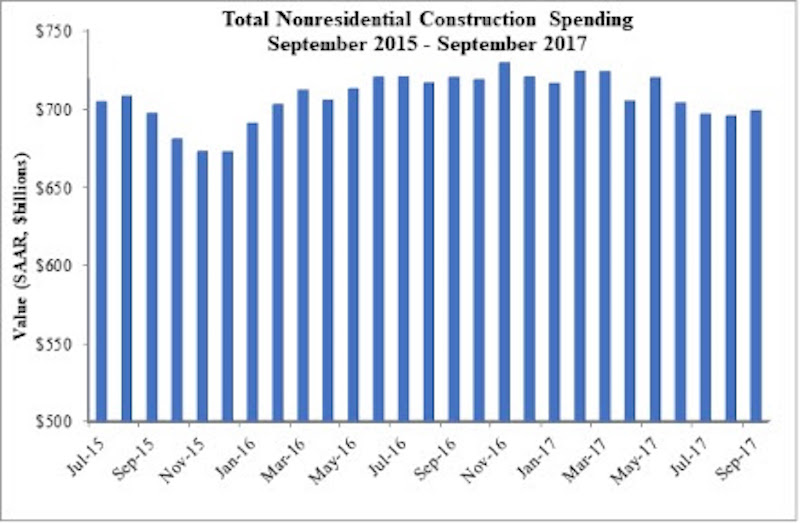

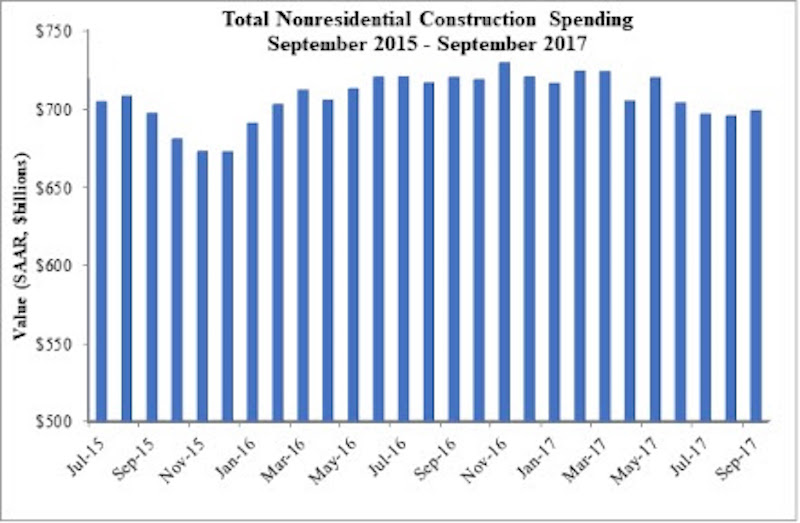

Nonresidential construction spending rose 0.5% in September, totaling $698.1 billion on a seasonally adjusted basis, according to an Associated Builders and Contractors (ABC) analysis of data from the U.S. Census Bureau. However, nonresidential construction spending is down 2.9% on a year-over-year basis, with construction spending related to manufacturing down 20.3% since September 2016. August and July nonresidential spending totals were revised upwards by a collective $11 billion, however.

“There is a lot of positive news about the U.S. economy right now,” said ABC Chief Economist Anirban Basu. “The nation has added nearly 1.8 million net new jobs over the past year, the official unemployment rate stands at a 16-year low and asset prices have skyrocketed. Those factors have given American household wealth a boost. Despite all of that, nonresidential construction spending is down on a year-over-year basis by nearly 3%.

“Much of this is due to declining public spending in water supply and other public sector categories, but not all,” said Basu. “Key private segments like manufacturing and power have also experienced diminished construction activity. A likely partial explanation is the low commodity prices that characterized much of 2015 and 2016.

“At the same time, construction firms are boosting employment levels, with many firms reporting that the retirement of experienced workers is resulting in rapid hiring of other workers who are hopefully trainable, but who are not yet as productive on a one-for-one basis,” said Basu. “For many firms, this dynamic is likely squeezing profit margins. Many firms are also offering significant pay increases to their most talented workers to enhance retention and delay retirement.

“All of this is consistent with the notion that proposed policy initiatives that would better support U.S. economic growth remain important even in the context of an improving economy,” said Basu. “Beyond the tax reform initiative currently in the spotlight, one hopes that an infrastructure-led stimulus package funded primarily by private investors receives more focus during the months to come.”

Related Stories

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.

Market Data | Mar 18, 2021

Commercial Construction Contractors’ Outlook lifts on rising revenue expectations

Concerns about finding skilled workers, material costs, and steel tariffs linger.

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.