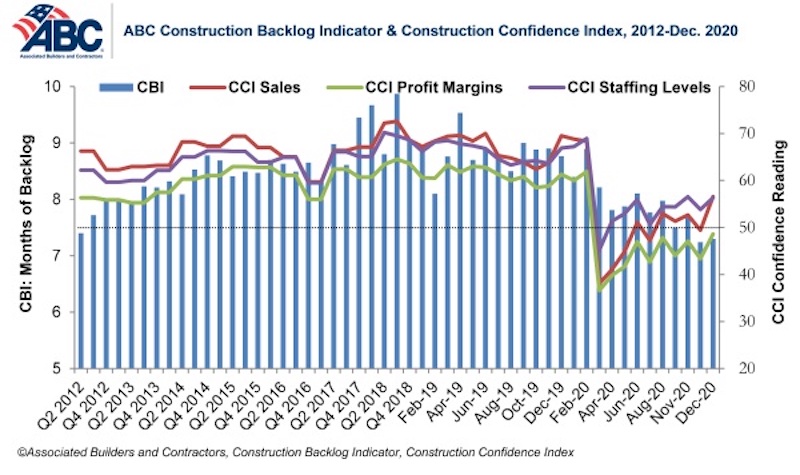

Associated Builders and Contractors reported today that its Construction Backlog Indicator rebounded modestly to 7.3 months in December, an increase of 0.1 months from November’s reading, according to an ABC member survey conducted from Dec. 18 to Jan. 5. Backlog is 1.5 months lower than in December 2019.

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December. The sales index climbed above the threshold of 50, indicating contractors expect to grow sales over the next six months. The index reading for profit margins remained below that threshold. The staffing level index increased to 56.3 but remains well below its December 2019 reading.

“While many contractors enter 2021 with significant trepidation, the most recent backlog and confidence readings suggest that the onset of vaccinations has generally led to more upbeat assessments regarding nonresidential construction’s future,” said ABC Chief Economist Anirban Basu. “Backlog is down substantially from its year-ago level and profit margins remain under pressure, yet many contractors expect to enjoy higher sales and to support more staff six months from now.

“The baseline expectation is that by the spring, the U.S. economy will blossom,” said Basu. “With many households sitting on mounds of savings and sustaining pent-up demand for many goods and services, the U.S. economy is set for rapid growth as it reopens more fully during mid to late 2021. While it will take time for that to fully translate into new construction projects, some that were postponed earlier during the pandemic are likely to come back to life over the next several months. That should help many contractors begin to rebuild backlog, and to eagerly await 2022.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.

Market Data | Dec 17, 2021

Construction jobs exceed pre-pandemic level in 18 states and D.C.

Firms struggle to find qualified workers to keep up with demand.

Market Data | Dec 15, 2021

Widespread steep increases in materials costs in November outrun prices for construction projects

Construction officials say efforts to address supply chain challenges have been insufficient.

Market Data | Dec 15, 2021

Demand for design services continues to grow

Changing conditions could be on the horizon.

Market Data | Dec 5, 2021

Construction adds 31,000 jobs in November

Gains were in all segments, but the industry will need even more workers as demand accelerates.

Market Data | Dec 5, 2021

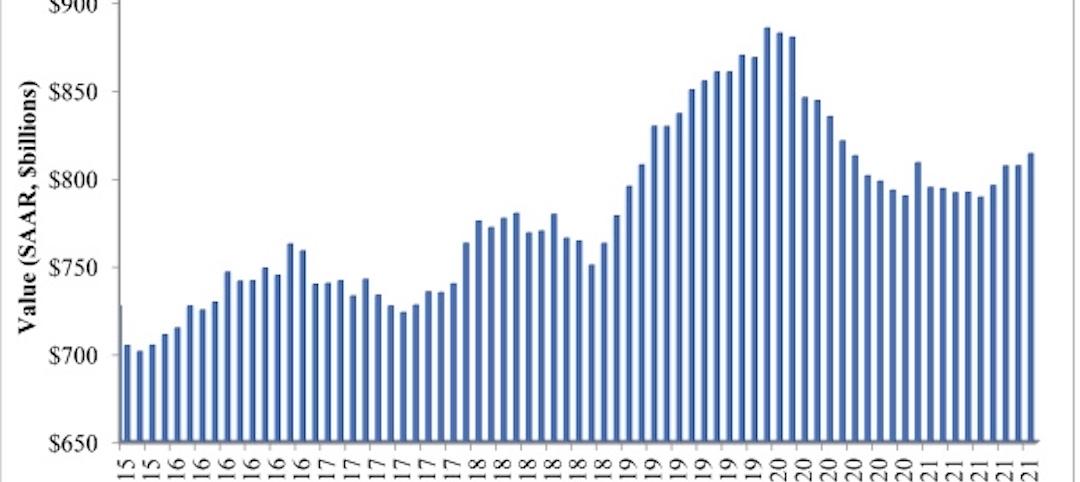

Construction spending rebounds in October

Growth in most public and private nonresidential types is offsetting the decline in residential work.

Market Data | Dec 5, 2021

Nonresidential construction spending increases nearly 1% in October

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories.

Market Data | Nov 30, 2021

Two-thirds of metro areas add construction jobs from October 2020 to October 2021

The pandemic and supply chain woes may limit gains.