The construction industry continues to tackle the challenges of rising construction materials costs, a skilled labor shortage and overall lack of productivity improvements, offering an expansive opportunity for disruption. According to the newly released JLL research report, “The State of Construction Technology,” Silicon Valley investors are stepping in to seize that opportunity. Venture capital funds are funneling unprecedented levels of cash into Construction Technology startups’ pockets.

In the first half of 2018, venture capital firms invested $1.05 billion in global construction tech startups, setting a record high. The 2018 investment volume is already up nearly 30 percent over the 2017 total, with six months still remaining in the year. To date, the Construction Technology sector has found three Unicorns—startups valued at more than $1 billion—in Katerra, Procore and Uptake.

“The construction sector is on the verge of major disruption as tech start-ups tackle head-on the industry’s biggest pressure points,” says Todd Burns, President, Project and Development Services, JLL. “These startups can provide technology that helps deliver projects faster, cheaper and with fewer resources than ever before, effectively addressing the existing challenges in the industry.”

Emerging technology is opening a significant opportunity for venture capitalists and construction executives. JLL recognized this opportunity early, and last year brought on two Silicon Valley veterans to launch JLL Spark, a global business that identifies and delivers new technology-driven real estate service offerings, including a $100 million global venture fund.

JLL’s research uncovered three primary focus areas of construction tech startups:

1. Collaboration software. Considering that dozens of professionals can be working on a given construction project at the same time, leveraging cloud-based software to optimize the workflow could profoundly improve collaboration and impact the bottom line. Front-runners such as Procore Technologies, PlanGrid, Clarizen and Flux Factory are utilizing cloud capabilities, mobile platforms and dedicated design software to enable collaboration.

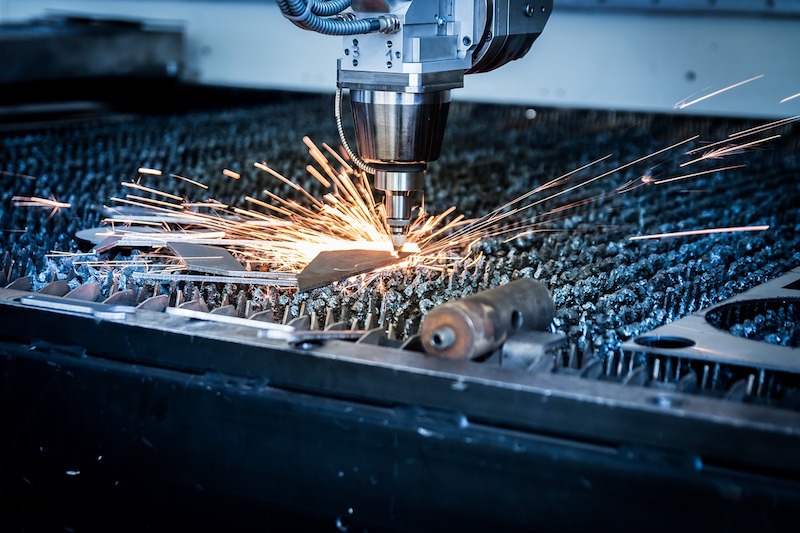

2. Offsite construction. As skilled construction labor becomes harder to find and general competition for construction inputs heats up, offsite construction startups are championing a different approach to how buildings are built: building component manufacturing. Offsite manufacturing and delivery of finalized components to the construction site equals shorter assembly time and more centralized production to help offset the labor pinch and rising costs. Industry leaders include Katerra, Blu Homes and Project Frog.

3. Big data and artificial intelligence (AI). From materials delivery to equipment maintenance, predictive data and automation tools can collect data on nearly every aspect of a construction project, resulting in data pools at risk of going to waste. Armed with big data and AI software, construction teams can make more informed business decisions to save time and money by extending the life of expensive equipment, reducing worksite risk and automating simple business processes. Top startups in this area include Uptake Technologies, Flux Factory and SmartEquip.

Since 2009, investors have closed 478 Construction Technology funding deals totaling $4.34 billion, underscoring the continued volume of construction projects and the recent urgency to innovate and offset industry costs. The huge bump in Construction Technology investment in 2018 is hopeful proof of an impending surge of technology and hardware marvels, promising to optimize the industry.

Related Stories

Building Team | Feb 19, 2019

Strategies and tools to help navigate a successful M&A

Based on Hinge’s industry research, smaller firms typically spend a higher percentage of revenue on marketing and business development efforts for the same return.

Building Team | Feb 13, 2019

3 exciting tech developments that show promise for AEC adoption

The BD+C editorial team is on a mission to track and evaluate the latest tech tools and trends that show promise for widespread AEC adoption.

Building Team | Jan 10, 2019

Skilled labor shortages continue to make off-site fabrication and construction attractive

But the AEC industry’s “culture” impedes greater acceptance, according to a recent National Institute of Building Sciences survey.

Building Team | Jan 7, 2019

2019 outlook: Firms not betting on another record-setting year

Despite the positive indicators for the market, AEC professionals remain largely cautious when it comes to growth prospects for 2019.

Building Team | Jan 4, 2019

Design-build delivery is setting new parameters for project management

FMI paper provides clues to what makes these contracts click (or not).

Building Team | Dec 11, 2018

And then there were two: HQ2 sites, in hindsight, seemed obvious

The two cities already had the greatest number of Amazon employees outside of Seattle.

Building Team | Oct 16, 2018

Dead lobby syndrome: An affliction only experience can cure

The competition for great tenants has rarely been as fierce as it is today.

Building Team | Aug 21, 2018

Five habits that are keeping your digital strategy from working

Strategies are always created with the best of intentions for improving business, the effort involved in executing the strategy – especially ones involving disruptive digital capabilities – is greatly underestimated.

Building Team | Aug 17, 2018

Silicon Valley is here. Get over it.

AEC firms continue to have angst about a tech-industry takeover of the market. One expert’s advice: “Embrace technology. Do not fear. You can shape it.”