Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

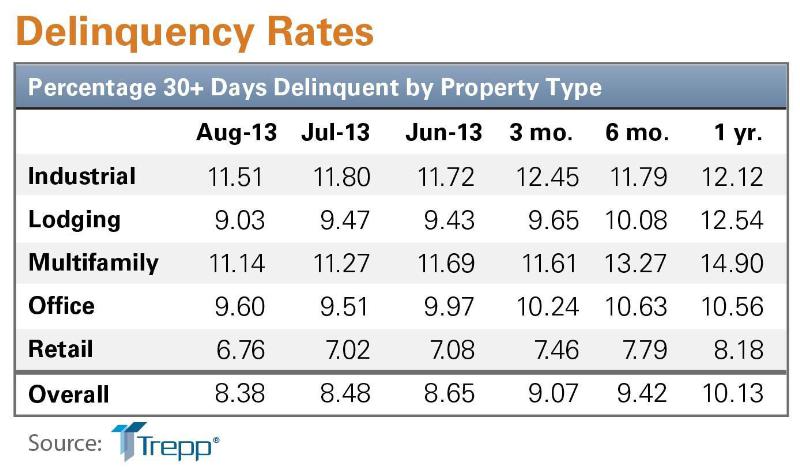

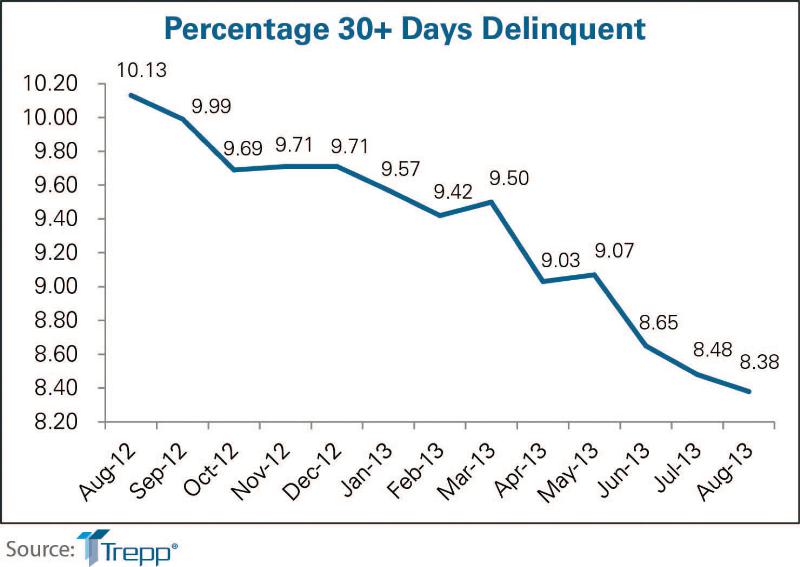

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

Women in Design+Construction | Jul 18, 2022

Registration is open for BD+C's 2022 Women in Design+Construction Conference

Join your AEC industry peers in Chicago, September 26-28, 2022, for the 7th annual Women in Design+Construction Conference, hosted by the BD+C editorial team and the 35-person WIDC Advisory Board.

Airports | Jul 18, 2022

FAA will award nearly $1 billion for airport projects

The Federal Aviation Administration (FAA) will award nearly $1 billion to 85 airports of all sizes across the country to improve terminals.

Building Team | Jul 18, 2022

Understanding the growing design-build market

FMI’s new analysis of the design-build market forecast for the next fives years shows that this delivery method will continue to grow, despite challenges from the COVID-19 pandemic.

Mixed-Use | Jul 18, 2022

Mixed-use development outside Prague uses a material made from leftover bricks

Outside Prague, the Sugar Factory, a mixed-used residential development with public space, marks the largest project to use the sustainable material Rebetong.

Building Team | Jul 15, 2022

ABC: Construction materials prices increased in June, up 20% from a year ago

Construction input prices increased 1.9% in June compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Arenas | Jul 15, 2022

U. of Oregon renovation aims for ‘finest track and field facility in the world’

The renovation of the University of Oregon’s Hayward Field had the goal of creating the “finest track and field facility in the world.”

Building Team | Jul 14, 2022

ABC’s construction backlog inches lower in June; Contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator fell 0.1 months in June and stands at 8.9 months, according to an ABC member survey conducted June 21 to July 5.

Sustainable Development | Jul 14, 2022

Designing for climate change and inclusion, with CBT Architects' Kishore Varanasi and Devanshi Purohit

Climate change is having a dramatic impact on urban design, in terms of planning, materials, occupant use, location, and the long-term effect of buildings on the environment. Joining BD+C's John Caulfield to discuss this topic are two experts from the Boston-based CBT Architects: Kishore Varanasi, a Principal and director of urban design; and Devanshi Purohit, an Associate Principal.

Multifamily Housing | Jul 14, 2022

Multifamily rents rise again in June, Yardi Matrix reports

Average U.S. multifamily rents rose another $19 in June to edge over $1,700 for the first time ever, according to the latest Yardi® Matrix Multifamily Report.

Building Team | Jul 14, 2022

Austin PBS gets a new state-of-the-art facility with three studios

Since the 1970s, Austin PBS, birthplace of the Austin City Limits TV series, has been based inside the communications building on the University of Texas campus—a space it has long outgrown.