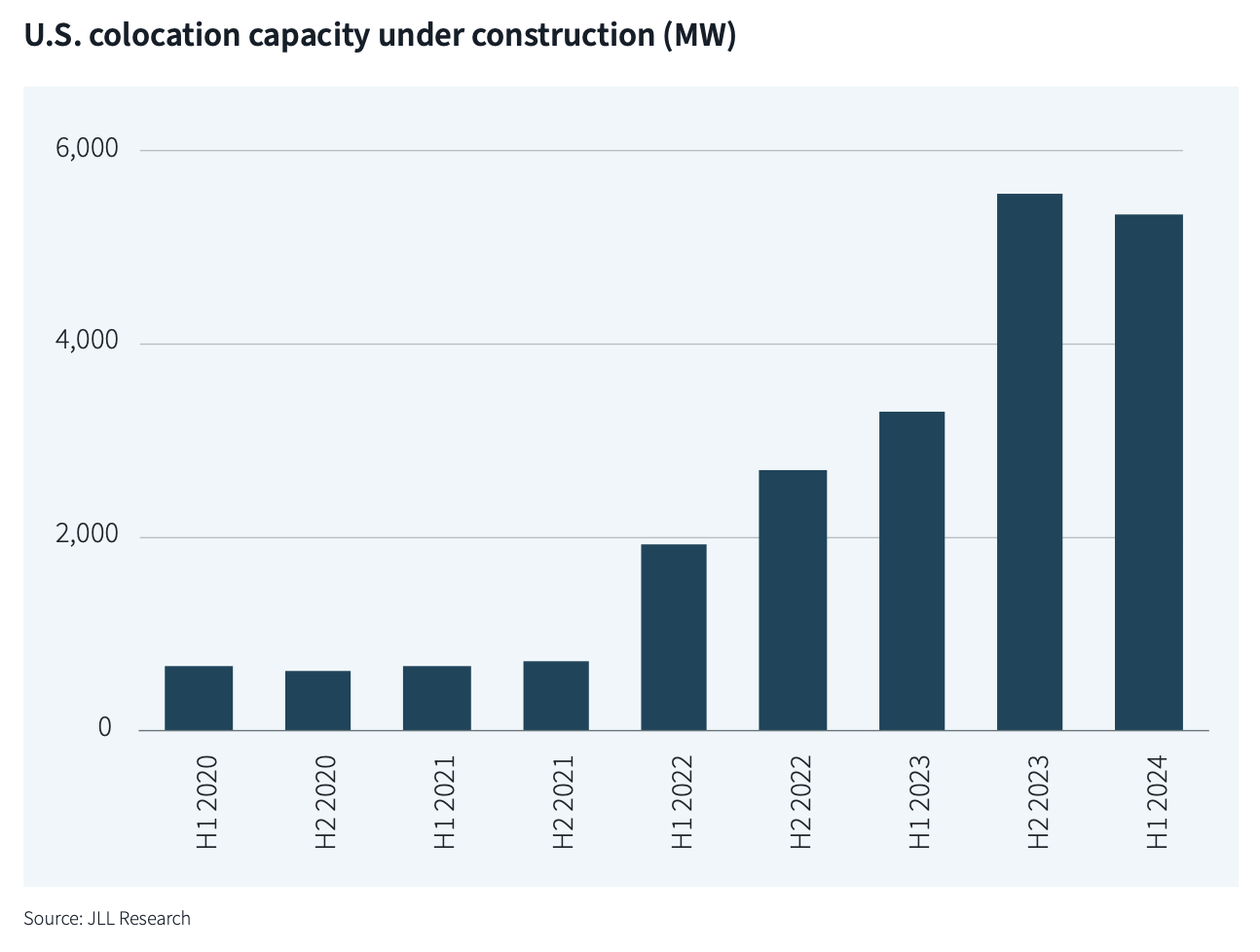

Data center demand is expanding exponentially, with data creation expected to increase at a 23% compound annual growth rate through 2030. New operations to meet that demand, however, are imperiled by labor shortages and power infrastructure that isn’t keeping up with demand.

Those are some of the conclusions that Jones Lang Lasalle (JLL) draws in its U.S. Data Center Report for Midyear 2024. That report looks at conditions for the country and digs deeper into 18 markets. It compares leasing fundamentals such as construction and vacancy rates, rents, investment trends, and prospective demand from artificial intelligence.

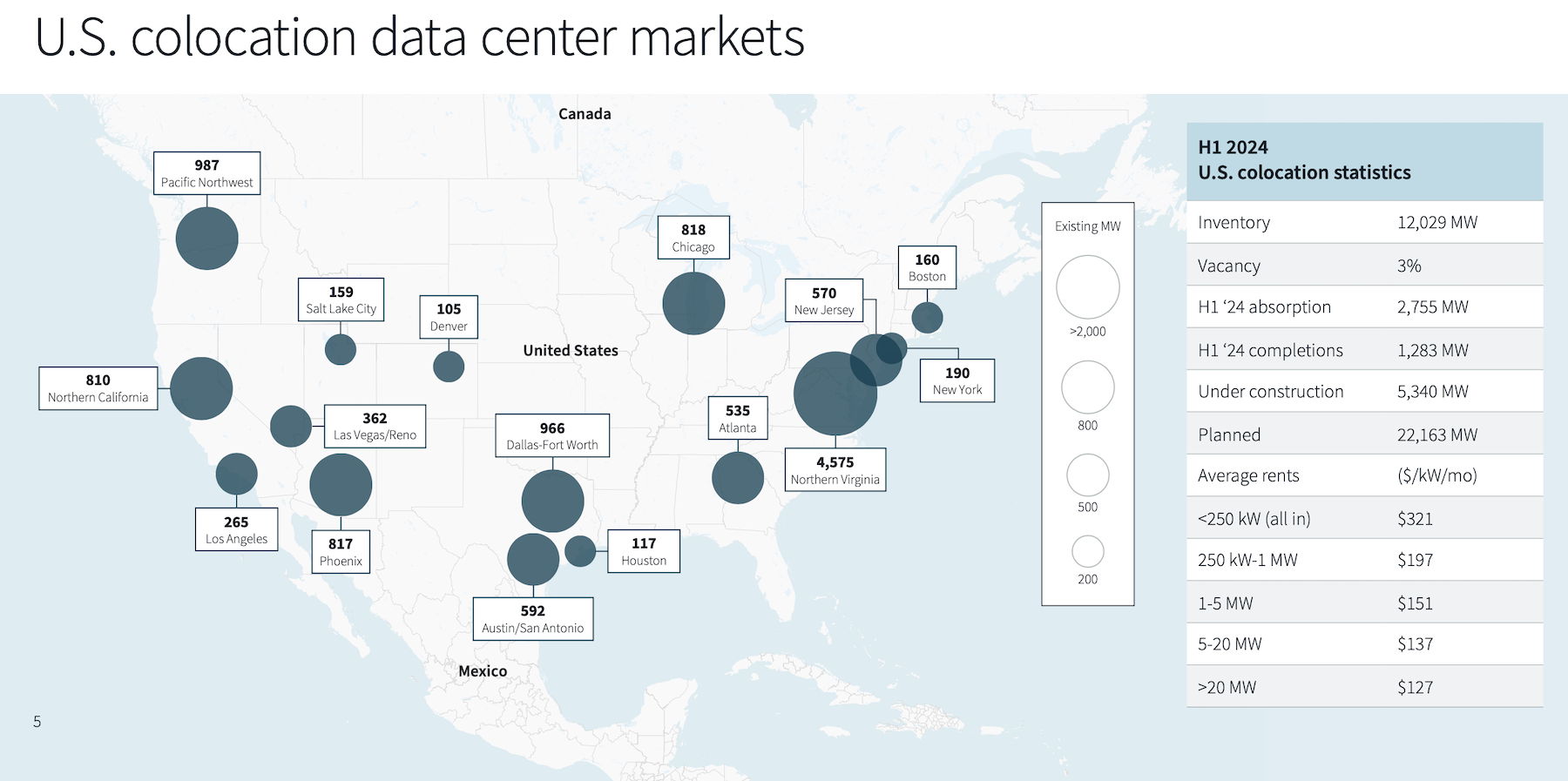

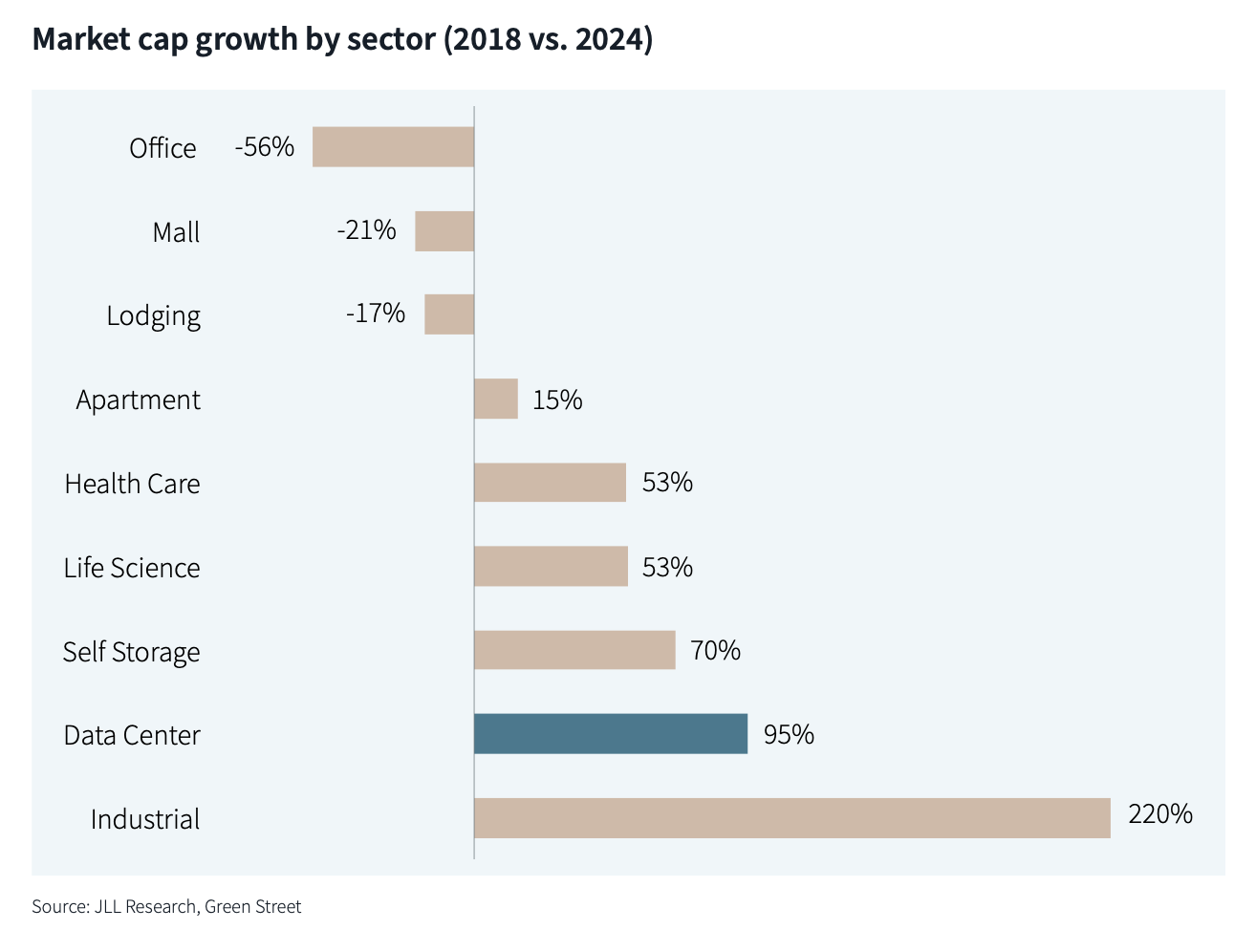

JLL paints a picture of a data center market that has insatiable demand from users. At midyear 2024, the existing supply of colocation data center capacity in the U.S. stood at 12 GW. Colocation capacity in the U.S. has doubled since 2020, increasing at a 21% compound annual growth rate. Northern Virginia remains the largest market by a factor of four, accounting for nearly half of the capacity growth since 2020. But markets in the South and West regions have been faster growing on percentage basis.

Currently, 76% of total colocation capacity resides in primary markets and 24% in secondary markets. Atlanta gained the top spot for colocation capacity under construction for the first time, following several years of heightened investor interest.

Nationally, construction and build-to-suit projects remain more active than core trades, as development yields on powered shell deals are pricing in the 7.5%-plus range and turnkey developments in the 9.5%-plus range. Projects reaching completion in 2024 were built to lower development yields than the market is bearing, and the stabilized cost of capital is contributing to a bid-ask spread.

Colocation completions increased to a new record of 1.3 GW in the first half of 2024. Nearly all the capacity delivering was preleased. The Northern Virginia market once again led the U.S. in completions, delivering 519 MW. The Pacific Northwest and Austin/San Antonio were standouts during JLL’s reporting period, delivering six and four times their traditional levels, respectfully.

With the completion of all projects currently under construction or planned, the U.S. colocation market will triple in size from current levels.

Still, colocation capacity under construction leveled off in the first half of 2024 at 5.34 GW (equal to the electrical consumption of the Tampa Bay region, and to over $53 billion in asset value). That drop-off could be a potential signal that the U.S. power grid cannot support faster development.

Despite rampant construction and completion activity, colocation vacancy declined to a record low of 3% at midyear 2024 due to insatiable demand. Simultaneously, colocation capacity under construction is 84% preleased. With limited existing vacancy, nearly all new data center demand is forced to lease capacity under construction. Given recent demand trends and the high preleasing rate for product under construction, vacancy will continue to trend towards 0% over the next few years, predicts JLL.

Skyrocketing data center rents

Absorption in the first half of 2024 reached a new record of nearly 2.8 GW, representing a ninefold increase over 2020 levels. Absorption was concentrated in four markets which had significant capacity breaking ground or delivering.

In aggregate, rents for the sector have increased at an 11% compound annual growth rate since 2020. However, rent increases have accelerated noticeably in the last year, states JLL. Commercial electricity rates were stable from 2010 through 2020 but have increased 25% in the last three years as power suppliers ramp up spending to address aging infrastructure and record demand. Meanwhile, the power grid is nearing full capacity.

Artificial Intelligence (AI) capital expenditures in recent years are estimated to be north of $300 billion, with investment levels accelerating in 2024. AI represents roughly 20% of new data center demand. What is known is that the largest global technology firms have announced significant AI CapEx targets for 2024, which will continue to fuel data center demand. An evolving storyline in recent months has been the shift in investor sentiment towards AI. Questions about the future revolve around investment trends, AI adoption rates, and the technology’s unclear path to profitability.

A power grid under more stress

The current power constraint situation the U.S. grid is facing is creating an opportunity for more capital inflows to the infrastructure and data center space. More capital is needed to support on-site energy campuses.

While data center power demand has been growing at a 21% CAGR in recent years, the sector only accounted for about 3% of total U.S. power in 2023. However, if trendlines hold, that percentage is projected surpass 11% within the next decade.

In aggregate, the U.S. power grid is not in danger of running out of capacity in the near term. But medium- to long-term challenges need to be addressed. During peak summer demand in 2024, the U.S. power grid was projected to operate at 94% of permitted capacity. By 2033, power demand could exceed supply when factoring in data center growth projections, planned power retirements and anticipated power additions. Solutions will present themselves, but investments in research and development need to be made today.

Developers are turning to bridge energy solutions such as fuel cells or supplemental natural gas turbines to activate projects on shorter schedules. More data centers are operating as a microgrid. And development is expanding into secondary and rural markets with more readily available power.

Technical labor at a premium

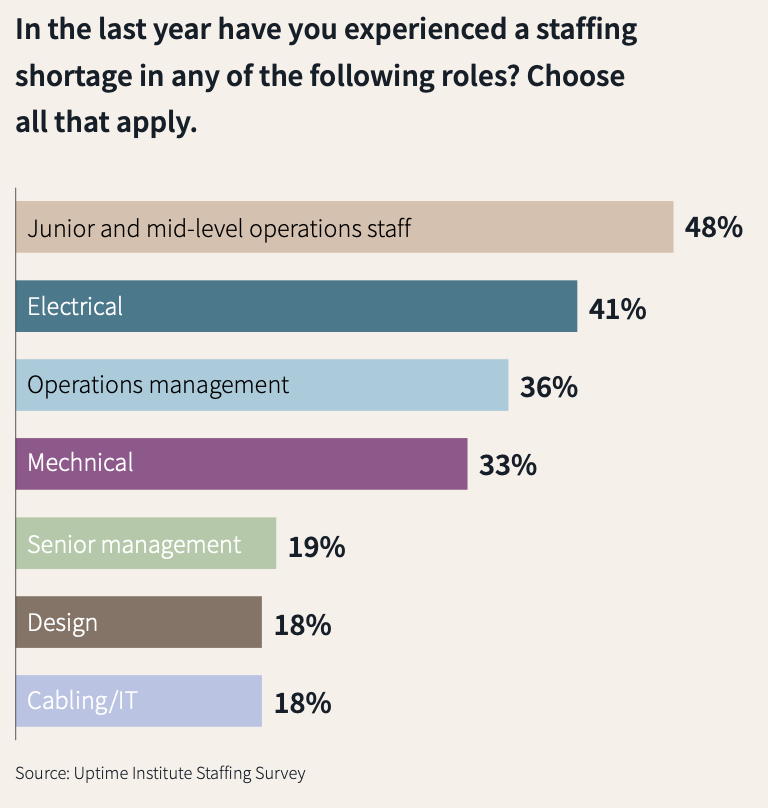

Finding the right talent remains a challenge for data center operators, and the issue is becoming more acute given the rapid expansion of the sector in recent years. Only about 15% of applicants meet the minimum job qualifications. It is estimated that 10% of data center roles at existing facilities are unfilled, more than twice the national average across all industries. As a result, data center operators have been resorting to cross-functional roles and staff augmentation.

Attrition is particularly severe among younger workers, where the retention rate in the first year of employment is only 18%. In exit interviews, data center employees list three primary reasons for resigning: pay, burnout, and career development. To address burnout in the industry, employers need to ensure a positive employee experience that extends beyond compensation.

Within the data center industry, one-third of the technical workforce is at or nearing retirement age. That ratio is likely to double in the next few years due to demographic trends. JLL states that, to withstand the current labor environment and forthcoming generational shifts, data center operators need to prioritize succession planning and establish clear career development pathways.

The operators might start with diversity: less than 10% of the data center workforce is female, and only 28% is made up of people of color. Educating these two cohorts about the employment opportunities within the data center industry would significantly expand the labor pool, suggests JLL.

Related Stories

Giants 400 | Aug 30, 2021

2021 Giants 400 Report: Ranking the largest architecture, engineering, and construction firms in the U.S.

The 2021 Giants 400 Report includes more than 130 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 26, 2021

2021 Data Center Giants: Top architecture, engineering, and construction firms in the U.S. data center facilities sector

Corgan, Holder Construction, Jacobs, and Whiting-Turner top BD+C's rankings of the nation's largest data center facilities sector architecture, engineering, and construction firms, as reported in the 2021 Giants 400 Report.

Contractors | Jul 23, 2021

The aggressive growth of Salas O'Brien, with CEO Darin Anderson

Engineering firm Salas O'Brien has made multiple acquisitions over the past two years to achieve its Be Local Everywhere business model. In this exclusive interview for HorizonTV, BD+C's John Caulfield sits down with the firm's Chairman and CEO, Darin Anderson, to discuss its business model.

Data Centers | Mar 20, 2021

Japan’s NTT pushes U.S. data center expansion

Two new facilities opened last month, with several others under construction.

Data Centers | Mar 16, 2021

Greener data centers can also be more profitable

A new white paper explores revenue-enhancing ways for data centers to reduce their greenhouse gas emissions.

Data Centers | Feb 18, 2021

Arcari Cimini Architettura designs Data Center Floating Island

The concept looks to create an entire floating city centered around a data center.

Data Centers | Jan 21, 2021

The Weekly show, Jan 21, 2021: Data centers in a pandemic world, and LGBT certification for AEC firms

This week on The Weekly show, BD+C editors speak with AEC industry leaders about LGBT certification for architecture, engineering, and construction firms, and the current state of data centers in a pandemic world.

Giants 400 | Dec 16, 2020

Download a PDF of all 2020 Giants 400 Rankings

This 70-page PDF features AEC firm rankings across 51 building sectors, disciplines, and specialty services.

Data Centers | Dec 9, 2020

COVID-19 pandemic elevates data centers to key priority market for investors

But supply-chain and labor problems could slow deliveries, according to Turner & Townsend’s 2020 report that looks at 40 markets.

Giants 400 | Dec 3, 2020

2020 Data Center Giants: Top architecture, engineering, and construction firms in the U.S. data center facilities sector

Corgan, Jacobs, and Whiting-Turner Contracting Company top BD+C's rankings of the nation's largest data center facilities sector architecture, engineering, and construction firms, as reported in the 2020 Giants 400 Report.