Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

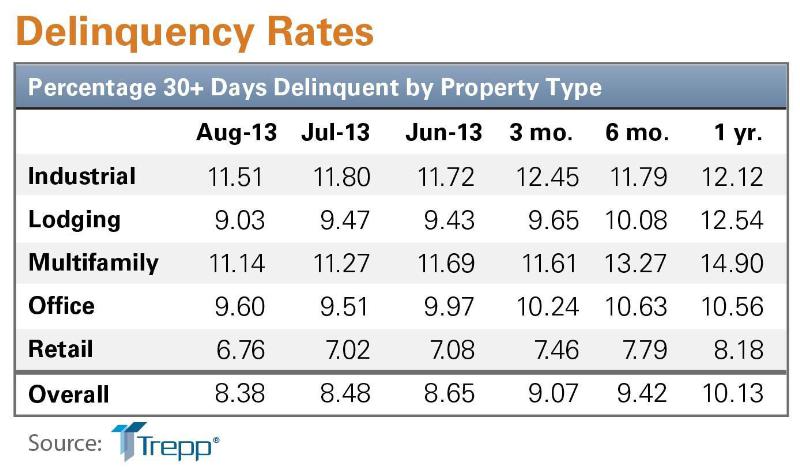

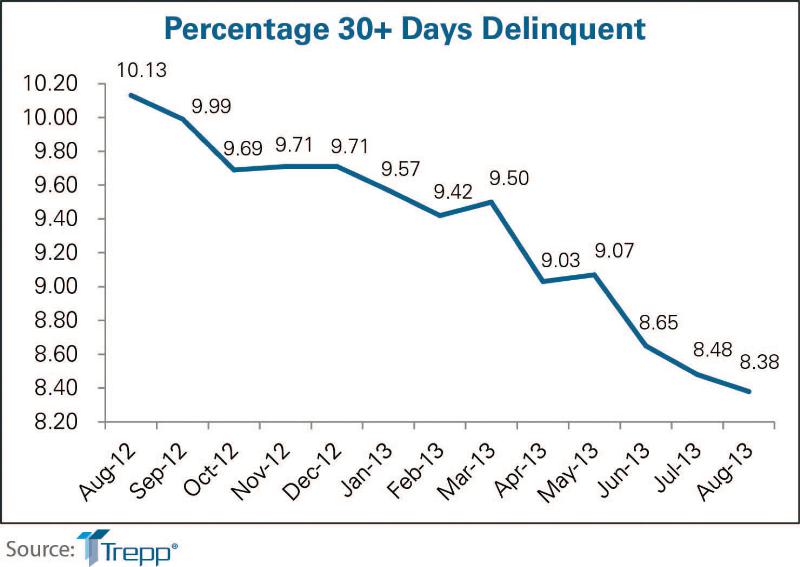

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| May 31, 2012

2011 Reconstruction Award Profile: Seegers Student Union at Muhlenberg College

Seegers Student Union at Muhlenberg College has been reconstructed to serve as the core of social life on campus.

| May 31, 2012

2011 Reconstruction Awards Profile: Ka Makani Community Center

An abandoned historic structure gains a new life as the focal point of a legendary military district in Hawaii.

| May 31, 2012

5 military construction trends

Defense spending may be down somewhat, but there’s still plenty of project dollars out there if you know where to look.

| May 31, 2012

New School’s University Center in NYC topped out

16-story will provide new focal point for campus.

| May 31, 2012

Day & Zimmermann taps Jobe for ECM VP

Ken Jobe, a senior executive with 30+ years of industry-related experience, joins Day & Zimmermann to expand footprint in the process & industrial markets.

| May 31, 2012

Perkins+Will-designed engineering building at University of Buffalo opens

Clad in glass and copper-colored panels, the three-story building thrusts outward from the core of the campus to establish a new identity for the School of Engineering and Applied Sciences and the campus at large.

| May 30, 2012

Construction milestone reached for $1B expansion of San Diego International Airport

Components of the $9-million structural concrete construction phase included a 700-foot-long, below-grade baggage-handling tunnel; metal decks covered in poured-in-place concrete; slab-on-grade for the new terminal; and 10 exterior architectural columns––each 56-feet tall and erected at a 14-degree angle.

| May 30, 2012

Pringle Brandon in discussions to join forces with Perkins+Will

The London offices would be known as Pringle Brandon Perkins+Will.

| May 30, 2012

Boral Bricks announces winners of “Live.Work.Learn” student architecture contest

Eun Grace Ko, a student at the Ryerson University in Toronto, Canada, named winner of annual contest.