Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

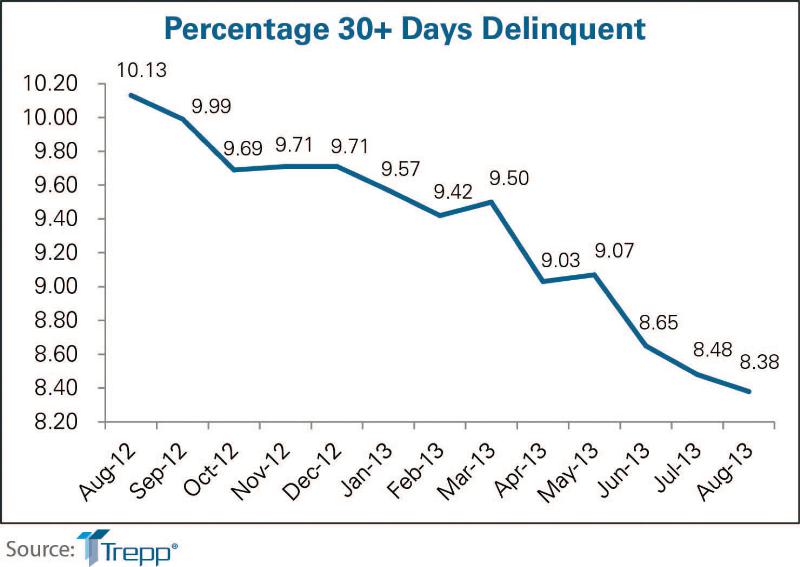

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

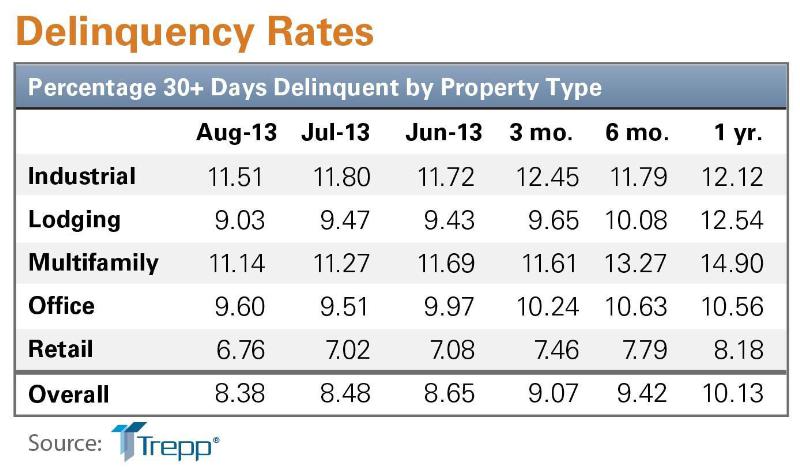

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Nov 10, 2011

Skanska Moss to expand and renovate Greenville-Spartanburg International Airport

The multi-phase terminal improvement program consists of an overall expansion to the airport’s footprint and major renovations to the existing airport terminal.

| Nov 10, 2011

Suffolk Construction awarded MBTA transit facility and streetscape project

The 21,000-sf project will feature construction of a cable-stayed pedestrian bridge over Ocean Avenue, an elevated plaza deck above Wonderland MBTA Station, a central plaza, and an at-grade pedestrian crossing over Revere Beach Boulevard

| Nov 10, 2011

Thornton Tomasetti’s Joseph and Choi to co-chair the Council on Tall Buildings and Urban Habitat’s Outrigger Design Working Group

Design guide will describe in detail the application of outriggers within the lateral load resisting systems of tall buildings, effects on building behavior and recommendations for design.

| Nov 9, 2011

Lincoln Center Pavilion wins national architecture and engineering award

The project team members include owner Lincoln Center for the Performing Arts, New York; design architect and interior designer of the restaurant, Diller Scofidio + Renfro, New York; executive architect, FXFOWLE, New York; and architect and interior designer of the film center, Rockwell Group, New York; structural engineer Arup (AISC Member), New York; and general contractor Turner Construction Company (AISC Member), New York.

| Nov 9, 2011

Sika Sarnafil Roof Recycling Program recognized by Society of Plastics Engineers

Program leads the industry in recovering and recycling roofing membrane into new roofing products.

| Nov 9, 2011

American Standard Brands joins the Hospitality Sustainable Purchasing Consortium

American Standard will collaborate with other organizations to build an industry-wide sustainability performance index.

| Nov 8, 2011

Transforming a landmark coastal resort

Originally built in 1973, the building had received several alterations over the years but the progressive deterioration caused by the harsh salt water environment had never been addressed.

| Nov 8, 2011

WEB EXCLUSIVE: Moisture-related failures in agglomerated floor tiles

Agglomerated tiles offer an appealing appearance similar to natural stone at a lower cost. To achieve successful installations, manufacturers should provide design data for moisture-related dimensional changes, specifiers should require in-situ moisture testing similar to those used for other flooring materials, and the industry should develop standards for fabrication and installation of agglomerated tiles.