Total construction spending edged higher in October, as gains in public and private project types outmatched decreases in single- and multifamily residential outlays, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials noted that public sector investments would likely rise in the near future because of the recently-passed infrastructure bill, but cautioned that labor shortages and supply chain problems were posing significant challenges for the industry.

“It is encouraging to see such a broad-based pickup in spending on nonresidential projects in the latest month,” said Ken Simonson, the association’s chief economist. “But the construction industry still faces major challenges from workforce shortages and supply-chain bottlenecks.”

Construction spending in October totaled $1.60 trillion at a seasonally adjusted annual rate, 0.2% above the September rate and 8.6% higher than in October 2020. Year-to-date spending in the first 10 months of 2021 combined increased 7.5% from the total for January-October 2020.

Among the 16 nonresidential project types the Census Bureau reports on, all but two posted spending increases from September to October. Total public construction spending rose 1.8% for the month, while private nonresidential spending inched up 0.2%. However, for the first 10 months of 2021 combined, nonresidential spending trailed the January-October 2020 total by 4.7%, with mixed results by type.

Combined private and public spending on electric power and oil and gas projects--the largest nonresidential segment--declined 0.6% for the month and lagged 2020 year-to-date total by 1.7%. But the other large categories all rose in October. Highway and street construction spending increased 2.4% for the month, though the year-to-date total lagged the same months of 2020 by 0.8%. Education construction rose 0.2% in October but trailed the 2020 year-to-date total by 9.2%. Commercial construction--comprising warehouse, retail, and farm structures--was nearly unchanged from September to October but was 1.9% higher for the first 10 months combined than in January-October 2020.

Residential construction spending declined for the second month in a row, slipping 0.5% from the rate in September. Nevertheless, the year-to-date total for residential spending was 24.2% higher than in the same months of 2020. Spending on new single-family houses decreased 0.8% for the month but outpaced the 2020 year-to-date total by 25.9%. Multifamily construction spending dipped 0.1% in October but topped the 2020 year-to-date total by 16.6%.

Association officials said that spending on many categories of public construction is likely to increase soon as the investments from the Bipartisan Infrastructure bill begin to flow. But they cautioned that the supply chain challenges and labor shortages were impacting construction schedules and budgets and prompting some owners to delay or cancel projects. They urged the Biden administration to explore new ways to relieve shipping delays and to invest more in career and technical education programs that serve as a pipeline into construction careers.

“Getting a handle on supply chains and encouraging more people to work in construction will go a long way in helping this industry recover,” said Stephen E. Sandherr, the association’s chief executive officer.

Related Stories

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Market Data | May 7, 2019

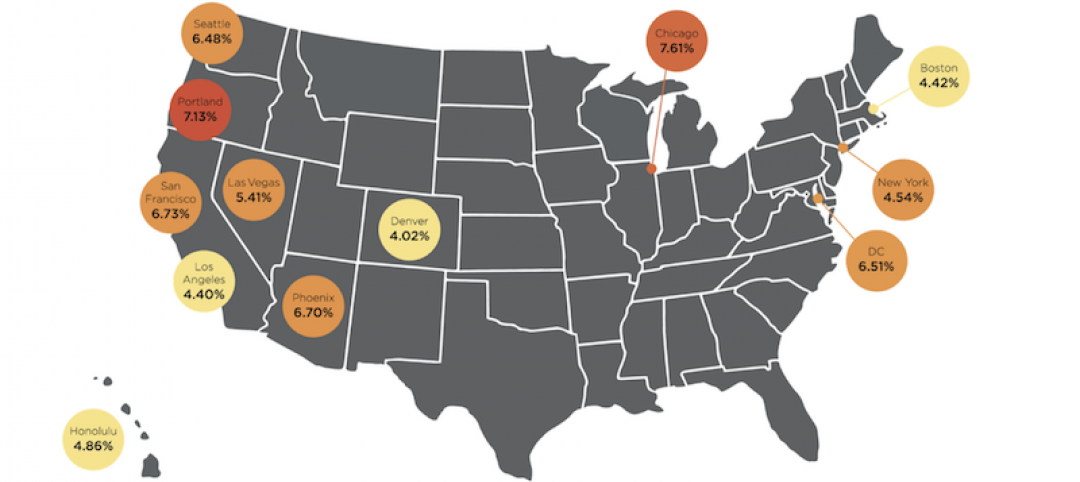

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

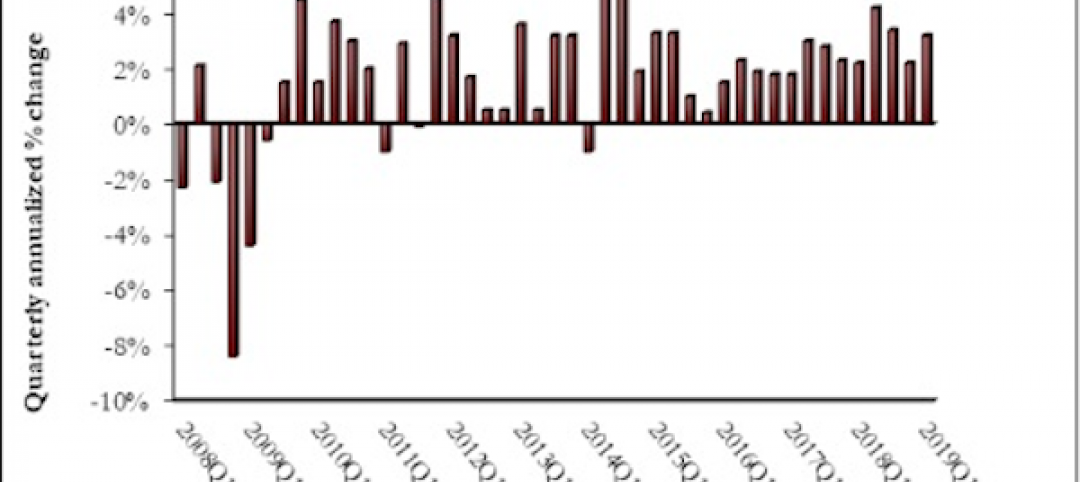

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.

Market Data | Apr 18, 2019

ABC report: 'Confidence seems to be making a comeback in America'

The Construction Confidence Index remained strong in February, according to the Associated Builders and Contractors.