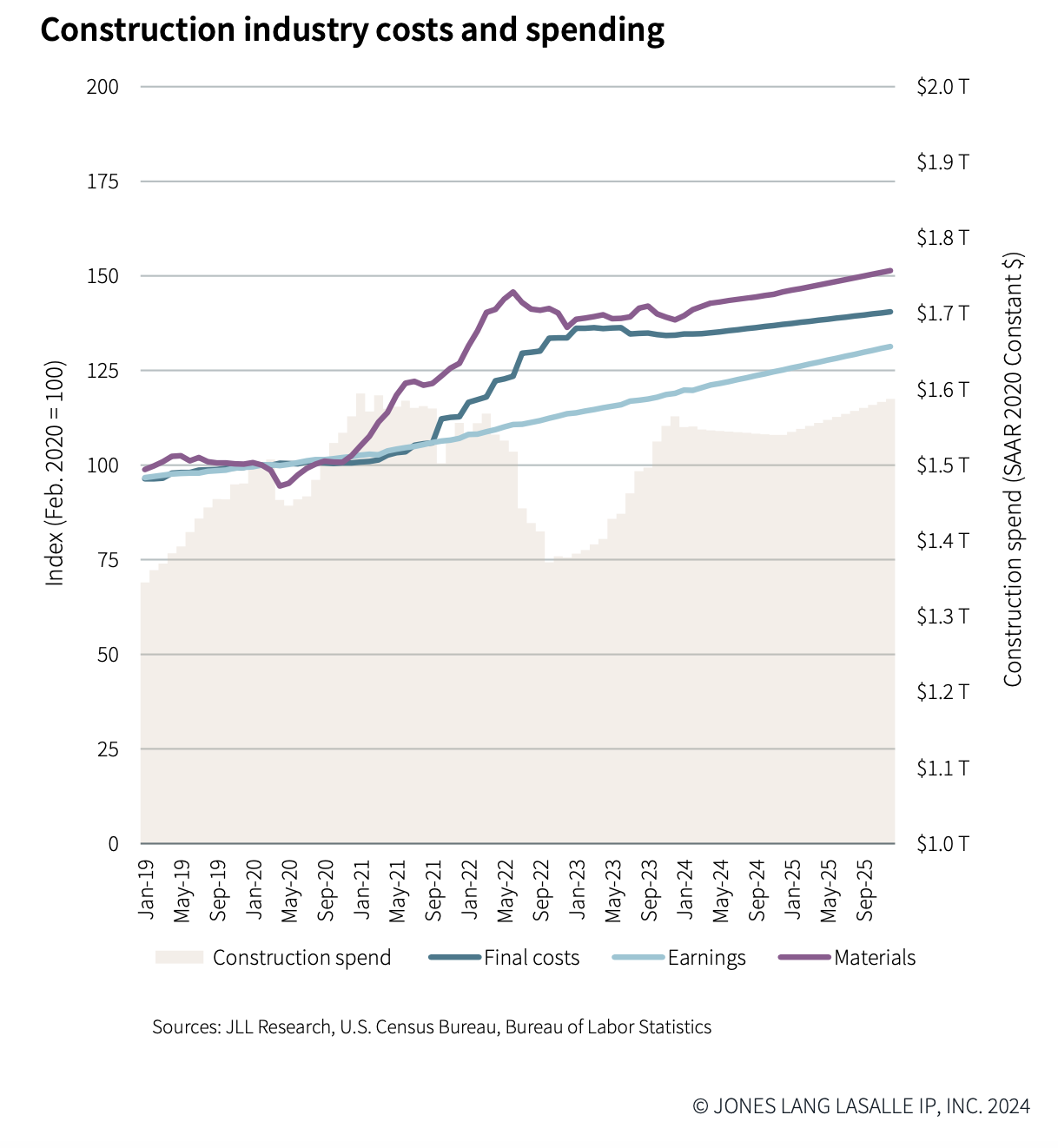

In the first half of 2024, construction costs stabilized. And through the remainder of this year, total cost growth is projected to be modest, and matched by an overall increase in construction spending.

That prediction can be found in JLL’s 2024 Midyear Construction Update and Reforecast, released today. JLL bases its market analyses on insights gleaned from its global team of more than 550 research professionals who track economic and property trends and forecast future conditions in over 60 countries.

The Update acknowledges that the industry has been adjusting to new patterns of demand, as not all sectors are performing equally well. Interest in projects in general has increased, lending regulations are not tightening, and spending is up more than originally anticipated.

Still, the trajectory of interest rates “continues to elude forecasters,” observes JLL, “making ‘higher for longer’ the correct operating paradigm.” Yet despite financial constraints, JLL expects cost growth and development to continue. Stakeholders need to account for maturing debt, lease expirations, and emerging global advantages as they navigate the realities of sustained higher interest rates and varied local outcomes.

One area of opportunity for AEC firms, under these circumstances, is resilient and sustainable design and construction, says JLL.

Spending is outpacing employment availability

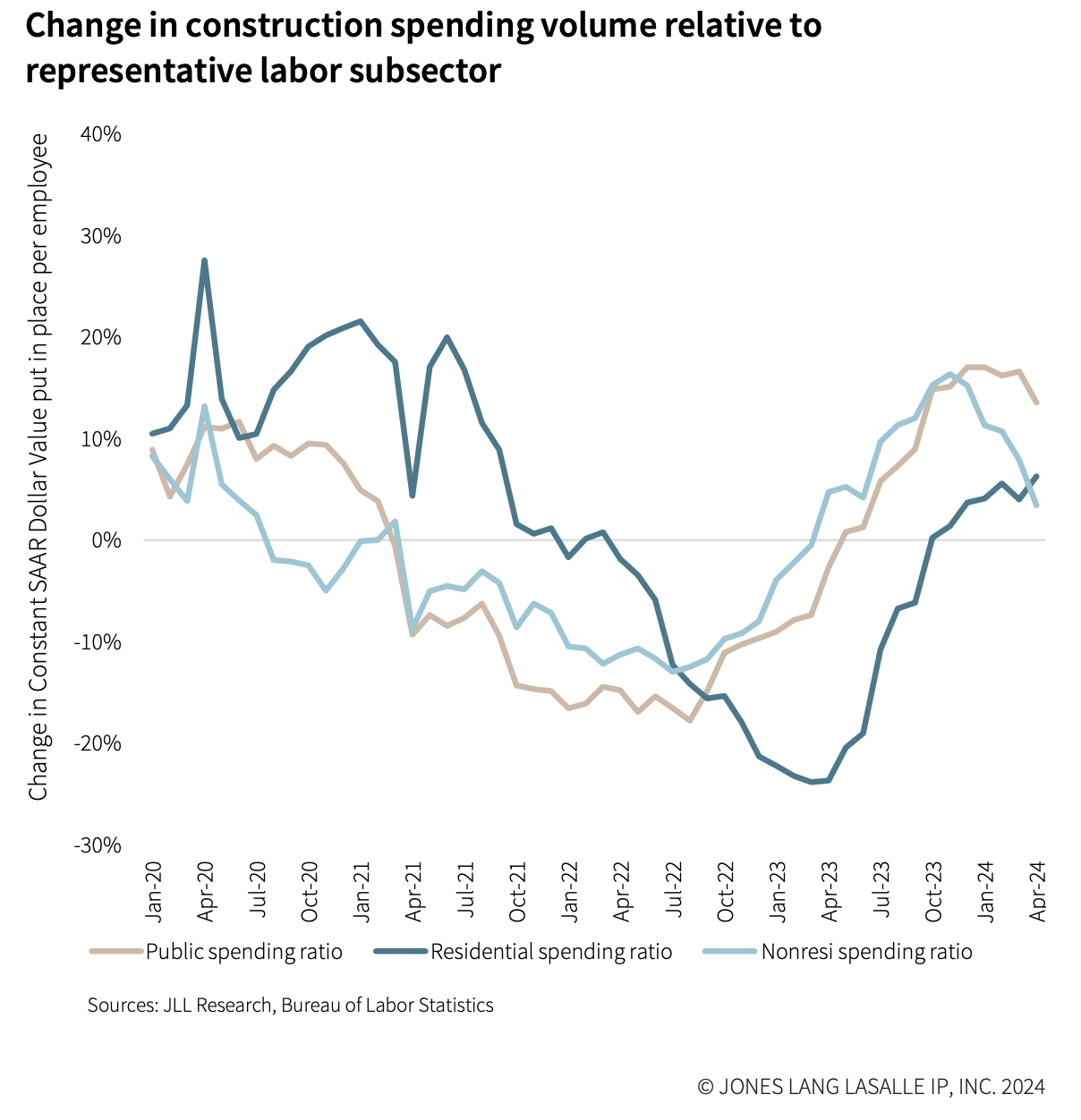

With these positive outlooks, construction employment has risen, along with compensation. Labor costs driven by limited availability continue to provide a growth floor for broader industry costs. JLL states that its predictions of wage growth at moderately higher than historical rates remain unchanged.

This is because construction spending has been outpacing employment. “Relative strain in production value required per employee is returning to pre-pandemic points [but] with a very different workforce, and remains heavily concentrated in select metros,” JLL states.

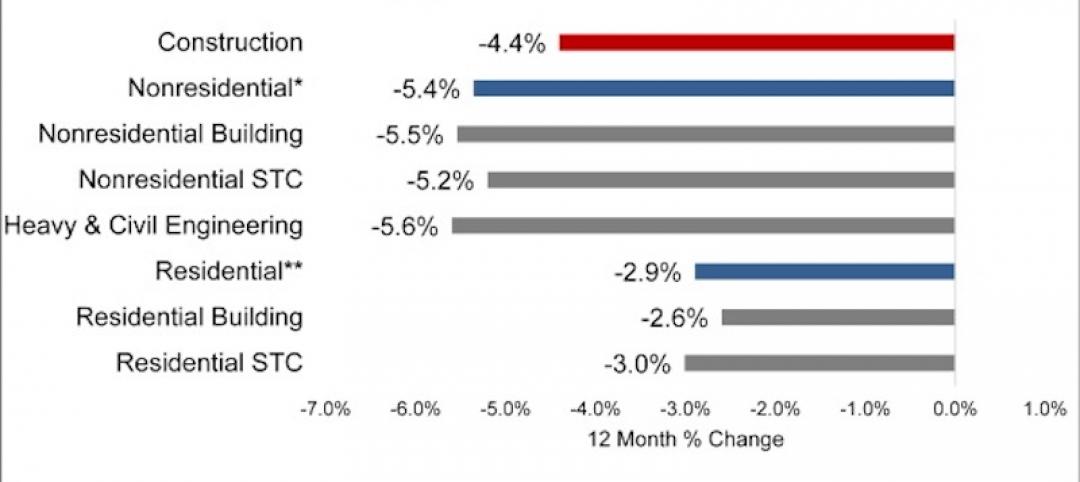

While overall growth has been restrained to average below expectations, volatility persists, notably on the cost of materials. Demand for finished goods remains high, especially for MEP products as more sectors electrify and upgrade their operating systems.

Staples of demand are changing and, with them, expectations for price moderation and normal market behavior. For example, bid prices for staple materials such as metals and concrete are at their lowest average monthly movement since 2020. JLL observes that price stability reflects efforts to develop backlogs and secure work and margins. But with global events being so unpredictable, this current period of price stability, says JLL, is transient “and likely short-lived.”

Big question: continued infrastructure investment

JLL believes that market participants, namely developers, suppliers, and AEC firms, are going to hold their current growth pace over the short term. Its Update advises stakeholders to engage the nuances of local markets and design demands “as early as possible” to determine market direction and to navigate disruptions.

So far, firms have been able to compress their margins, mainly because material costs have trended lower than expected, which in turn has allowed for higher-than-anticipated construction spending. But labor challenges continue unabated and are expected to exert pressure on costs into 2025 and beyond.

Consequently, JLL has revised some of its forecasts for the remainder of 2024, most prominently that total costs would increase just 1-2% for the year, and that construction spending (which JLL previously thought would be flat) will increase.

JLL notes, too, that aggregate materials, currently on the low end of price increases, might experience more volatility. JLL also states that anticipating spending increases—and the price floor that such demand would set—will depend on continued public investment in infrastructure and other construction projects.

Related Stories

Market Data | Jul 20, 2020

Construction employment rises from May to June in 31 states, slips in 18

Recent data from Procore on jobsite workers’ hours indicates employment may have leveled off.

Market Data | Jul 20, 2020

6 must reads for the AEC industry today: July 20, 2020

Never waste a crisis and robotic parking systems help developers optimize parking amenities.

Market Data | Jul 17, 2020

7 must reads for the AEC industry today: July 17, 2020

Kennedy Middle School's new Administration/Family Center and Tips to make optimal use of salvaged materials.

Market Data | Jul 16, 2020

Final NEPA rule will make it easier to rebuild infrastructure, reinvigorate the economy, and continue protecting the environment

Administration’s final reforms to the federal environmental review process fix problems with prior process, maintain environmental rigor, and accelerate needed infrastructure improvements.

Market Data | Jul 16, 2020

5 must reads for the AEC industry today: July 16, 2020

1928 hotel reimagined as a new resiential and cultural hub and Walgreens plans hundreds of doctor's offices at its stores.

Market Data | Jul 10, 2020

5 must reads for the AEC industry today: July 10, 2020

The world's tallest hybrid timber tower and the Florida Gators have a new $65 million ballpark.

Market Data | Jul 9, 2020

6 must reads for the AEC industry today: July 9, 2020

The world's most sustainable furniture factory and what will construction look like when COVID-19 ends?

Market Data | Jul 8, 2020

North America’s construction output to fall by 6.5% in 2020, says GlobalData

Even though all construction activities have been allowed to continue in most parts of the US and Canada since the start of the COVID-19 pandemic, many projects in the bidding or final planning stages have been delayed or canceled.

Market Data | Jul 8, 2020

5 must reads for the AEC industry today: July 8, 2020

AEMSEN develops concept for sustainable urban living and nonresidential construction has recovered 56% of jobs lost since March.

Market Data | Jul 7, 2020

Nonresidential construction has recovered 56% of jobs lost since March employment report

Nonresidential construction employment added 74,700 jobs on net in June.