Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

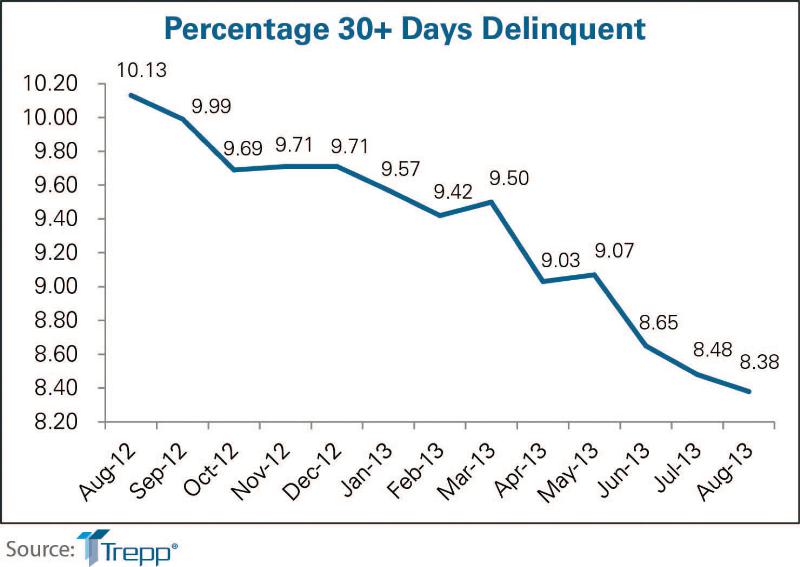

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

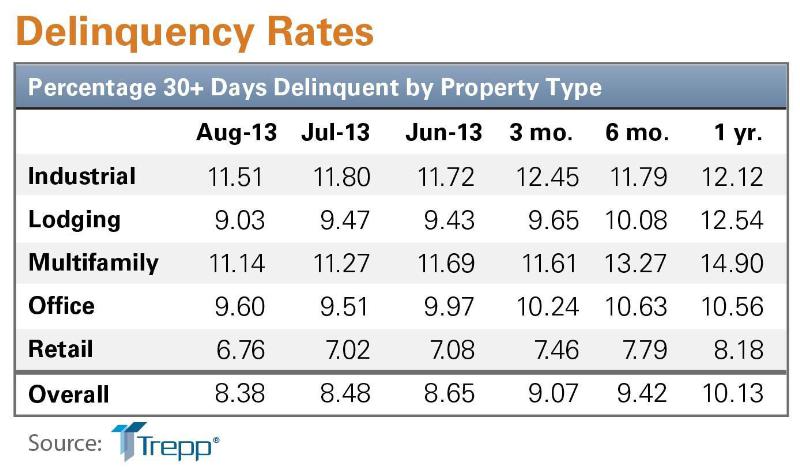

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

Office Buildings | Oct 16, 2023

The impact of office-to-residential conversion on downtown areas

Gensler's Duanne Render looks at the incentives that could bring more office-to-residential conversions to life.

Giants 400 | Oct 11, 2023

Top 100 Industrial Sector Architecture Firms for 2023

Ware Malcomb, Arcadis, Stantec, and Gresham Smith top the ranking of the nation's largest industrial facility sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Products and Materials | Oct 10, 2023

‘Works with WELL’ product licensing program launched by International WELL Building Institute

The International WELL Building Institute (IWBI) recently launched the Works with WELL product licensing program. Works with Well certification allows manufacturers to demonstrate that their products align with WELL strategies.

Mass Timber | Oct 10, 2023

New York City launches Mass Timber Studio to spur more wood construction

New York City Economic Development Corporation (NYCEDC) recently launched New York City Mass Timber Studio, “a technical assistance program to support active mass timber development projects in the early phases of project planning and design.”

Government Buildings | Oct 10, 2023

GSA names Elliot Doomes Public Buildings Service Commissioner

The U.S. General Services Administration (GSA) announced that the agency’s Public Buildings Service Commissioner Nina Albert will depart on Oct. 13 and that Elliot Doomes will succeed her.

Esports Arenas | Oct 10, 2023

Modular esports arena attracts more than gamers

As the esports market continues to grow to unprecedented numbers, more facilities are being developed by universities and real estate firms each year.

Higher Education | Oct 10, 2023

Tracking the carbon footprint of higher education campuses in the era of online learning

With more effective use of their facilities, streamlining of administration, and thoughtful adoption of high-quality online learning, colleges and universities can raise enrollment by at least 30%, reducing their carbon footprint per student by 11% and lowering their cost per student by 15% with the same level of instruction and better student support.

MFPRO+ News | Oct 6, 2023

Announcing MultifamilyPro+

BD+C has served the multifamily design and construction sector for more than 60 years, and now we're introducing a central hub within BDCnetwork.com for all things multifamily.

Giants 400 | Oct 5, 2023

Top 175 Healthcare Architecture Firms for 2023

HDR, HKS, CannonDesign, Stantec, and SmithGroup top BD+C's ranking of the nation's largest healthcare sector architecture and architecture/engineering (AE) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.

Biophilic Design | Oct 4, 2023

Transforming the entry experience with biophilic design

Vessel Architecture & Design's Cassandra Wallace, AIA, NCARB, explores how incorporating biophilic design elements and dynamic lighting can transform a seemingly cavernous entry space into a warm and inviting focal point.