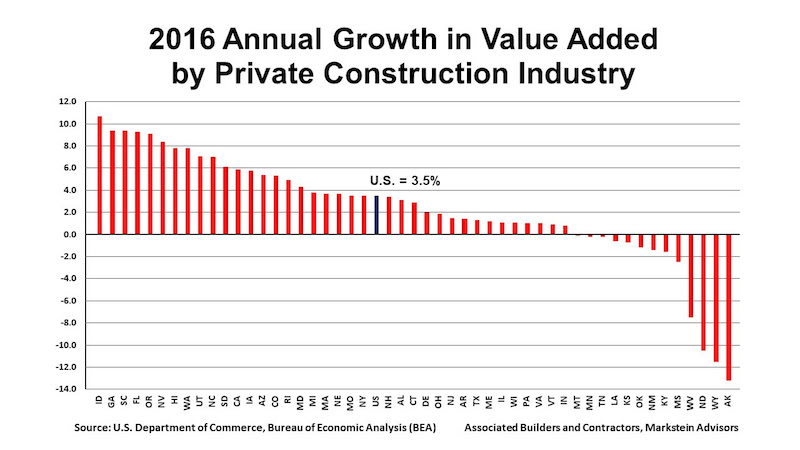

According to a report released today by Associated Builders and Contractors (ABC), the private construction industry’s value added as a percentage of the nation’s real gross domestic product (GDP) rose to 4 in 2016, the highest level since 2009. The report also shows annual growth in real construction spending, which rose 3.5% in 2016. Thirty-seven states benefited from the rise in construction activity in their state, while 13 states experienced a reduction in activity.

“Although the relative impact of the value added by private construction on various state economies varies both among states in a particular year and within a state over time, every state benefits from construction activity,” said Bernard M. Markstein, Ph.D., president and chief economist of Markstein Advisors, who conducted the analysis and prepared the report for ABC. “The increase in that activity in a particular year adds to the income and potential growth of each state. A decline in that activity acts as a drag on a state’s economic performance.”

The 3.5% national increase in real construction spending was a slowdown from the 4.9% increase in 2015. Only 18 states had a greater growth in real construction spending in 2016 compared to 2015.

2016 CONSTRUCTION SPENDING: THE TOP FIVE STATES

The fastest growth was in the West and the South. The first state outside of those two regions in the ranking of construction growth rates is Rhode Island with the 16th largest increase (up 4.9%). In 2016, the top five states for the increase in their real value added from construction in order from highest to lowest were:

1. Idaho, up 10.7%

2. Georgia and South Carolina (tie), up 9.4%

4. Florida, up 9.3%

5. Oregon, up 9.1%

Idaho had the highest percentage contribution from construction, even though state real GDP advanced a respectable, but more modest, 1.8%. Georgia slipped from its number-one ranking in 2015, while South Carolina made a significant jump from 17th to second place.

Florida’s ranking of number four is down from second place in 2015 when its real construction spending was 11.1%. Oregon saw a big improvement from 33rd place in 2015.

2016 CONSTRUCTION SPENDING: THE BOTTOM FIVE STATES

All of the bottom five states suffered from the effects of low energy prices.

46. Mississippi, down 2.5%

47. West Virginia, down 7.5%

48. North Dakota, down 10.5%

49. Wyoming, down 11.5%

50. Alaska, down 13.2%

Alaska has struggled over the last few years. Not only did it experience the largest drop in real private construction spending in 2016, but it also experienced the second largest decrease in state GDP in the nation, down 5%. Real private construction spending has been down every year starting in 2011, except for 2015 (up 0.2%).

Although Wyoming improved its 2016 ranking—it had the largest decrease in 2015 at 6.6%—the 11.5% plunge was an acceleration of a bad outcome. North Dakota had the third largest decline in its real private construction spending in 2016 and 2015, down 10.5% and 4.1%, respectively. However, the state’s growth in construction spending ranked in the top 10 from 2008 through 2014.

West Virginia had the fourth largest decline in its real private construction spending in 2016 and 2015, down 7.5% and 3.1%, respectively. Mississippi’s 2016 decrease represents a slowdown in the decline in construction from 2014 and 2015, when private construction activity fell 8.6% and 5.6%, respectively.

Read the full report here.

Related Stories

MFPRO+ Research | Oct 15, 2024

Multifamily rents drop in September 2024

The average multifamily rent fell by $3 in September to $1,750, while year-over-year growth was unchanged at 0.9 percent.

Contractors | Oct 1, 2024

Nonresidential construction spending rises slightly in August 2024

National nonresidential construction spending increased 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.22 trillion.

The Changing Built Environment | Sep 23, 2024

Half-century real estate data shows top cities for multifamily housing, self-storage, and more

Research platform StorageCafe has conducted an analysis of U.S. real estate activity from 1980 to 2023, focusing on six major sectors: single-family, multifamily, industrial, office, retail, and self-storage.

Student Housing | Sep 17, 2024

Student housing market stays strong in summer 2024

As the summer season winds down, student housing performance remains strong. Preleasing for Yardi 200 schools rose to 89.2% in July 2024, falling just slightly behind the same period last year.

MFPRO+ Research | Sep 11, 2024

Multifamily rents fall for first time in 6 months

Ending its six-month streak of growth, the average advertised multifamily rent fell by $1 in August 2024 to $1,741.

Contractors | Sep 10, 2024

The average U.S. contractor has 8.2 months worth of construction work in the pipeline, as of August 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 8.2 months in August, according to an ABC member survey conducted Aug. 20 to Sept. 5. The reading is down 1.0 months from August 2023.

Construction Costs | Sep 2, 2024

Construction material decreases level out, but some increases are expected to continue for the balance Q3 2024

The Q3 2024 Quarterly Construction Insights Report from Gordian examines the numerous variables that influence material pricing, including geography, global events and commodity volatility. Gordian and subject matter experts examine fluctuations in costs, their likely causes, and offer predictions about where pricing is likely to go from here. Here is a sampling of the report’s contents.

Contractors | Aug 21, 2024

The average U.S. contractor has 8.4 months worth of construction work in the pipeline, as of July 2024

Associated Builders and Contractors reported today that its Construction Backlog Indicator held steady at 8.4 months in July, according to an ABC member survey conducted July 22 to Aug. 6. The reading is down 0.9 months from July 2023.

MFPRO+ Research | Aug 9, 2024

Apartment completions to surpass 500,000 for first time ever

While the U.S. continues to maintain a steady pace of delivering new apartments, this year will be one for the record books.

Contractors | Aug 1, 2024

Nonresidential construction spending decreased 0.2% in June

National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.21 trillion. Nonresidential construction has expanded 5.3% from a year ago.