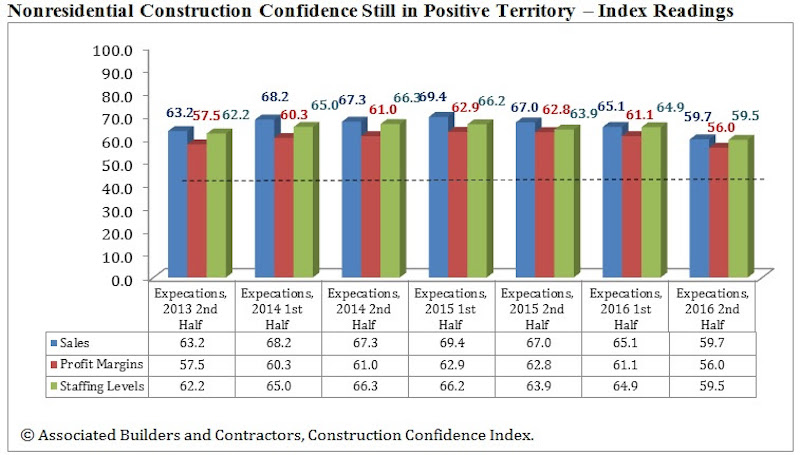

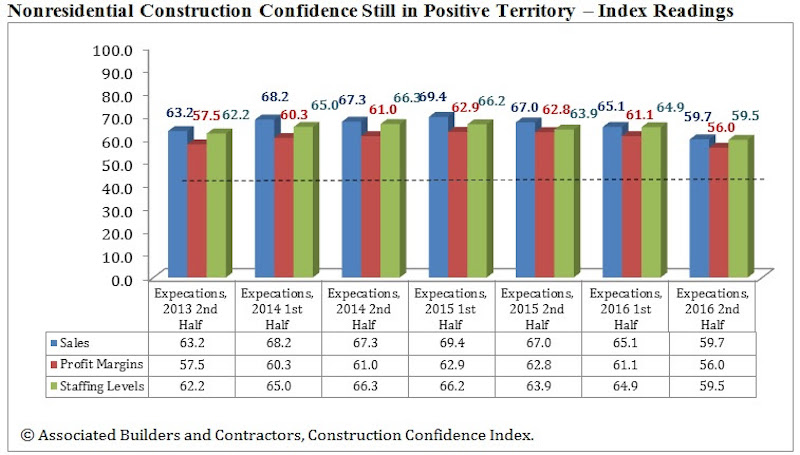

Expectations for 2017 have become less optimistic, but the majority of industrial and commercial construction contractors still expect growth this year, according to the latest Associated Builders and Contractors (ABC) Construction Confidence Index (CCI). Although all three diffusion indices in the survey — profit margins, sales and staffing levels—fell by more than five points, they remain well above the threshold of 50, which signals that construction activity will continue to be one of the few significant drivers of economic growth.

The latest survey revealed that:

- The CCI for sales expectations fell from 65.1 to 59.7;

- The CCI for profit margin expectations fell from 61.1 to 56;

- The CCI for staffing levels fell from 64.9 to 59.5.

“There may be a period during which the pro-business agenda being forwarded in Washington, D.C., will significantly impact construction firm expectations,” says ABC Chief Economist Anirban Basu in a release. “In fact, many construction executives have become more confident, including those who would stand to benefit most directly from an infrastructure package. However, there is a realization among construction firms that, if implemented, many of these pro-business initiatives would begin impacting the economy beyond the six-month timeframe built into ABC’s construction confidence survey.

“Despite an ongoing dearth of public construction spending growth, certain construction segments have experienced significant expansion over time, including office, hotel, healthcare and multifamily segments,” says Basu. “This helps explain why more than 60% of respondents expect their sales to rise during early 2017 and the same number expect staffing levels to rise.

“Respondents from Florida and other rapidly growing states are reporting significant shortages of appropriately skilled workers, which is helping to drive compensation costs higher,” says Basu. “This helps explain why fewer than half (48%) of respondents now expect profit margins to climb. That is down from 54% from the previous CCI, supporting the proposition that the construction skills shortfall has worsened over the past six months.

“For now, confidence appears to be supported less by policymaking than by the ongoing momentum of the U.S. construction industry,” says Basu. “Going forward, confidence is likely to depend more intensely on the new administration’s capacity to move its pro-business agenda from theory to practice.”

The following chart reflects the distribution of responses to ABC’s most recent surveys.

Related Stories

Market Data | Jun 12, 2019

Construction input prices see slight increase in May

Among the 11 subcategories, six saw prices fall last month, with the largest decreases in natural gas.

Market Data | Jun 3, 2019

Nonresidential construction spending up 6.4% year over year in April

Among the 16 sectors tracked by the U.S. Census Bureau, nine experienced an increase in monthly spending, led by water supply and highway and street.

Market Data | Jun 3, 2019

4.1% annual growth in office asking rents above five-year compound annual growth rate

Market has experienced no change in office vacancy rates in three quarters.

Market Data | May 30, 2019

Construction employment increases in 250 out of 358 metros from April 2018 to April 2019

Demand for work is outpacing the supply of workers.

Market Data | May 24, 2019

Construction contractors confidence remains high in March

More than 70% of contractors expect to increase staffing levels over the next six months.

Market Data | May 22, 2019

Slight rebound for architecture billings in April

AIA’s ABI score for April showed a small increase in design services at 50.5 in April.

Market Data | May 9, 2019

The U.S. hotel construction pipeline continues to grow in the first quarter as the economy shows surprising strength

Projects currently under construction stand at 1,709 projects/227,924 rooms.

Market Data | May 9, 2019

Construction input prices continue to rise

Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Market Data | May 7, 2019

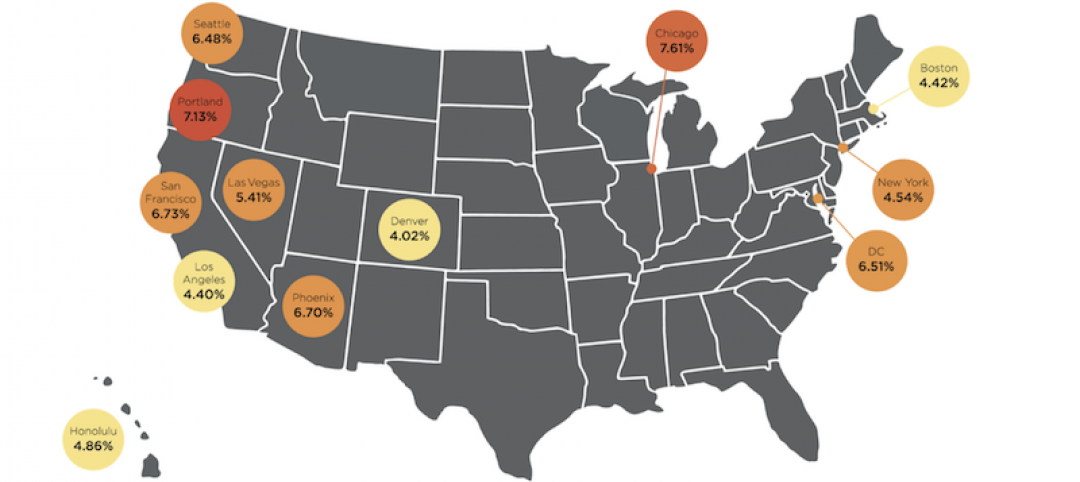

Construction costs in major metros continued to climb last year

Latest Rider Levett Bucknall report estimates rise at more than double the rate of 2018 Growth Domestic Product.

Market Data | Apr 29, 2019

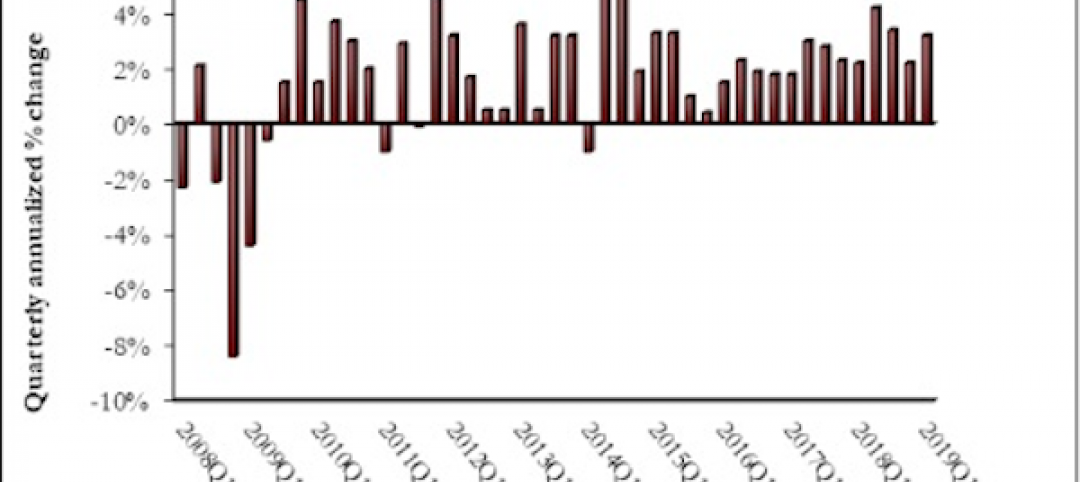

U.S. economic growth crosses 3% threshold to begin the year

Growth was fueled by myriad factors, including personal consumption expenditures, private inventory investment, surprisingly rapid growth in exports, state and local government spending and intellectual property.