Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

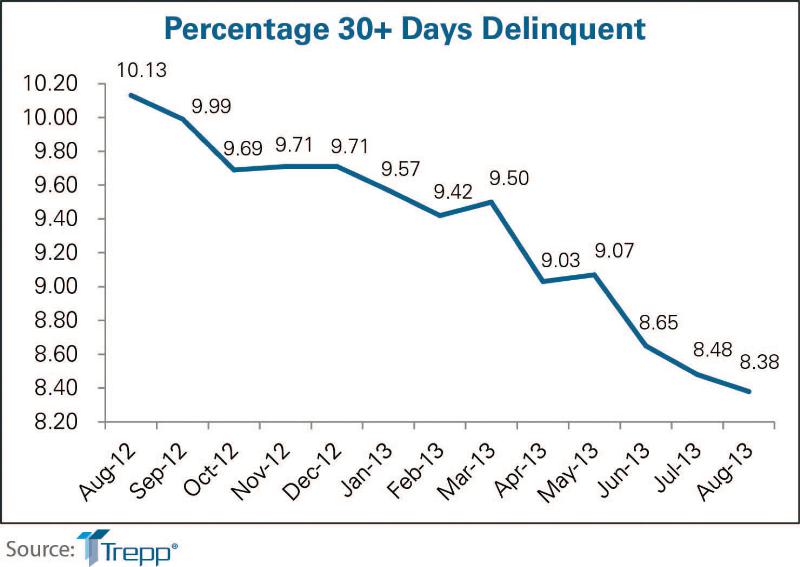

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

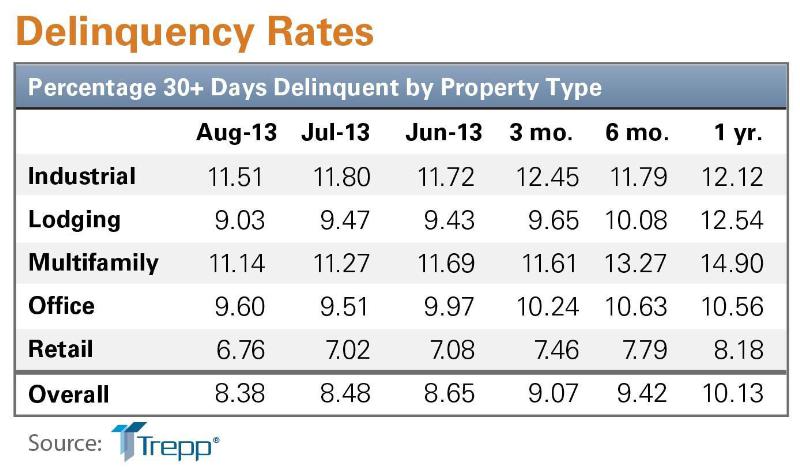

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Sep 14, 2022

Indian tribe’s new educational campus supports culturally appropriate education

The Kenaitze Indian Tribe recently opened the Kahtnuht’ana Duhdeldiht Campus (Kenai River People’s Learning Place), a new education center in Kenai, Alaska.

| Sep 13, 2022

California building codes now allow high-rise mass-timber buildings

California recently enacted new building codes that allow for high-rise mass-timber buildings to be constructed in the state.

| Sep 13, 2022

Orange County opens civic center complex—one of California’s largest P3 projects

Orange County’s recently opened County Administration North (CAN) building caps an urban center development that constitutes one of California’s largest ever P3 projects.

Laboratories | Sep 12, 2022

Lab space scarcity propels construction demand in life sciences sector

In its 2021 Life Sciences Real Estate Outlook, JLL predicted that access to talent would be a primary concern for an industry sector that had been growing by leaps and bounds. A year later, talent still guides real estate decisions. But market conditions of a different sort were cooling the biotech field: namely, investors that have soured on startups which underperformed after going public. What this means for new construction and renovation going forward is unpredictable, as the drivers behind life sciences’ surge are still palpable.

Architects | Sep 12, 2022

FWA Group joins national architecture, interior design, and planning firm Hord Coplan Macht

Hord Coplan Macht acquires FWA Group.

| Sep 12, 2022

Staff at New York City architecture firm is first in U.S. to unionize

Staff at New York City architecture firm is first in U.S. to unionize.

| Sep 12, 2022

San Antonio’s new courthouse aims to provide safety and security while also welcoming the public

The San Antonio Federal Courthouse, which opened earlier this year, replaces a courthouse that had been constructed as a pavilion for the 1968 World’s Fair.

Giants 400 | Sep 9, 2022

Top 20 Casino Architecture + AE Firms for 2022

JCJ Architecture, DLR Group, HBG Design, and Cuningham top the ranking of the nation's largest casino architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Sep 9, 2022

Top 120 Hospitality Sector Architecture + AE Firms for 2022

Gensler, WATG, HKS, and JCJ Architecture top the ranking of the nation's largest hospitality facilities sector architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

| Sep 9, 2022

Add sand shortage to supply chain woes

As if it wasn’t enough to have lumber, windows, doors, and metal pipe in short supply, you can add sand, which is theoretically plentiful on Earth, to the list of construction materials that can be hard to come by.