Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

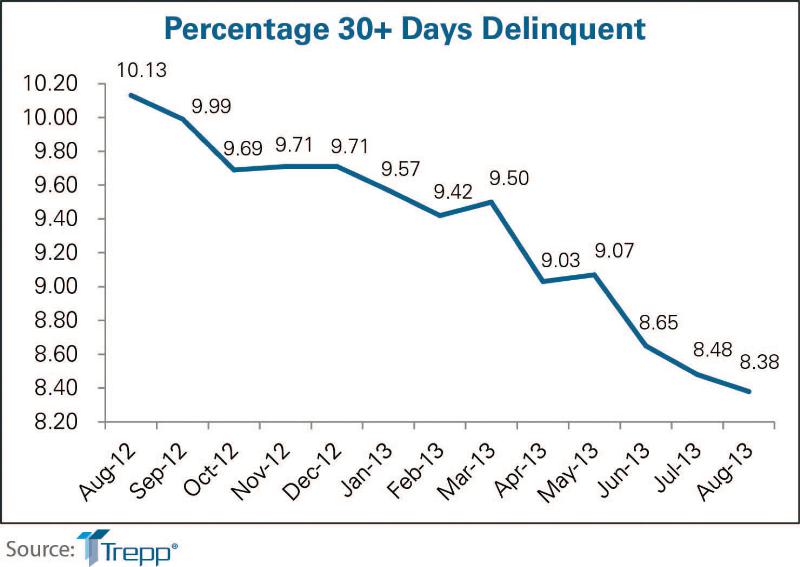

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

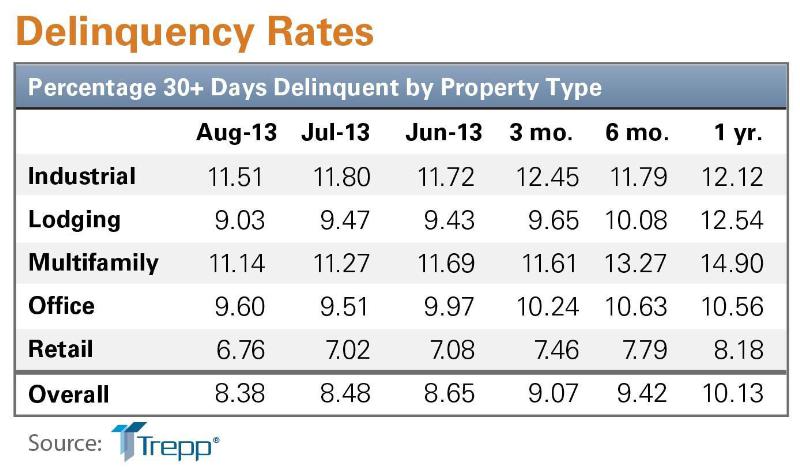

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Jun 1, 2012

AIA 2030 Commitment Program reports new results

The full report contains participating firm demographics, energy reduction initiatives undertaken by firms, anecdotal accounts, and lessons learned.

| Jun 1, 2012

Robert Wilson joins SmithGroupJJR

Wilson makes the move to SmithGroupJJR from VOA Associates, Inc., where he served as a senior vice president and technical director in its Chicago office.

| Jun 1, 2012

Gilbane Building's Sue Klawans promoted

Industry veteran tasked with boosting project efficiency and driving customer satisfaction, to direct operational excellence efforts.

| Jun 1, 2012

Ground broken for Children’s Hospital Colorado South Campus

Children’s Hospital Colorado expects to host nearly 80,000 patient visits at the South Campus during its first year.

| Jun 1, 2012

K-State Olathe Innovation Campus receives LEED Silver

Aspects of the design included a curtain wall and punched openings allowing natural light deep into the building, regional materials were used, which minimized the need for heavy hauling, and much of the final material included pre and post-consumer recycled content.

| Jun 1, 2012

New York City Department of Buildings approves 3D BIM site safety plans

3D BIM site safety plans enable building inspectors to take virtual tours of construction projects and review them in real-time on site.

| May 31, 2012

Product Solutions June 2012

Curing agents; commercial faucets; wall-cladding systems.

| May 31, 2012

8 steps to a successful BIM marketing program

It's not enough to have BIM capability--you have to know how to sell your BIM expertise to clients and prospects.

| May 31, 2012

3 Metal Roofing Case Studies Illustrate Benefits

Metal roofing systems offer values such as longevity, favorable life cycle costs, and heightened aesthetic appeal.

| May 31, 2012

AIA Course: High-Efficiency Plumbing Systems for Commercial and Institutional Buildings

Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.