Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

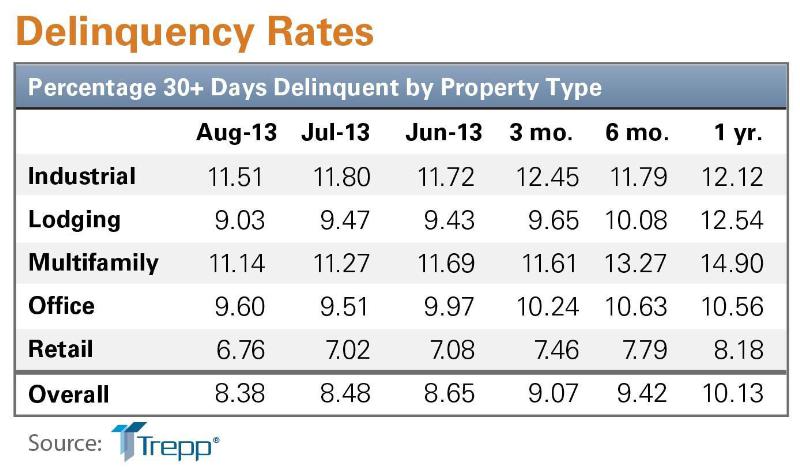

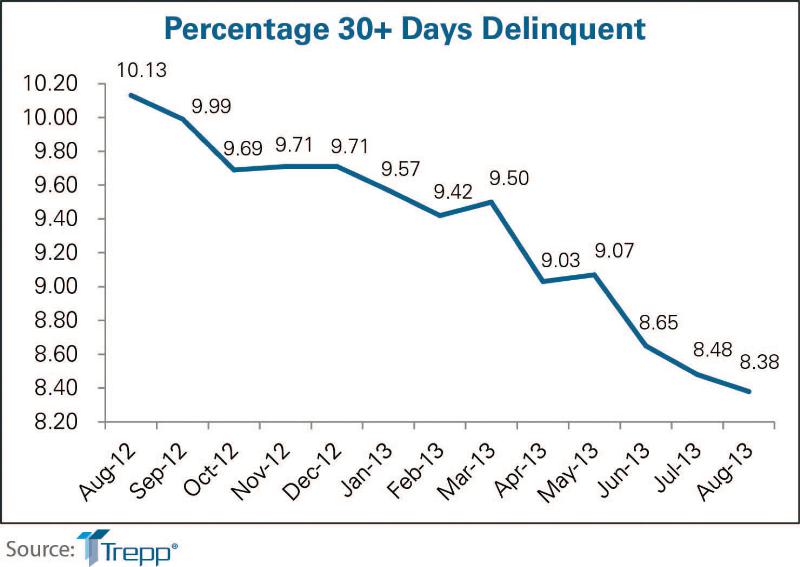

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| May 13, 2014

Universities embrace creative finance strategies

After Moody’s and other credit ratings agencies tightened their standards a few years ago, universities had to become much more disciplined about their financing mechanisms.

| May 13, 2014

19 industry groups team to promote resilient planning and building materials

The industry associations, with more than 700,000 members generating almost $1 trillion in GDP, have issued a joint statement on resilience, pushing design and building solutions for disaster mitigation.

| May 13, 2014

Libeskind wins competition to design Canadian National Holocaust Monument

A design team featuring Daniel Libeskind and Gail Dexter-Lord has won a competition with its design for the Canadian National Holocaust Monument in Toronto. The monument is set to open in the autumn of 2015.

| May 12, 2014

Defining BIM – What do owners really want?

Given the complexities of the building process, it can be difficult for building owners to effectively communicate what they want and need with BIM. The response to the question usually is, “Give me everything.”

| May 12, 2014

The best of affordable housing: 4 projects honored with 2014 AIA/HUD Secretary Awards [slideshow]

The winners include two dramatic conversions of historic YMCA buildings into modern, affordable multifamily complexes.

| May 11, 2014

8 starter questions to answer when thinking about building

So, are you ready to start building? Completing these eight questions will help you answer that confidently. SPONSORED CONTENT

| May 11, 2014

Final call for entries: 2014 Giants 300 survey

BD+C's 2014 Giants 300 survey forms are due Wednesday, May 21. Survey results will be published in our July 2014 issue. The annual Giants 300 Report ranks the top AEC firms in commercial construction, by revenue.

| May 10, 2014

How your firm can gain an edge on university projects

Top administrators from five major universities describe how they are optimizing value on capital expenditures, financing, and design trends—and how their AEC partners can better serve them and other academic clients.

| May 9, 2014

It's official: Norman Foster-designed Harmon hotel and casino to be razed due to structural issues

Construction of the Las Vegas tower was halted in 2008 after experts discovered faulty steel beams in the structure. Now its owner, MGM, has received permission to demolish the building.

| May 9, 2014

5 trends transforming higher education

Performance-based funding models and the adoption of advanced technologies like augmented reality for teaching are just a few of the predictions offered by CannonDesign's higher education sector leader, Brad Lukanic.