In the recent U.S. Construction Pipeline Trend Report released by Lodging Econometrics (LE), at the close of the fourth quarter of 2021, Dallas leads the U.S. markets in the number of pipeline projects with 152 projects/18,180 rooms. Following Dallas, the U.S. markets with the largest total hotel construction pipelines by project count are Atlanta, at a cyclical high, with 133 projects/17,593 rooms; New York City with 121 projects/19,303 rooms; Los Angeles with 120 projects/19,815 rooms; and Houston, with 91 projects/9,912 rooms.

Despite the impact COVID-19 has had on hotel development, three markets in the U.S. announced more than 10 new construction projects in Q4‘21. Miami had the highest number of new projects announced into the pipeline with 17 projects/2,797 rooms. Following Miami is Dallas with 13 projects/1,308 rooms, and then Orlando with 11 projects/1,791 rooms.

The market with the greatest number of projects already in the ground, at the end of the fourth quarter, is New York with 90 projects/14,513 rooms. Following distantly are Dallas with 28 projects/3,945 rooms, Austin with 28 projects/3,706 rooms, Atlanta with 26 projects/4,120 rooms, and Detroit with 23 projects under construction, accounting for 2,432 rooms. These five markets collectively account for 20% of the total number of projects currently under construction in the U.S.

Dallas has the most projects scheduled to start in the next 12 months, with 51 projects/5,989 rooms. Behind Dallas are Atlanta with 51 projects/5,989 rooms; Houston, with 42 projects/4,107 rooms; Los Angeles with 41 projects/6,278 rooms; and Phoenix with 38 projects/4,401 rooms. Dallas also has the largest number of projects in early planning, at the end of Q4’21, with 73 projects/8,246 rooms. Los Angeles follows with 57 projects/9,907 rooms; Atlanta 56 projects/6,561 rooms; Orlando 45 projects/7,896 rooms; and Nashville 38 projects/4,680 rooms.

The top 50 markets saw 449 hotels/63,742 rooms open in 2021. LE is forecasting these same 50 markets to open another 446 projects/57,837 rooms in 2022 for a 2.2% growth rate, and 421 projects/52,460 rooms in 2023 for a growth rate of 1.9%.

Moving into the New Year, an important metric to monitor will be markets with large construction pipelines as compared to their existing census of open & operating hotels. These markets are likely to see the fastest supply growth and largest supply-demand variances over the next few years. At the end of 2021, there were 17 markets with total pipelines in excess of 15% of their current census. Raleigh-Durham tops this list at 24.1%, followed by Miami, Fort Worth-Arlington, Austin, and then Memphis at 22.1%.

The markets topping the forecast for new hotel openings in 2022 will be New York City with 48 new hotels/6,656 rooms for a 5.4% growth rate, Atlanta with 22 projects/2,398 rooms for a 2.1% growth rate, Dallas with 21 projects/2,522 rooms for a 2.4% growth rate, and Austin with 20 projects/2,722 rooms for a 5.9% growth rate. LE expects a 2.1% average growth rate for the top 25 markets in 2022 and, come 2023, these top 25 markets will experience an average growth rate of 1.9%. New York will again top the charts in 2023 for new hotel openings. LE anticipates New York will open 42 new hotels, accounting for 7,058 rooms, again for a 5.4% growth rate, followed by Atlanta 21 projects/3,664 rooms for a 3.2% growth rate, and Dallas with 21 new opens/2,318 rooms for a growth rate of 2.2%.

Related Stories

Market Data | Oct 5, 2020

Construction spending rises 1.4% in August as residential boom outweighs private nonresidential decline and flat public categories

Construction officials caution that demand for non-residential construction will continue to stagnate without new federal coronavirus recovery measures, including infrastructure and liability reform.

Market Data | Oct 5, 2020

7 must reads for the AEC industry today: October 5, 2020

Zaha Hadid unveils 2 Murray Road and the AEC industry is weathering COVID-19 better than most.

Market Data | Oct 2, 2020

AEC industry is weathering COVID-19 better than most

Nearly one-third of firms have had layoffs, more than 90% have experienced project delays.

Market Data | Oct 2, 2020

6 must reads for the AEC industry today: October 2, 2020

BIG imagines how to live on the moon and smart buildings stand on good data.

Market Data | Oct 1, 2020

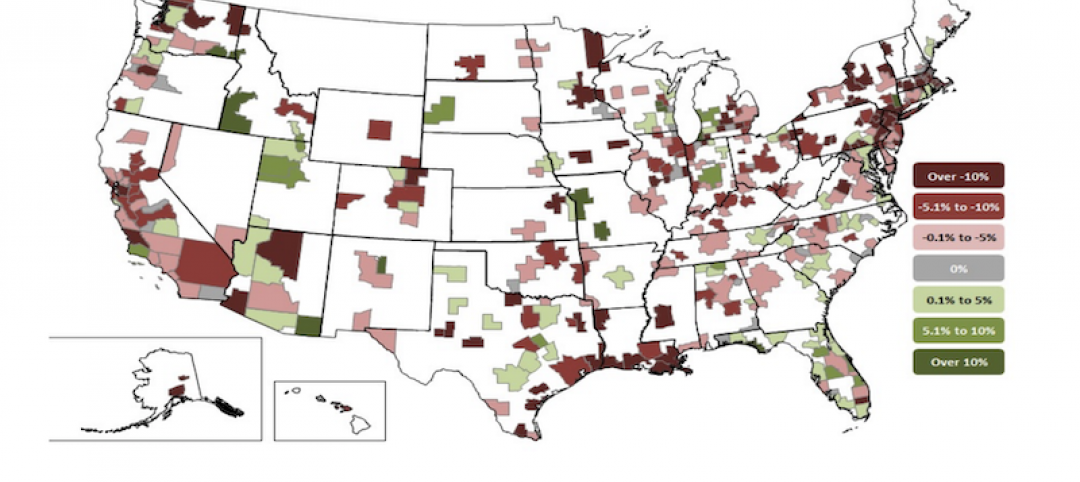

Two-thirds of metros shed construction jobs from August 2019 to August 2020

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 12-month losses, while Indianapolis-Carmel-Anderson, Ind. and Niles-Benton Harbor, Mich. top job gainers.

Market Data | Oct 1, 2020

6 must reads for the AEC industry today: October 1, 2020

David Adjaye to receive 2021 Royal Gold Medal for Architecture and SOM reimagines the former Cook County Hospital.

Market Data | Sep 30, 2020

6 must reads for the AEC industry today: September 30, 2020

Heatherwick Studio designs The Cove for San Francisco and Washington, D.C.'s first modular apartment building.

Market Data | Sep 29, 2020

6 must reads for the AEC industry today: September 29, 2020

Renovation to Providence's downtown library is completed and Amazon to build 1,500 new last-mile warehouses.

Market Data | Sep 25, 2020

5 must reads for the AEC industry today: September 25, 2020

AIA releases latest 2030 Commitment results and news delivery robots could generate trillions for U.S. economy.

Market Data | Sep 24, 2020

6 must reads for the AEC industry today: September 24, 2020

SOM's new waterfront neighborhood and a portable restroom designed for mobility.