Total construction spending increased in November compared to levels in October and a year earlier, as gains in private residential and nonresidential projects outweighed decreases in public outlays, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted that public sector investments were down in part because Congress has failed to provide funding so far for the Bipartisan Infrastructure bill enacted last year.

“Private nonresidential spending appears to be on a solid upswing, with five consecutive months of growth, but public outlays for construction remain erratic,” said Ken Simonson, the association’s chief economist. “The public side isn’t likely to post steady gains until funds from the new infrastructure law become available and turn into actual projects.”

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate, 0.4% above the October rate and 9.3% higher than in November 2020. Year-to-date spending in the first 11 months of 2021 combined increased 7.9% from the total for January-November 2020.

Private construction spending rose 0.6% in November from the October total and 12.5% from November 2020. In contrast, public construction spending slipped 0.2% for the month and 0.9% year-over-year.

There were gains in both residential and nonresidential private construction. Spending on new single- and multifamily residential projects, along with additions and renovations to existing houses, increased 0.9% for the month and 16.3% from a year earlier. Private nonresidential spending edged up 0.1% from October and 6.7% from November 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 7.5% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--dipped 0.1% in November but jumped 15.1% year-over-year. Manufacturing construction increased for the 11th month in a row, by 0.9%, putting the total 22.4% above the year-earlier level.

The largest public categories posted mixed results. Highway and street construction slid 0.8% from October but rose 0.2% compared to November 2020. Educational construction climbed 0.3% for the month but declined 6.3% year-over-year. Transportation spending fell 0.5% in November but rose 0.7% from the year-earlier total.

Association officials said that public construction spending likely suffered from the fact Congress has not yet allocated the additional funds that were authorized in the Bipartisan Infrastructure bill that the President signed into law last year. As a result, the economic benefits from that measure will be delayed for at least a few months until Congress passes a new spending bill.

“Construction demand is definitely being impacted by Congress’ failure to include the funding increases it promised as part of the Bipartisan Infrastructure bill,” said Stephen E. Sandherr, the association’s chief executive officer.

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

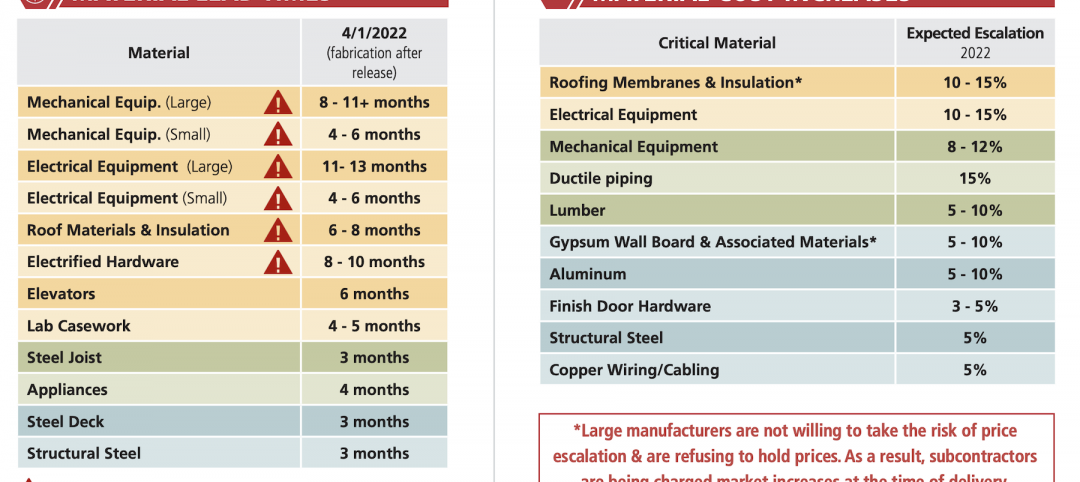

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment