In 2021, a record $4.5 billion were invested in Construction Technology startups, triple the amount in 2020, according Cemex Ventures. But there remains a disconnect between this outpouring for innovation and what’s actually being used in the field and back offices.

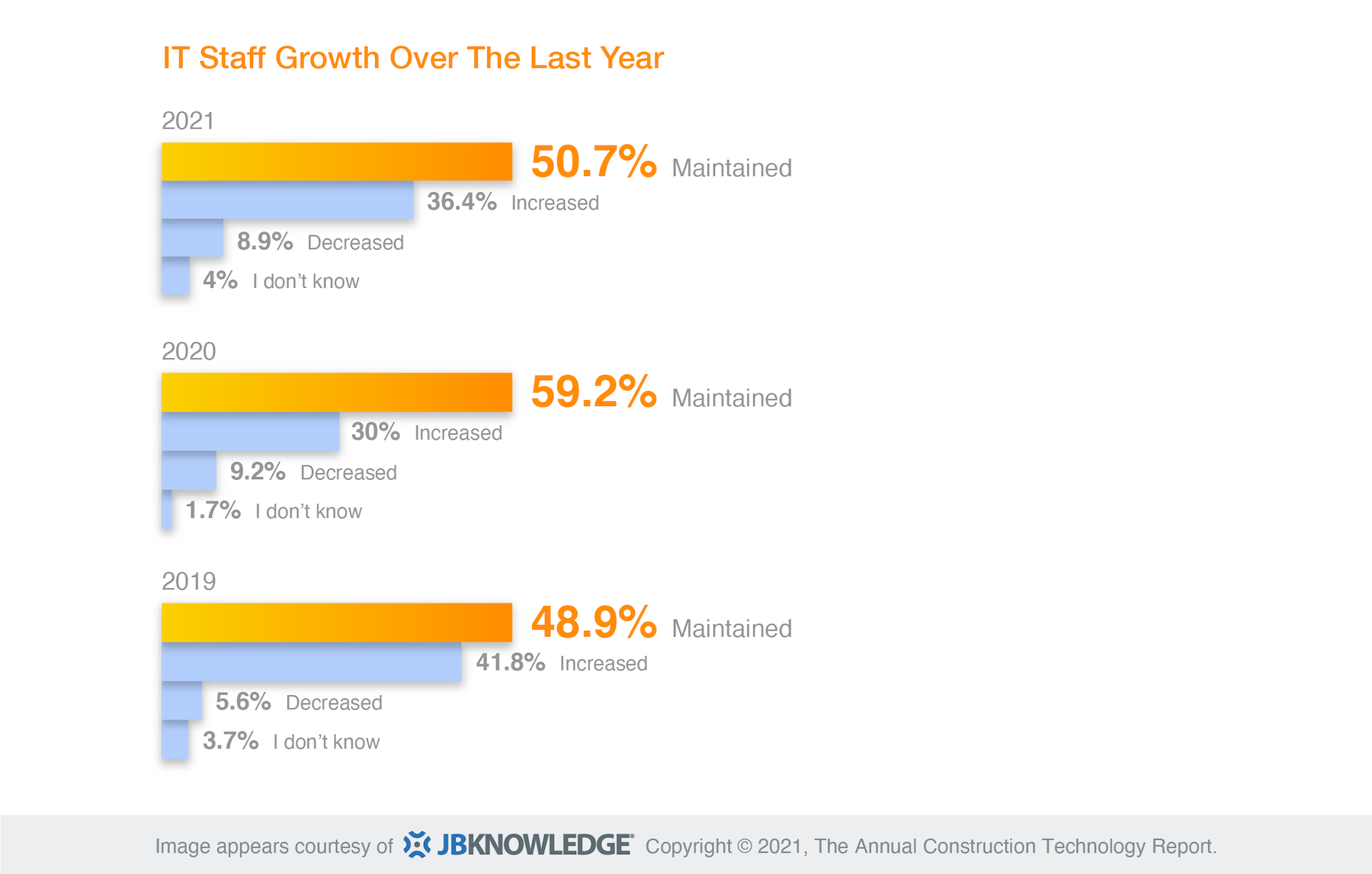

For example, less than half of contractor companies have departments dedicated to Information Technology, and even fewer don’t bill for IT expenditures. Over the past few years, construction companies have been reducing dedicated IT support and relying more on outsourcing some, if not all, of their IT functions.

Those are some of the findings that emerge from the 10th edition of JBKnowledge’s Annual Construction Technology Report, which was recently released. The report was produced in partnership with the Mechanical Contractors Association of America, the National Electrical Contractors Association, the Construction Financial Management Association, the Sheet Metal and Air Conditioning Contractors’ National Association, and the Construction Sciences Department of Texas A&M University.

JBKnowledge did not reveal the exact number of respondents to its survey except to tell BD+C that around 2,000 were from the construction industry in both field and administrative capacities. The survey was conducted in June and July 2021.

More than half of the total respondents to JBKnowleldge’s survey was between the ages of 42 and 61. Just over one-fifth (21 percent) was female, and the highest percentage of respondents (30 percent) was executives. Nearly three-quarters (73.8 percent) identified commercial building as their primary industry. While the survey received responses from 29 countries, 96.3 percent arrived from North America.

The report betrays an industry with too many companies that don’t prioritize IT. “Many construction companies fail to realize that an investment in IT will [lead to] greater profitability and increased ROI,” the report contends. “It’s no coincidence that construction companies are measuring on the lower-end of productivity as compared to other industries.”

While three-fifths of those polled say their companies have between one and five employees dedicated to IT on their payrolls, more than one-third spends less that 1 percent of annual sales on IT. “Construction spending on IT is behind the curve.”

MOBILE APP INTEGRATION A CHALLENGE

The report is not without its contradictions. Respondents were generally satisfied with the IT training and resources their companies provided them. While 43.4 percent says their companies have dedicated R&D employees, 56 percent doesn’t have dedicated R&D budgets. “The most important thing to remember about Research & Development is: If you make R&D a ‘spare time’ endeavor, you will only receive ‘spare time’ results,” the report cautions.

More than half of the respondents says their companies’ cybersecurity includes using mobile device management, two-factor authentication, and cyber liability insurance. (Twelve percent of those polled says their companies experienced a data breach in 2021, and another 6 percent answered “I don’t know” to the question about breaches.)

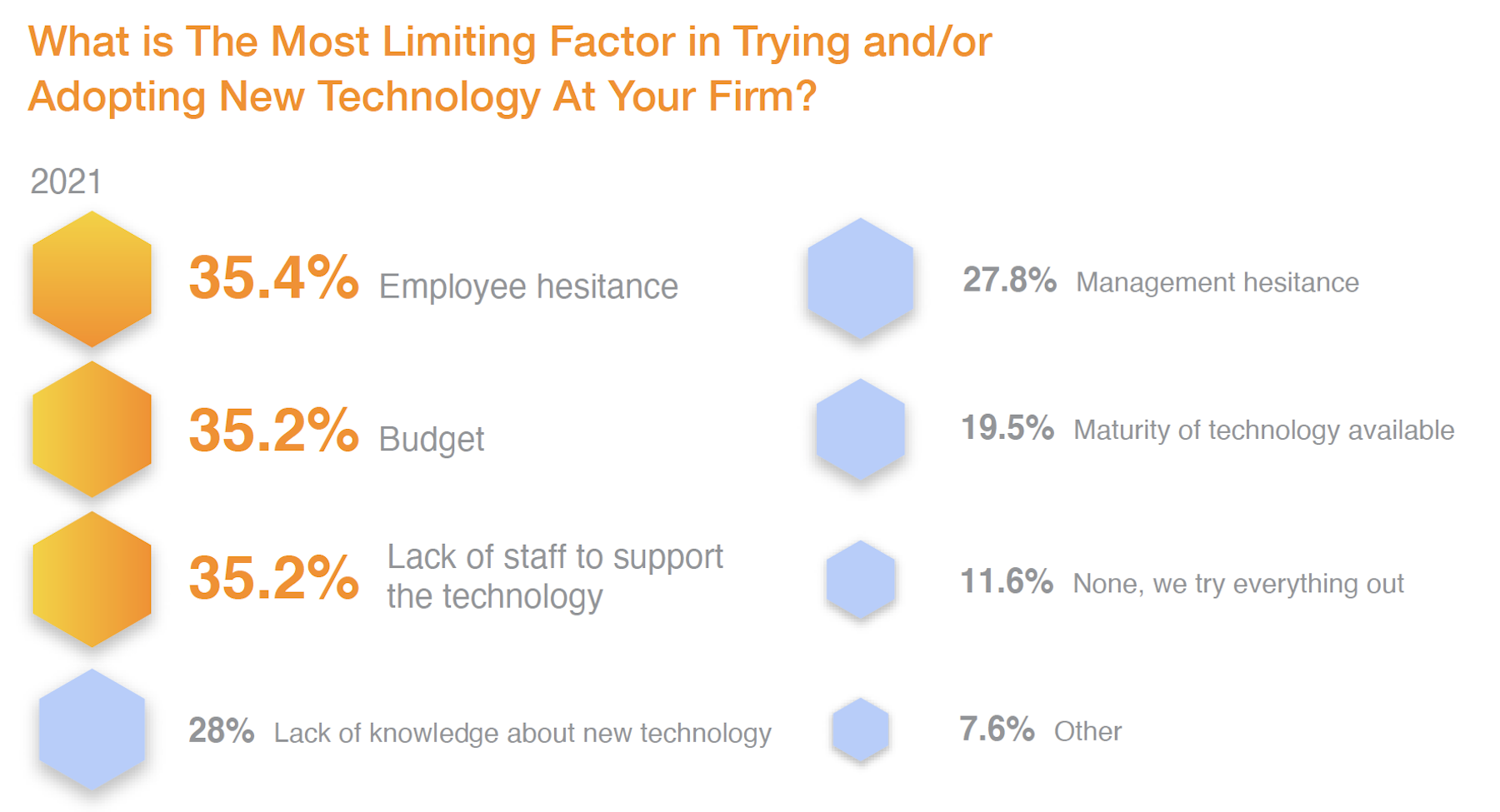

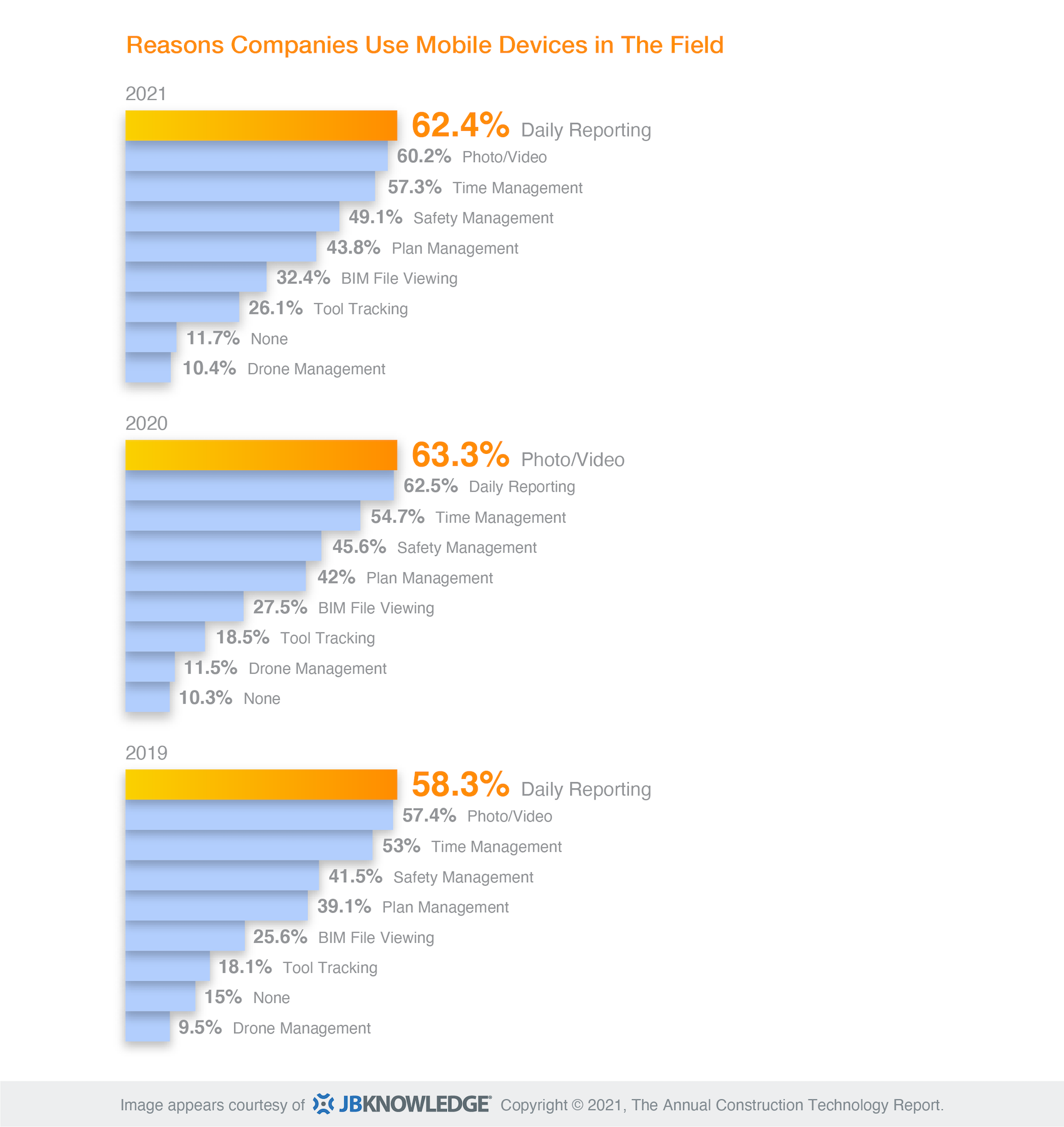

The top reason why respondents say they use mobile devices in the field is for daily reporting (62.4 percent), followed by photo/video capture (60.2 percent) and time management (57.3 percent) “Anyone who has been on the fence about whether a mobile app is necessary, the construction industry has spoken—mobile apps are key.” But technology integration remains a “big challenge” for many companies: more than half of all respondents still manually transfers data for apps without integrations. A surprising 15.3 percent of respondents doesn’t transfer data between apps at all, up from 11.8 percent in 2019.

Nearly all of those polled use smartphones for daily work purposes. But only around one-third says that their companies request that personal devices be secure and approved. (35.3 percent doesn’t use such personal devices at work.)

PREFAB A ‘COMPETITIVE ADVANTAGE’

Based on the survey’s responses, Procore is the favored app for managing plans, daily reporting, safety management, time management, and image capture; Bluebeam for viewing BIM files; DroneDeploy for controlling drones; and ToolWatch for tool tracking.

Workflows likely to rely on dedicated software include accounting/ERP (83 percent), estimating (60.7 percent), and project management (58.2 percent). However, more than three-fifths of those polled say they still use spreadsheets for estimating instead of software, and more than two-fifths use spreadsheets over software for project management.

The most popular software includes Sage for accounting/ERP (21.3 percent of respondents cited it), OnScreen Takeoff for takeoffs (37.6 percent), custom in-house software for estimating (17 percent), BuildingConnected for bid management (31.2 percent), Microsoft Project for scheduling (59.8 percent), Procore for project management (46.2 percent), and Consential for client relationship management (32.4 percent).

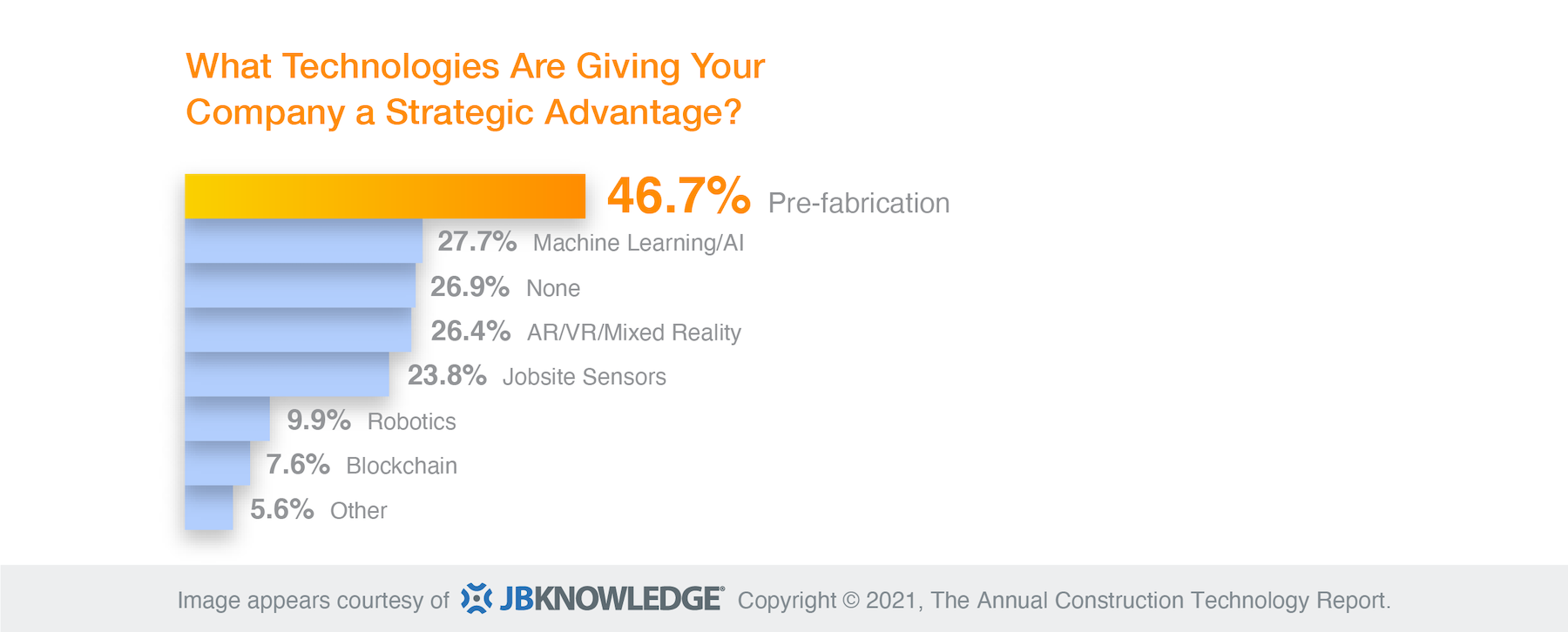

As for tech innovations, 36.6 percent of respondents says their companies use drones on jobsites (although that percentage was down from previous years). And nearly two fifths (38.6 percent) say their companies have built with prefabricated components in the previous 12 months. Nearly half of respondents sees prefab as a competitive advantage.

Conversely, a portion of contractors still isn’t sold on Building Information Modeling (BIM): 35 percent says their firms outsource it, and 27.8 percent says their firms don’t bid on projects that involve BIM or Virtual Design and Construction (VDC). “The good news is, for the first time in the past five years more respondents reported their company had a BIM department,” the report states.

Related Stories

| Jun 11, 2018

Accelerate Live! talk: ‘AEC can has Blockchains?’

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), HOK’s Greg Schleusner explores how the AEC industry could adapt the best ideas from other industries (banking, manufacturing, tech) to modernize inefficient design and construction processes.

| May 30, 2018

Accelerate Live! talk: Seven technologies that restore glory to the master builder

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), AEC technophile Rohit Arora outlines emerging innovations that are poised to transform how we design and build structures in the near future.

| May 30, 2018

Accelerate Live! talk: Why the AEC industry must adapt to the Internet of Things boom

In this 15-minute talk at BD+C’s Accelerate Live! conference (May 10, 2018, Chicago), building systems expert Jeff Carpenter explores established and emerging IoT applications for commercial and institutional buildings, and offers a technology roadmap for navigating the IoT landscape.

Sponsored | | May 24, 2018

Water treatment facility renovation benefits from laser scanning technology

BIM and Information Technology | Apr 5, 2018

Tech Report 5.0: Why wait for 3D renderings?

With emerging real-time rendering tools, project teams can design and render on the fly, for enhanced collaboration and resource savings. But the software comes with a catch.

Building Technology | Mar 1, 2018

Small construction businesses will continue to lag other sectors in tech spending this year

A survey of 800 companies found tepid interest overall in investing in “big data.”

BD+C University Course | Jan 2, 2018

The art and science of rendering: Visualization that sells architecture [AIA course]

3D artist Ramy Hanna offers guidelines and tricks-of-the-trade to ensure that project artwork is a stunning depiction of the unbuilt space.

Giants 400 | Dec 14, 2017

Top 85 BIM construction firms

Turner Construction Co., Gilbane Building Co., and The Whiting-Turner Contracting Co. top BD+C’s ranking of the nation’s largest BIM contractors and CM firms, as reported in the 2017 Giants 300 Report.

Giants 400 | Dec 14, 2017

Top 150 BIM design firms

Jacobs, Gensler, and WSP top BD+C’s ranking of the nation’s largest BIM design firms, as reported in the 2017 Giants 300 Report.