The construction industry continues to tackle the challenges of rising construction materials costs, a skilled labor shortage and overall lack of productivity improvements, offering an expansive opportunity for disruption. According to the newly released JLL research report, “The State of Construction Technology,” Silicon Valley investors are stepping in to seize that opportunity. Venture capital funds are funneling unprecedented levels of cash into Construction Technology startups’ pockets.

In the first half of 2018, venture capital firms invested $1.05 billion in global construction tech startups, setting a record high. The 2018 investment volume is already up nearly 30 percent over the 2017 total, with six months still remaining in the year. To date, the Construction Technology sector has found three Unicorns—startups valued at more than $1 billion—in Katerra, Procore and Uptake.

“The construction sector is on the verge of major disruption as tech start-ups tackle head-on the industry’s biggest pressure points,” says Todd Burns, President, Project and Development Services, JLL. “These startups can provide technology that helps deliver projects faster, cheaper and with fewer resources than ever before, effectively addressing the existing challenges in the industry.”

Emerging technology is opening a significant opportunity for venture capitalists and construction executives. JLL recognized this opportunity early, and last year brought on two Silicon Valley veterans to launch JLL Spark, a global business that identifies and delivers new technology-driven real estate service offerings, including a $100 million global venture fund.

JLL’s research uncovered three primary focus areas of construction tech startups:

1. Collaboration software. Considering that dozens of professionals can be working on a given construction project at the same time, leveraging cloud-based software to optimize the workflow could profoundly improve collaboration and impact the bottom line. Front-runners such as Procore Technologies, PlanGrid, Clarizen and Flux Factory are utilizing cloud capabilities, mobile platforms and dedicated design software to enable collaboration.

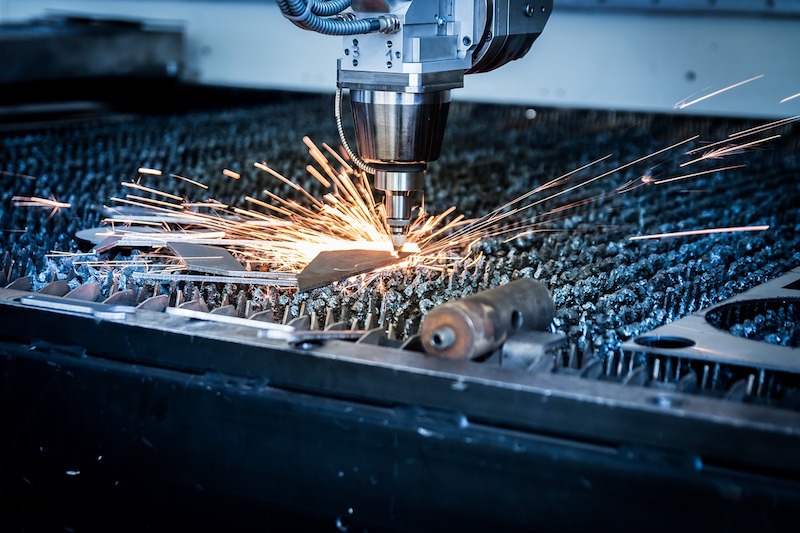

2. Offsite construction. As skilled construction labor becomes harder to find and general competition for construction inputs heats up, offsite construction startups are championing a different approach to how buildings are built: building component manufacturing. Offsite manufacturing and delivery of finalized components to the construction site equals shorter assembly time and more centralized production to help offset the labor pinch and rising costs. Industry leaders include Katerra, Blu Homes and Project Frog.

3. Big data and artificial intelligence (AI). From materials delivery to equipment maintenance, predictive data and automation tools can collect data on nearly every aspect of a construction project, resulting in data pools at risk of going to waste. Armed with big data and AI software, construction teams can make more informed business decisions to save time and money by extending the life of expensive equipment, reducing worksite risk and automating simple business processes. Top startups in this area include Uptake Technologies, Flux Factory and SmartEquip.

Since 2009, investors have closed 478 Construction Technology funding deals totaling $4.34 billion, underscoring the continued volume of construction projects and the recent urgency to innovate and offset industry costs. The huge bump in Construction Technology investment in 2018 is hopeful proof of an impending surge of technology and hardware marvels, promising to optimize the industry.

Related Stories

Sponsored | BD+C University Course | Apr 1, 2022

Video surveillance systems for multifamily housing projects

This introductory course provides detailed technical information and advice from security expert Michael Silva, CPP, on designing a video surveillance system for multifamily housing communities – apartments, condominiums, townhouses, or senior living communities. Technical advice on choosing the right type of cameras and optimizing the exterior lighting for their use is offered.

K-12 Schools | Apr 1, 2022

Charleston County’s award-winning career and technical education high school

BD+C Executive Editor Rob Cassidy talks with the team behind the award-winning Cooper River Center for Advanced Studies, a Career|Technical Education high school in Charleston County, S.C.

Modular Building | Mar 31, 2022

Rick Murdock’s dream multifamily housing factory

Modular housing leader Rick Murdock had a vision: Why not use robotic systems to automate the production of affordable modular housing? Now that vision is a reality.

Contractors | Mar 28, 2022

Amid supply chain woes, building teams employ extreme procurement measures

Project teams are looking to eliminate much of the guesswork around product availability and price inflation by employing early bulk-purchasing measures for entire building projects.

Contractors | Mar 23, 2022

Hiring Construction Workers in a Frantic Post-Covid Job Market

McCarthy Building Companies' Director of Talent Acquisition, Ben Craigs, discusses the construction giant's recruitment and training strategies in a hyper-competitive market. Craigs sits down with BD+C Senior Editor John Caulfield.

Sponsored | BD+C University Course | Jan 30, 2022

Optimized steel deck design

This course provides an overview of structural steel deck design and the ways to improve building performance and to reduce total-project costs.

Urban Planning | Jan 25, 2022

Retooling innovation districts for medium-sized cities

This type of development isn’t just about innovation or lab space; and it’s not just universities or research institutions that are driving this change.

Sponsored | Resiliency | Jan 24, 2022

Norshield Products Fortify Critical NYC Infrastructure

New York City has two very large buildings dedicated to answering the 911 calls of its five boroughs. With more than 11 million emergency calls annually, it makes perfect sense. The second of these buildings, the Public Safety Answering Center II (PSAC II) is located on a nine-acre parcel of land in the Bronx. It’s an imposing 450,000 square-foot structure—a 240-foot-wide by 240-foot-tall cube. The gleaming aluminum cube risesthe equivalent of 24 stories from behind a grassy berm, projecting the unlikely impression that it might actually be floating. Like most visually striking structures, the building has drawn as much scorn as it has admiration.

Engineers | Jan 12, 2022

Private equity: An increasingly attractive alternative for AEC firm sellers

Private equity firms active in the AEC sector work quietly in the background to partner with management, hold for longer periods, and build a win-win for investors and the firm. At a minimum, AEC firms contemplating ownership transition should consider private equity as a viable option. Here is why.

Sponsored | BD+C University Course | Jan 12, 2022

Total steel project performance

This instructor-led video course discusses actual project scenarios where collaborative steel joist and deck design have reduced total-project costs. In an era when incomplete structural drawings are a growing concern for our industry, the course reveals hidden costs and risks that can be avoided.