Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

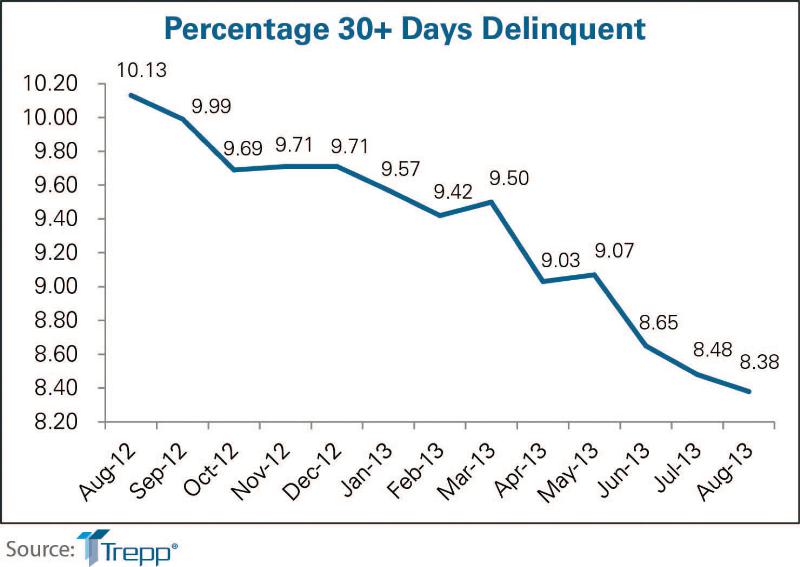

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

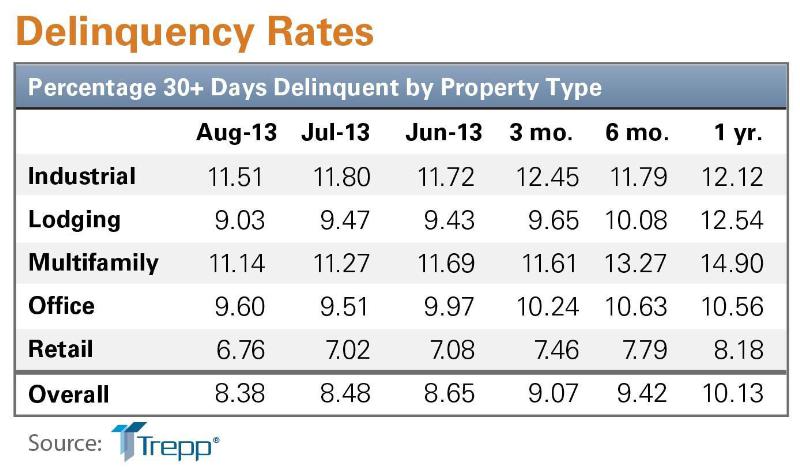

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Aug 8, 2022

Mass timber and net zero design for higher education and lab buildings

When sourced from sustainably managed forests, the use of wood as a replacement for concrete and steel on larger scale construction projects has myriad economic and environmental benefits that have been thoroughly outlined in everything from academic journals to the pages of Newsweek.

AEC Tech | Aug 8, 2022

The technology balancing act

As our world reopens from COVID isolation, we are entering back into undefined territory – a form of hybrid existence.

Legislation | Aug 5, 2022

D.C. City Council moves to require net-zero construction by 2026

The Washington, D.C. City Council unanimously passed legislation that would require all new buildings and substantial renovations in D.C. to be net-zero construction by 2026.

Cultural Facilities | Aug 5, 2022

A time and a place: Telling American stories through architecture

As the United States enters the year 2026, it will commence celebrating a cycle of Sestercentennials, or 250th anniversaries, of historic and cultural events across the land.

Sponsored | | Aug 4, 2022

Brighter vistas: Next-gen tools drive sustainability toward net zero line

New technologies, innovations, and tools are opening doors for building teams interested in better and more socially responsible design.

| Aug 4, 2022

Newer materials for green, resilient building complicate insurance underwriting

Insurers can’t look to years of testing on emerging technology to assess risk.

Sustainability | Aug 4, 2022

To reduce disease and fight climate change, design buildings that breathe

Healthy air quality in buildings improves cognitive function and combats the spread of disease, but its implications for carbon reduction are perhaps the most important benefit.

Multifamily Housing | Aug 4, 2022

Faculty housing: A powerful recruitment tool for universities

Recruitment is a growing issue for employers located in areas with a diminishing inventory of affordable housing.

Multifamily Housing | Aug 3, 2022

7 tips for designing fitness studios in multifamily housing developments

Cortland’s Karl Smith, aka “Dr Fitness,” offers advice on how to design and operate new and renovated gyms in apartment communities.

Building Materials | Aug 3, 2022

Shawmut CEO Les Hiscoe on coping with a shaky supply chain in construction

BD+C's John Caulfield interviews Les Hiscoe, CEO of Shawmut Design and Construction, about how his firm keeps projects on schedule and budget in the face of shortages, delays, and price volatility.