Construction spending increased in December compared to both November and a year ago thanks to growing demand for residential construction, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted, however, that spending on private nonresidential construction was flat for the month and down compared to a year ago while public sector construction spending fell for both the month and the year.

“Demand for new housing remains strong, while demand for nonresidential projects has been variable and most types of public sector investments in construction are declining,” said Ken Simonson, the association’s chief economist. “Contractors coping with rising materials prices and labor shortages are also dealing with the consequences of a nonresidential market that is, at best, uneven.”

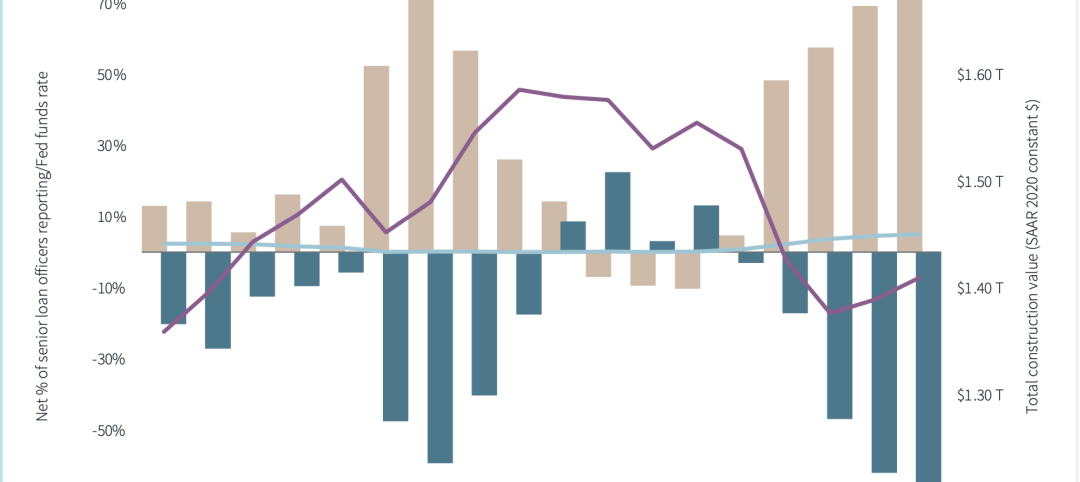

Construction spending in December totaled $1.64 trillion at a seasonally adjusted annual rate, 0.2% above the November rate and 9.0% higher than in December 2020. Full-year spending for 2021 increased 8.2% compared to 2020.

Private residential construction spending rose 0.7% in December from a month prior and 12.7% from December 2020. For 2021 as a whole, residential construction spending jumped 23.2% from 2020, with gains of 32.8% for single-family spending and 15.6% for multifamily spending.

Private nonresidential construction spending was nearly unchanged from November to December but increased 9.1% from December 2020. For all of 2021, private nonresidential spending slipped 2.3% from 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 4.9% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--inched up 0.1% in December and jumped 18.4% year-over-year, driven by surging demand for distribution facilities. Manufacturing construction spending fell by 1.9% in December, after 11 consecutive months of growth, but posted a 30.4% gain above its year-earlier level.

Public construction declined 1.6% in December, with decreases in 11 of the 12 categories, and 2.9% year-over-year. For 2021 as a whole, public construction fell 4.2% from 2020. Highway and street construction increased 0.1% from November and rose 0.9% compared to December 2020. Educational construction slipped 1.4% for the month and skidded 8.5% year-over-year. Transportation construction spending fell 3.0% in December and 6.3% year-over year.

Association officials said one reason for the declines in public sector construction spending is that Congress has yet to appropriate most of the additional funds authorized in the Bipartisan Infrastructure Bill signed by President Biden last year. They urged Congress to quickly make those new funds available so state and local officials can make the investments needed to improve the nation’s aging infrastructure.

“The Bipartisan Infrastructure Package’s immediate promise is not being met because Congress has yet to appropriate much of the increased funding,” said Stephen E. Sandherr, the association’s chief executive officer. “It is time to improve our infrastructure and protect those who rely on it.”

Related Stories

Contractors | Sep 12, 2023

The average U.S. contractor has 9.2 months worth of construction work in the pipeline, as of August 2023

Associated Builders and Contractors' Construction Backlog Indicator declined to 9.2 months in August, down 0.1 month, according to an ABC member survey conducted from Aug. 21 to Sept. 6. The reading is 0.5 months above the August 2022 level.

Contractors | Sep 11, 2023

Construction industry skills shortage is contributing to project delays

Relatively few candidates looking for work in the construction industry have the necessary skills to do the job well, according to a survey of construction industry managers by the Associated General Contractors of America (AGC) and Autodesk.

Market Data | Sep 6, 2023

Far slower construction activity forecast in JLL’s Midyear update

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.