In a recent survey, nearly 900 construction firms reported gains in profitability last year, especially among the top 25% whose financial performances significantly outpaced the respondents as a whole.

The Construction Financial Management Association (CFMA), headquartered in Princeton, N.J., emailed its annual questionnaire to about 8,000 member and nonmember construction firms, as well as member CPA firms that represent construction companies. CFMA received data from 869 companies, which submitted detailed financial statements and other required information.

Thirty-seven percent of the respondents were Industrial & Nonresidential contractors, 19% Heavy & Highway contractors, 43% Specialty Trade contractors, and less than 1% classified as “Other.” The typical company reported total annual sales of $39,710,000 for the 2015 fiscal year. Those with sales under $10 million comprised 16% of responding companies, and 8% of respondents reported sales of over $300 million.

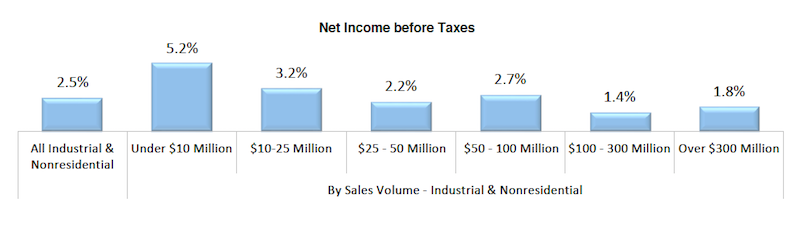

Smaller contracting companies showed stronger earnings last year. Chart: Construction Financial Management Association.

On average, the respondents’ returns on assets and equity rose last year. Returns on Assets was 9%, versus 6.9% in 2014. Returns on equity jumped to 25.3% in 2015, from 19% the previous year.

On the whole, getting paid for services rendered remains a struggle. The respondents’ invoices were in accounts receivable for an average of 55.2 days last year, an increase over the previous two years. As for their accounts payable, the contractors reported a decline to 33.4 days last year, from 35.6 days in 2014.

Gross profits as a percentage of revenue increased to 15%, from 13.1% in 2014. And net income last year stood a 4.4% of sales, versus 3.1% the previous year.

CFMA broke out the financial data by sales volume, and found that companies generating under $10 million in revenue generally had higher profitability ratios than other cohorts. Perhaps coincidentally, the smaller companies had lower debt-to-equity ratios, and significantly lower “underbillings-to-equity” ratios (4.4%, compared to 15.6% for companies with $300 million or more in annual revenue).

Conversely, the largest companies by revenue were more productive, reporting sales per employee of $751,348 ($276,000 more per employee than companies with between $100 million and $300 million in sales, and even higher compared to the other groups), and gross profit per employee of $71,851.

The top-performing contractors—based on a composite ranking of five performance metrics (ROA, ROE, debt to equity, fixed-asset ratios, and gross profit per employee)—were head and shoulders above respondent averages.

The highest achievers reported a 24% Return on Assets and 58.5% Return on Equity, substantively higher on both counts than the survey’s averages noted above.

Best in Class companies also reported less debt (1.2 times debt-to-equity versus 1.8 times for all respondents) and a more stable fixed asset ratio (16.6% versus 25.1% for all respondents). All respondents averaged a 15% gross profit margin, while the Best in Class companies achieved an 18.4% margin. Further, all respondents earned a 4.4% net income before taxes, compared with the highest achievers, which averaged 8.4% margin.

The CFMA survey was compiled and analyzed by Industry Insights and the organization’s Financial Survey & Benchmarker Committee. It did not provide explanations about why some contractors performed better than others.

Related Stories

Multifamily Housing | Jun 15, 2023

Alliance of Pittsburgh building owners slashes carbon emissions by 45%

The Pittsburgh 2030 District, an alliance of property owners in the Pittsburgh area, says that it has reduced carbon emissions by 44.8% below baseline. Begun in 2012 under the guidance of the Green Building Alliance (GBA), the Pittsburgh 2030 District encompasses more than 86 million sf of space within 556 buildings.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Engineers | Jun 14, 2023

The high cost of low maintenance

Walter P Moore’s Javier Balma, PhD, PE, SE, and Webb Wright, PE, identify the primary causes of engineering failures, define proactive versus reactive maintenance, recognize the reasons for deferred maintenance, and identify the financial and safety risks related to deferred maintenance.

University Buildings | Jun 14, 2023

Calif. State University’s new ‘library-plus’ building bridges upper and lower campuses

A three-story “library-plus” building at California State University, East Bay (CSUEB) that ties together the upper and lower campuses was recently completed. The 100,977-sf facility, known as the Collaborative Opportunities for Research & Engagement (“CORE”) Building, is one of the busiest libraries in the CSU system. The previous library served 1.2 million visitors annually.

Resiliency | Jun 14, 2023

HUD offers $4.8 billion in funding for green and resilient building retrofit projects

The Department of Housing and Urban Development (HUD) recently released guidelines for its Green and Resilient Retrofit Program (GRRP) that has $4.8 billion for funding green projects.

Arenas | Jun 14, 2023

A multipurpose arena helps revitalize a historic African American community in Georgia

In Savannah, Ga., Enmarket Arena, a multipurpose arena that opened last year, has helped revitalize the city’s historic Canal District—home to a largely African American community that has been historically separated from the rest of downtown.

Building Materials | Jun 14, 2023

Construction input prices fall 0.6% in May 2023

Construction input prices fell 0.6% in May compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices declined 0.5% for the month.

Contractors | Jun 13, 2023

The average U.S. contractor has 8.9 months worth of construction work in the pipeline, as of May 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator remained unchanged at 8.9 months in May, according to an ABC member survey conducted May 20 to June 7. The reading is 0.1 months lower than in May 2022. Backlog in the infrastructure category ticked up again and has now returned to May 2022 levels. On a regional basis, backlog increased in every region but the Northeast.

Mass Timber | Jun 13, 2023

Mass timber construction featured in two-story mixed-use art gallery and wine bar in Silicon Valley

The Edes Building, a two-story art gallery and wine bar in the Silicon Valley community of Morgan Hill, will prominently feature mass timber. Cross-laminated timber (CLT) and glulam posts and beams were specified for aesthetics, biophilic properties, and a reduced carbon footprint compared to concrete and steel alternatives.

Industry Research | Jun 13, 2023

Two new surveys track how the construction industry, in the U.S. and globally, is navigating market disruption and volatility

The surveys, conducted by XYZ Reality and KPMG International, found greater willingness to embrace technology, workplace diversity, and ESG precepts.