Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

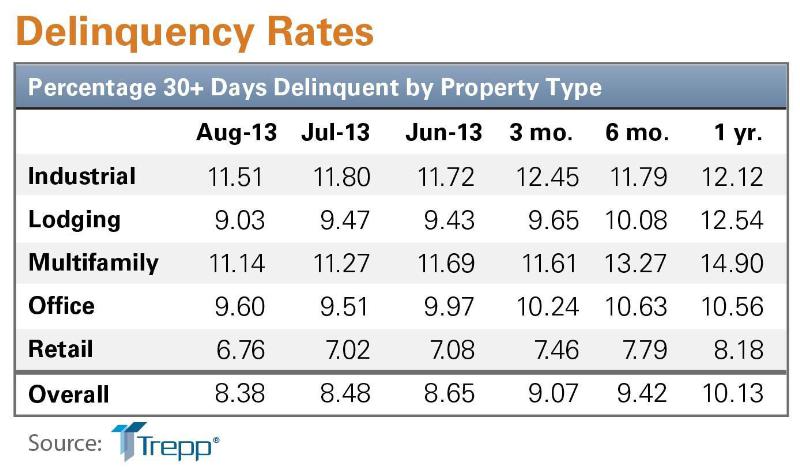

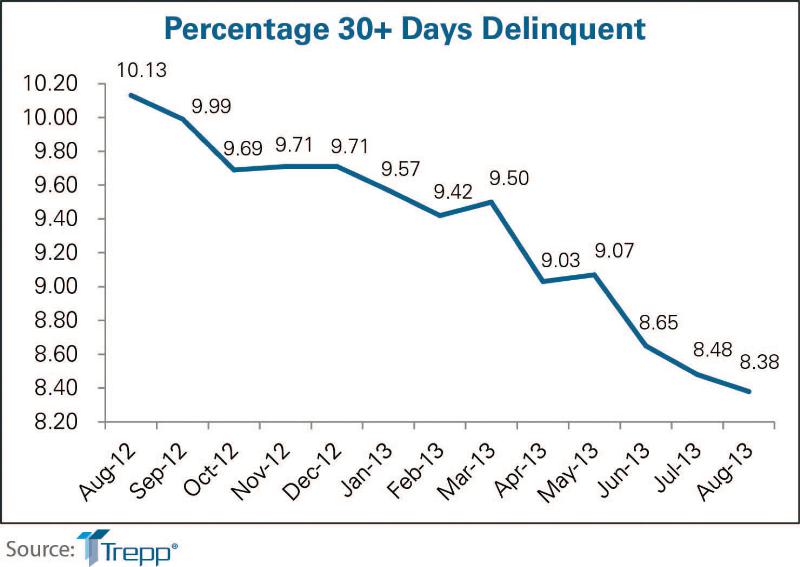

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Jun 13, 2012

GAF’s Roving Truck promotion coming to your town soon

Professional roofing contractors or builders/remodelers in the U.S. can enter to win a Ford F-150 truck.

| Jun 13, 2012

Is it time to stop building convention centers?

Over the last 20 years, convention space in the United States has increased by 50%; since 2005, 44 new convention spaces have been planned or constructed in this country alone.

| Jun 13, 2012

Steven L. Newman Real Estate Institute to hold energy asset conference for property owners, senior real estate managers

Top-level real estate professionals have been ignored as the industry has pushed to get sustainability measures in place.

| Jun 12, 2012

SAC Federal Credit Union selects LEO A DALY to design corporate headquarters

LEO A DALY also provided site selection, programming and master planning services for the project over the past year.

| Jun 12, 2012

Restoration Millwork exterior trim achieves GreenCircle certification

Made from cellular polyvinyl chloride, the full line of Restoration Millwork trim, beadboard and accessories is engineered to look, feel and work like top-grade lumber.

| Jun 12, 2012

Piché joins C.W. Driver as director of business development

Piché will expand upon project opportunities for firm’s Southern California operations.

| Jun 12, 2012

BCA Architects transforms Anaheim schools into dynamic learning environments

BCA Architects was selected to update the district's long-range master plan.

| Jun 11, 2012

Survey reveals emerging trends in parking

Industry-transforming innovations are changing the way we park.

| Jun 11, 2012

Buro Hapold hires new principal Neil Porto

Porto brings a broad depth of expertise in civil and structural engineering to new and existing projects.

| Jun 11, 2012

Historic church gains energy efficiency, retains aesthetics with architecturally rated windows

New windows would need to not only stand the test of time, but also accommodate the aesthetics of an architecturally historic church.