Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

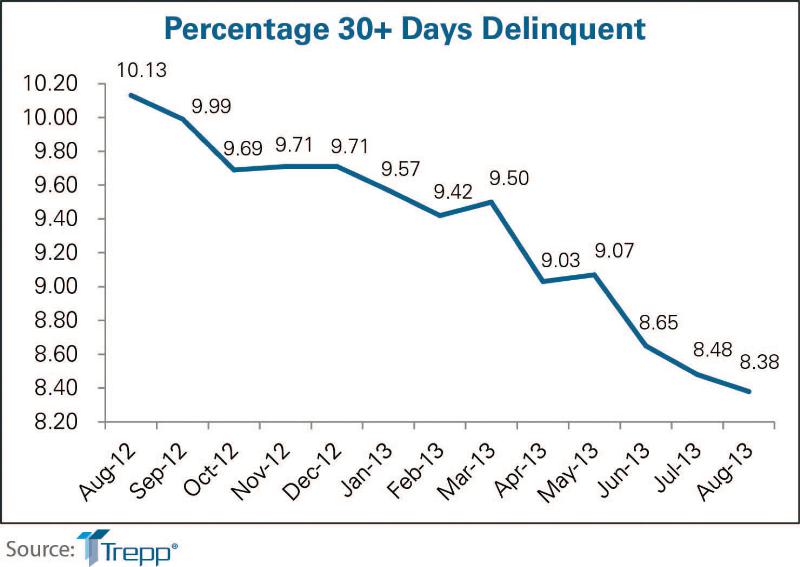

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

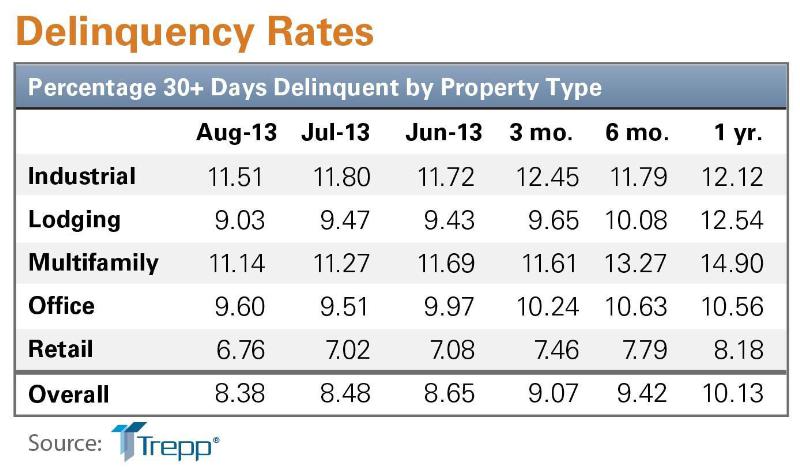

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Nov 20, 2012

PC Construction completes Juniper Hall at Champlain College

Juniper Hall is on track for LEED Gold certification from the U.S. Green Building Council.

| Nov 14, 2012

U.S. Green Building Council partners with Pearson

Partnership will help further USGBC’s mission by advancing green building education

| Nov 14, 2012

U.S. Green Building Council announces grant from Google to catalyze transformation of building materials industry and indoor health

Focus is on healthy building materials to promote indoor environmental quality and human health

| Nov 14, 2012

USGBC's Greenbuild International Conference and Expo kicks off in San Francisco

7,000 members of the green building industry convene for opening plenary headlined by "Morning Joe" co-hosts Mika Brzezinksi and Joe Scarborough

| Nov 13, 2012

Have colleges + universities gone too far with "Quality of Life" buildings?

We'd like your input - recent projects, photo/s, renderings, and expert insight - on an important article we're working on for our Jan 2013 issue

| Nov 13, 2012

Turner Construction’s green building Market Barometer reveals new findings on green building and certification

Respondents indicated a widespread commitment to sustainable practices

| Nov 13, 2012

Soladigm announces new glass product, changes company name to View, Inc.

Glass is installed and operating at W San Francisco adjacent to the 2012 Greenbuild show

| Nov 13, 2012

Sto Corp. announces appointment of new CMO

Bottema will be responsible for all corporate marketing, product management and sales activities.

| Nov 13, 2012

2012 LEED for Homes Award recipients announced

USGBC recognizes excellence in the green residential building community at its Greenbuild Conference & Expo in San Francisco

| Nov 12, 2012

PCI Skanska celebrates 40-year anniversary

Since its creation, PCI Skanska has provided EPC services to clients for more than 40 years.