Construction spending rallied in January as private nonresidential construction increased for the first time in seven months, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said that nonresidential construction spending remains below pre-pandemic levels and that rising materials prices and proposed labor law changes threaten the sector’s recovery.

“Despite a modest upturn in January, spending on private nonresidential construction remained at the second-lowest level in more than three years and was 10% below the January 2020 spending rate,” said Ken Simonson, the association’s chief economist. “All 11 of the private nonresidential categories in the government report were down, compared to a year earlier.”

Construction spending in January totaled $1.52 trillion at a seasonally adjusted annual rate, an increase of 1.7% from the pace in December and 5.8% higher than in January 2020. Residential construction jumped 2.5% for the month and 21% year-over-year. Meanwhile, combined private and public nonresidential spending climbed 0.9% from December but remained 5.0% below the year-ago level.

Private nonresidential construction spending rose 0.4% from December to January, although declines continued for the three largest components. The largest private nonresidential segment, power construction, fell 10.0% year-over-year and 0.8% from December to January. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—slumped 8.3% year-over-year and 1.8% for the month. Office construction decreased 4.4% year-over-year and 0.2% in January. Manufacturing construction tumbled 14.7% from a year earlier despite a 4.9% pickup in January.

Public construction spending increased 2.9% year-over-year and 1.7% for the month. Results were mixed among the largest segments. Highway and street construction rose 6.5% from a year earlier and 5.8% for the month, possibly reflecting unseasonably mild weather conditions in January 2021 compared to December and January 2020. Educational construction increased 0.9% year-over-year but dipped 0.1% in January. Spending on transportation facilities declined 0.6% for the year and 1.0% in January.

Private residential construction spending increased for the eighth-straight month, jumping 21% year-over-year percent and 2.5% in January. Single-family homebuilding leaped 24.2% compared to January 2020 and 3.0% for the month. Multifamily construction spending climbed 16.9% for the year and 0.7% for the month.

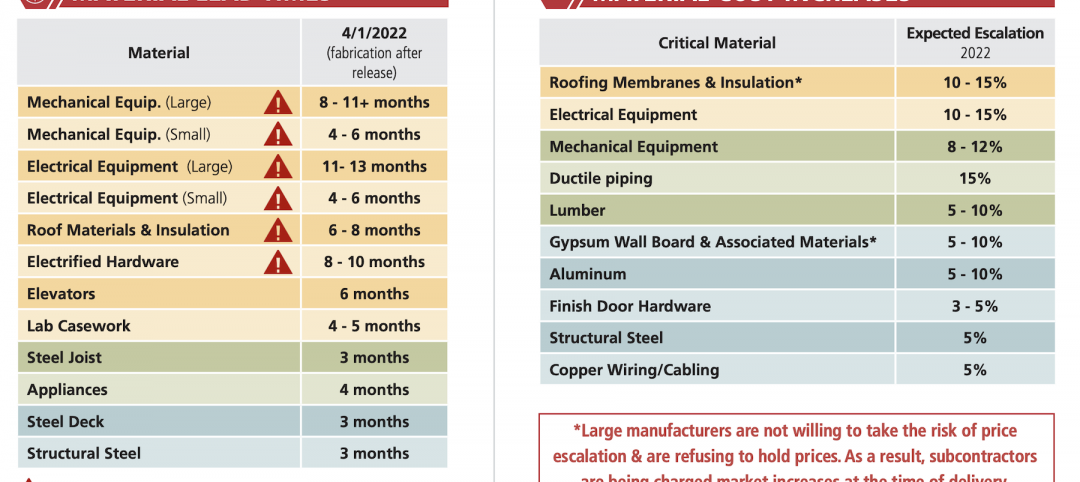

Association officials said that many construction firms report they are being squeezed by rising materials prices, particularly for lumber and steel, yet are having a hard time increasing what they charge to complete projects. They urged the Biden administration to explore ways to boost domestic supply and eliminate trade barriers for those key materials. They also cautioned that the proposed PRO Act and its significant changes to current labor laws could undermine labor harmony at a time when the industry is struggling to rebound.

“Contractors are getting caught between rising materials prices and stagnant bid levels,” said Stephen E. Sandherr, the association’s chief executive officer. “Add to that the possible threat of a new era of labor unrest, and many contractors are worried that the recovery will end before it really starts.”

Related Stories

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment