Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

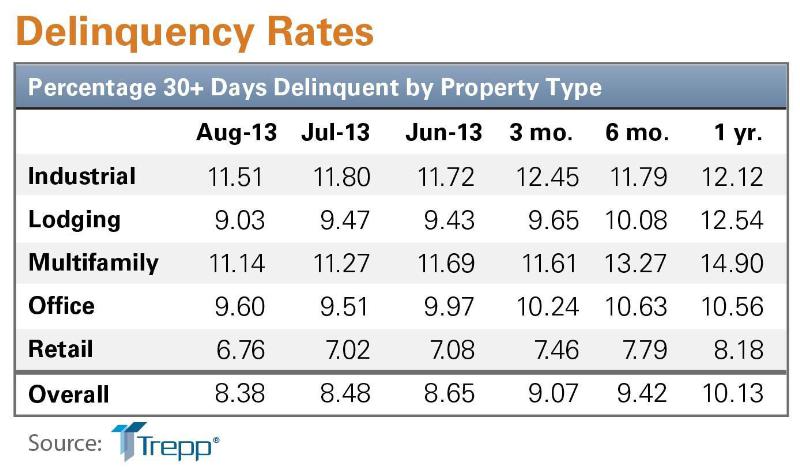

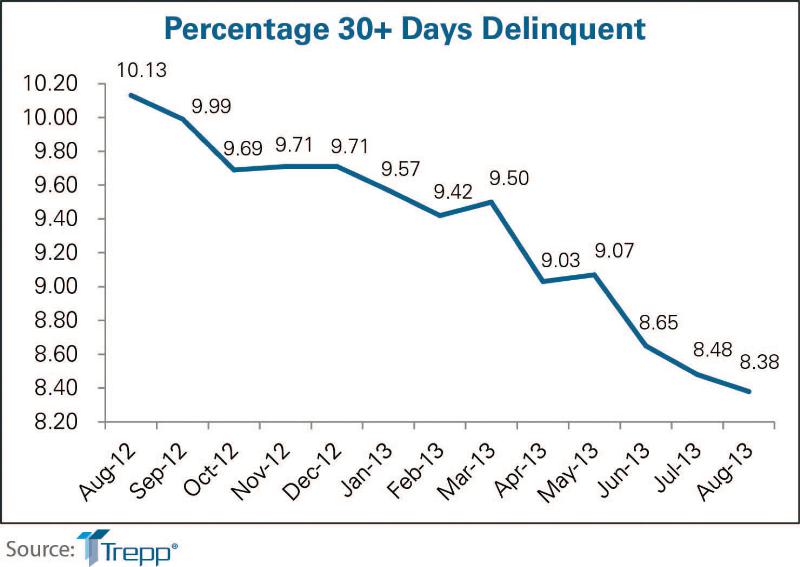

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| May 9, 2014

40 Under 40: Where are they now?

BD+C catches up with two past U40 honorees: Matt Dumich of Adrian Smith + Gordon Gill Architecture and David Montalba of Montalba Architects

| May 8, 2014

Perfecting prefab: 8 tips for healthcare construction projects

Leading AEC firms offer helpful advice for using BIM to pull off prefab for everything from MEP infrastructure to whole bathrooms.

| May 8, 2014

Don’t bother planning for the future - it doesn’t care about you

Though strategic planning has helped many businesses move forward, its time has passed. So says Economist and Author Bill Conerly. SPONSORED CONTENT

| May 8, 2014

Infographic: 4 most common causes of construction site fatalities

In honor of Safety Week, Skanska put together this nifty infographic on how to prevent deadly harm in construction.

| May 8, 2014

Sporting events in style: Infographic showcases novel stadiums of the world

UK precast concrete maker Banagher, which specializes in precast stadia solutions, has assembled a list of the world's top stadiums in terms of architectural and structural design.

| May 7, 2014

Design competition: $900,000 on the line in Las Vegas revitalization challenge

Las Vegas Mayor Carolyn Goodman wants your economic development ideas for remaking four areas within the city, including the Cashman Center and the Las Vegas Medical District.

| May 6, 2014

'Beyond' is artist's cinematic take on 2.5 years of development in the UAE

Seven-minute video offers a time-lapse trip through the built environments of Abu Dhabi and Dubai.

| May 6, 2014

'Ugliest building in New Jersey' finally getting facelift

After a decade of false starts and mishaps, the American Dream mall in the Meadowlands may finally get built.

| May 5, 2014

Toronto residential tower to feature drawer-like facade scheme

Some of the apartments in the new River City development will protrude from the building at different lengths, creating a drawer-like "push-pull" effect.