Total construction spending increased in November compared to levels in October and a year earlier, as gains in private residential and nonresidential projects outweighed decreases in public outlays, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted that public sector investments were down in part because Congress has failed to provide funding so far for the Bipartisan Infrastructure bill enacted last year.

“Private nonresidential spending appears to be on a solid upswing, with five consecutive months of growth, but public outlays for construction remain erratic,” said Ken Simonson, the association’s chief economist. “The public side isn’t likely to post steady gains until funds from the new infrastructure law become available and turn into actual projects.”

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate, 0.4% above the October rate and 9.3% higher than in November 2020. Year-to-date spending in the first 11 months of 2021 combined increased 7.9% from the total for January-November 2020.

Private construction spending rose 0.6% in November from the October total and 12.5% from November 2020. In contrast, public construction spending slipped 0.2% for the month and 0.9% year-over-year.

There were gains in both residential and nonresidential private construction. Spending on new single- and multifamily residential projects, along with additions and renovations to existing houses, increased 0.9% for the month and 16.3% from a year earlier. Private nonresidential spending edged up 0.1% from October and 6.7% from November 2020. The largest private nonresidential segment, power construction, rose 0.1% for the month and 7.5% year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--dipped 0.1% in November but jumped 15.1% year-over-year. Manufacturing construction increased for the 11th month in a row, by 0.9%, putting the total 22.4% above the year-earlier level.

The largest public categories posted mixed results. Highway and street construction slid 0.8% from October but rose 0.2% compared to November 2020. Educational construction climbed 0.3% for the month but declined 6.3% year-over-year. Transportation spending fell 0.5% in November but rose 0.7% from the year-earlier total.

Association officials said that public construction spending likely suffered from the fact Congress has not yet allocated the additional funds that were authorized in the Bipartisan Infrastructure bill that the President signed into law last year. As a result, the economic benefits from that measure will be delayed for at least a few months until Congress passes a new spending bill.

“Construction demand is definitely being impacted by Congress’ failure to include the funding increases it promised as part of the Bipartisan Infrastructure bill,” said Stephen E. Sandherr, the association’s chief executive officer.

Related Stories

Market Data | Feb 17, 2021

Soaring prices and delivery delays for lumber and steel squeeze finances for construction firms already hit by pandemic

Association officials call for removing tariffs on key materials to provide immediate relief for hard-hit contractors and exploring ways to expand long-term capacity for steel, lumber and other materials,

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

Market Data | Feb 9, 2021

USGBC top 10 states for LEED in 2020

The Top 10 States for LEED green building is based on gross square feet of certified space per person using 2010 U.S. Census data and includes commercial and institutional projects certified in 2020.

Market Data | Feb 8, 2021

Construction employment stalls in January with unemployment rate of 9.4%

New measures threaten to undermine recovery.

Market Data | Feb 4, 2021

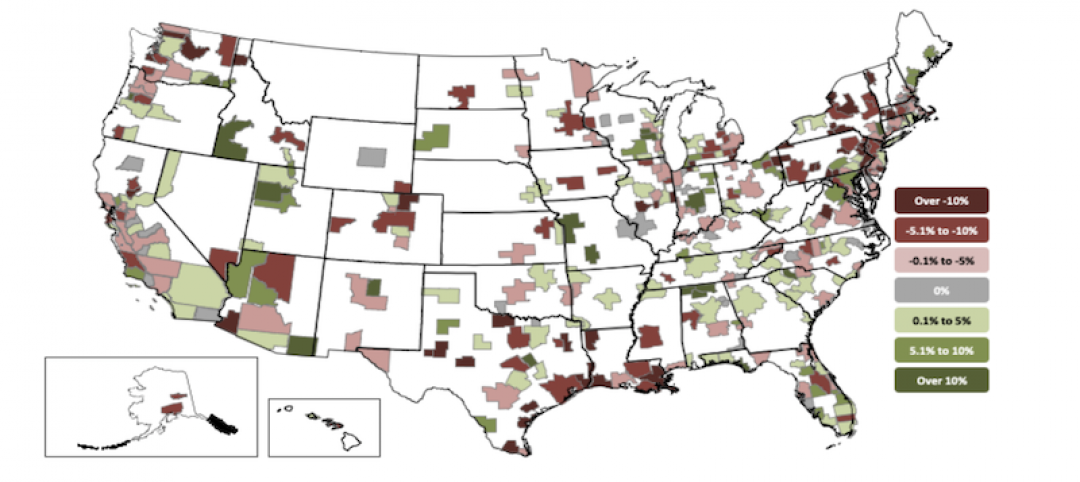

Construction employment declined in 2020 in majority of metro areas

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 2020 losses, while Indianapolis-Carmel-Anderson, Ind. and Walla Walla, Wash. register largest gains in industry jobs.

Market Data | Feb 3, 2021

Construction spending diverges in December with slump in private nonresidential sector, mixed public work, and boom in homebuilding

Demand for nonresidential construction and public works will decline amid ongoing pandemic concerns.

Market Data | Feb 1, 2021

The New York City market is back on top and leads the U.S. hotel construction pipeline

New York City has the greatest number of projects under construction with 108 projects/19,439 rooms.

Market Data | Jan 29, 2021

Multifamily housing construction outlook soars in late 2020

Exceeds pre-COVID levels, reaching highest mark since 1st quarter 2018.

Market Data | Jan 29, 2021

The U.S. hotel construction pipeline stands at 5,216 projects/650,222 rooms at year-end 2020

At the end of Q4 ‘20, projects currently under construction stand at 1,487 projects/199,700 rooms.

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.