Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

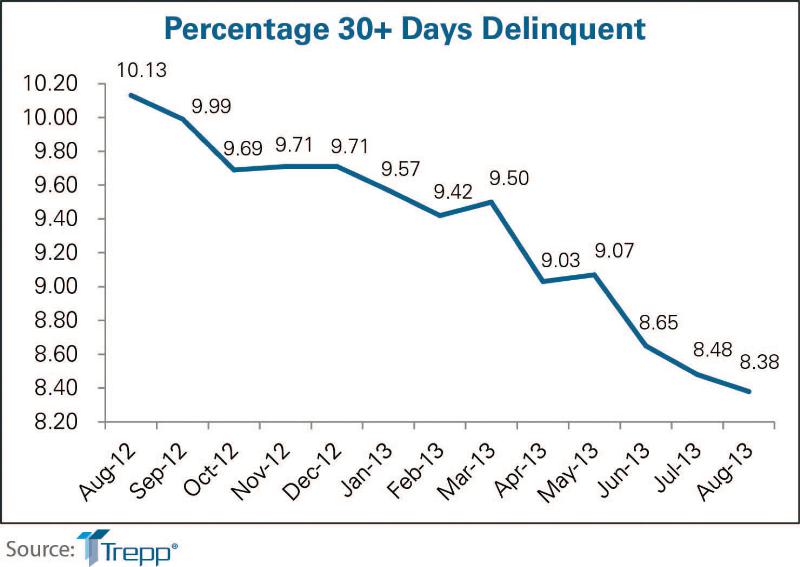

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

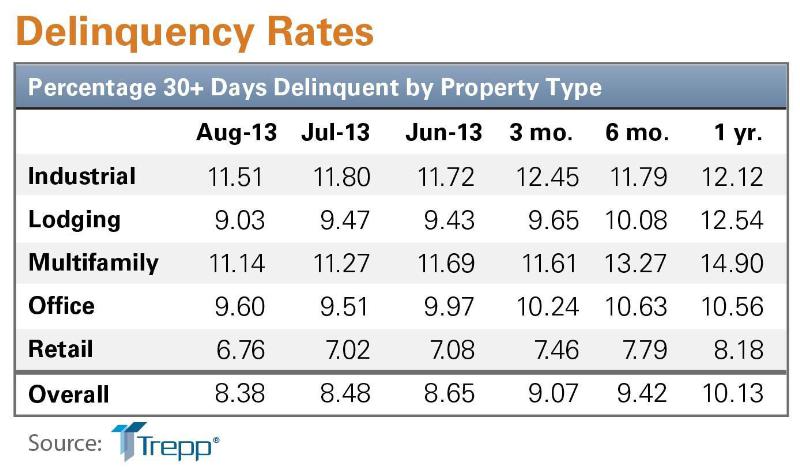

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Aug 11, 2022

Report examines supposed conflict between good design and effective cost management

A report by the American Institute of Architects and the Associated General Contractors of America takes a look at the supposed conflict between good design and effective cost management, and why it causes friction between architects and contractors.

Architects | Aug 11, 2022

Mancini Duffy Bill Mandara on expanding through diversification

In this segment for HorizonTV, BD+C's John Caulfield interviews Mancini Duffy's CEO and Co-owner William Mandara about his firm's recent growth, which includes an acquisition and new HQs office.

Energy Efficiency | Aug 11, 2022

Commercial Energy Efficiency: Finally “In-the-Money!”

By now, many business leaders are out in front of policymakers on prioritizing the energy transition.

High-rise Construction | Aug 11, 2022

Saudi Arabia unveils plans for a one-building city stretching over 100 miles long

Saudi Arabia recently announced plans for an ambitious urban project called The Line—a one-building city in the desert that will stretch 170 kilometers (106 miles) long and only 200 meters (656 feet) wide.

| Aug 10, 2022

U.S. needs more than four million new apartments by 2035

Roughly 4.3 million new apartments will be necessary by 2035 to meet rising demand, according to research from the National Multifamily Housing Council (NMHC) and National Apartment Association.

| Aug 10, 2022

Gresham Smith Founder, Batey M. Gresham Jr., passes at Age 88

It is with deep sadness that Gresham Smith announces the passing of Batey M. Gresham Jr., AIA—one of the firm’s founders.

| Aug 9, 2022

Work-from-home trend could result in $500 billion of lost value in office real estate

Researchers find major changes in lease revenues, office occupancy, lease renewal rates.

| Aug 9, 2022

5 Lean principles of design-build

Simply put, lean is the practice of creating more value with fewer resources.

| Aug 9, 2022

Designing healthy learning environments

Studies confirm healthy environments can improve learning outcomes and student success.

Legislation | Aug 8, 2022

Inflation Reduction Act includes over $5 billion for low carbon procurement

The Inflation Reduction Act of 2022, recently passed by the U.S. Senate, sets aside over $5 billion for low carbon procurement in the built environment.